China equities including domestic A-shares and Hong Kong-listed H-shares have had another stellar year in 2025 after a strong rally in 2024. The perception about China stocks being potentially “uninvestable” by foreign investors in recent years given the prolonged market downturn, has now shifted into one of the “unneglectable” markets. Many investors have reassessed their bearishness on China equities, especially after DeepSeek’s breakthrough early this year, combined with a suite of other AI innovations in the Mainland.

We remain positive on China equities and believe there is room for further upside for both A-shares and H-shares. Key drivers are:

- Rising AI demand from infrastructure to applications

- US-China’s “escalate to de-escalate” trade tension playbook

- A potential recovery in corporate earnings

- Reasonable relative valuations & growing investor confidence

1. Rising AI demand from infrastructure to applications

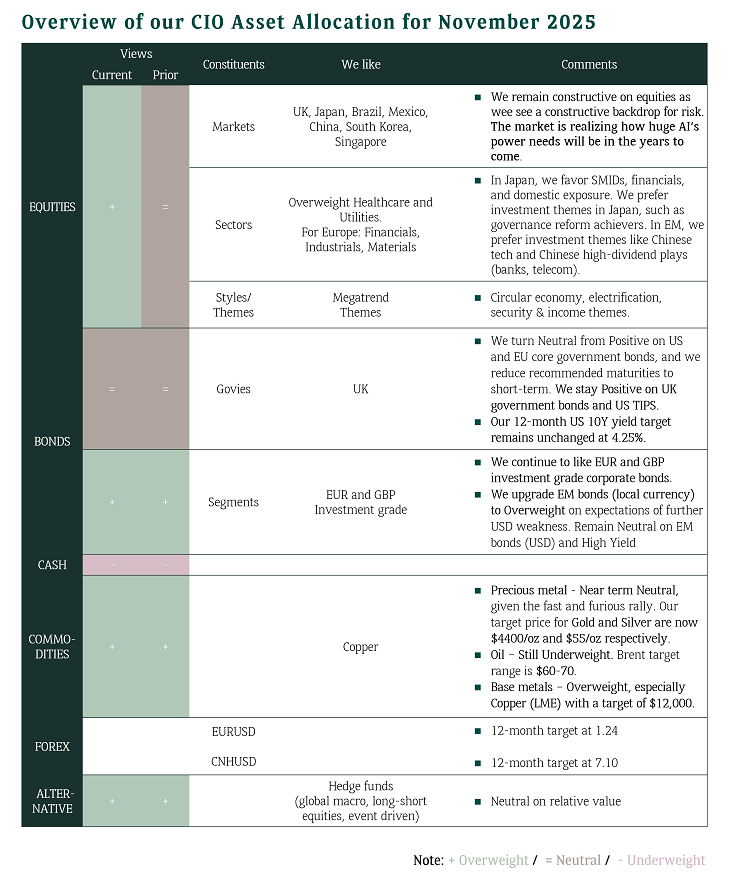

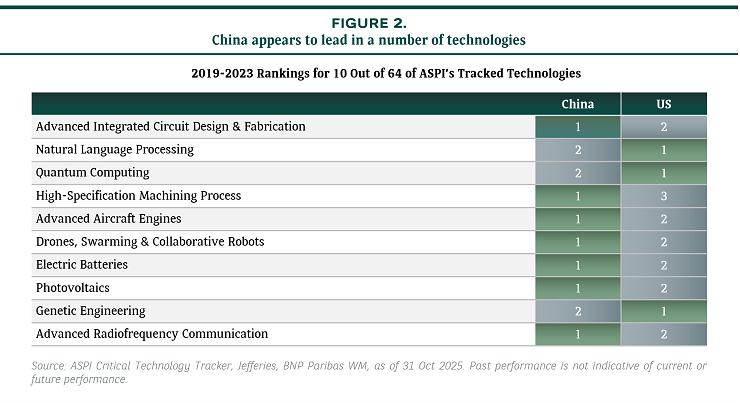

In the recent Fourth Plenum, Beijing outlined the 15th Five-Year Plan with the main focus on technological self-sufficiency. China leads globally with abundant and cost-efficient renewable energy and grid infrastructure to support the rising power demand driven by the strong AI demand. China is also a global producer for AI-integrated humanoid robots and smart service devices. China’s AI capex is estimated to reach RMB 600-700bn this year (see Figure 1), and a very large domestic market helps support commercialisation and scaling up of local technology brands.

2. US-China’s “escalate to de-escalate” trade tension playbook

The recent Trump-Xi meeting had a positive outcome with US-China agreeing on immediate reduction in fentanyl tariffs by half to 10% and a 1-year suspension of reciprocal tariffs, export controls and maritime charges. These measures will likely lower the weighted average additional US tariff on China in 2025 from 32% to 22%, which is close to the additional tariff on most of the regional peers, such as around 20% for ASEAN, 15% for Korea.

Market did not have strong response to the temporary easing in the bilateral relationship. This is because the tension de-escalation is well-expected and the market is used to the “escalate to de-escalate” playbook, though it did provide more policy visibility for the capital markets.

This new agreement marks a truce but not an end to the evolving US-China trade tensions, and the truce may still face some back-and-forth disruptions in the near future. Also, the decoupling in technology and critical minerals is still likely to accelerate in the long-term.

3. A potential recovery in corporate earnings

The strong performance of China equities (both A-shares and H-shares) year-to-date (YTD) has been largely driven by valuation expansion, rather than corporate earnings. Overall earnings growth is expected to bottom out next year. Key potential drivers for future earnings include profit boost from AI capex; profit reflation from “anti-involution” campaign and consumption stimulus, and profit enhancement form rising global market exposure given Chinese products’ rising competitiveness.

4. Reasonable relative valuations & growing investor confidence

Despite the Hang Seng Index and CSI 300 Index touching multi-year highs in October 2025, forward PE is currently at 12.7x and 16.3x respectively, much lower than S&P 500’s 25.8x.

Hong Kong market saw record net Southbound flows of USD 162 Billion (as of end-Oct 2025) from the Mainland YTD. We continue to see potential for the ongoing strengthening in domestic investor confidence on Hong Kong and China A-shares markets, which implies increasing reallocation of excess savings into equity markets. We also believe China equities would be increasingly back to global investors’ radar screen given their diversification demand, more reasonable relative valuations and persistent underweight allocations to China.

China equities (A+H): buy on dips

- As the 15th Five-Year Plan did not provide further details or specific targets on technology leadership and economic balancing, the next key events to watch will be the Central Economic Work Conference in December and the Two Sessions in March 2026.

- The global backdrop of “Fed put” and “Trump put” with loosening financial conditions are favourable for risk assets, including China equities. Also, China is expected to continue its moderate monetary and fiscal easing to achieve its goal of high quality growth. Financial conditions are also improving in the Mainland.

- Investors should accumulate both China A-shares and H-shares on the corrections. We continue to like the barbell strategy of investing in growth/tech stocks as well as high dividend plays in the Hong Kong/China financial and China telecom sectors.