SUMMER EDITION - JULY-AUGUST 2025

This edition of the Investment Navigator for July and August 2025 addresses the questions regarding investor concerns over the upcoming US tariffs on the 1st of August, touching on inflation and how that influences the US Federal Reserve’s interest rate path. It also covers trade uncertainty and how to best navigate in such an environment.

Key Questions

- What is the current trade situation under Trump 2.0?

- How will the new US tariffs on 1st August impact inflation?

- How will the US tariff influence the Fed’s interest rate path?

- Should investors be concerned about further tariff uncertainty?

- How should investors position to hedge against volatility?

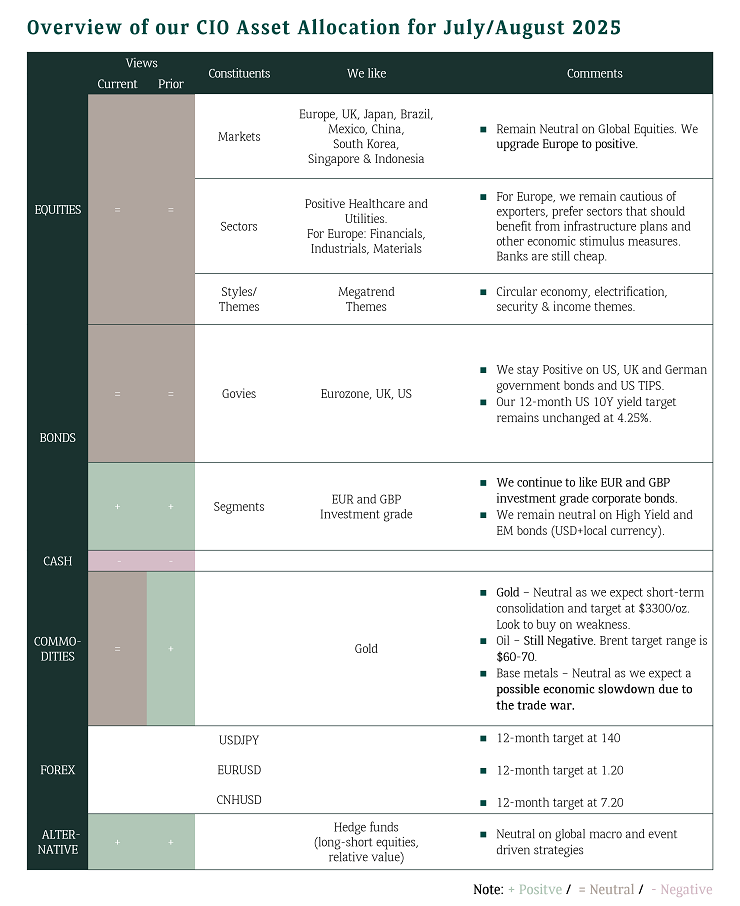

The US reciprocal tariffs announced on “Liberation Day” created a fair bit of market uncertainty. Since then, countries actively negotiating deals with the US, with the latest deadline being the 1st of August. Despite the recent volatility, markets have bounced back stronger. This suggests that we may be nearing the conclusion of the US trade tariff uncertainty.

What is the current trade situation under Trump 2.0?

No TACO (Trump Always Chicken Out) on Tariffs

Nearing the first extended tariff deadline on 9th July, US President Trump announced more aggressive tariffs across dozens of economies as well as on commodities. 1st August 2025 was announced as the new date where all proposed tariffs will go into effect, no further extensions from there on. Trading partners were essentially given an additional 3 weeks to secure a deal or be hit with more aggressive tariffs. Vietnam swiftly penned a deal with the US, with transshipment of goods as part of the clause. Since then, trade deals have accelerated, with the most recent being Japan, Philippines and Indonesia. Additionally, the recent passing of the One Big Beautiful Bill Act (OBBBA) also provided President Trump extra leverage on tariffs given that the tax cuts and fiscal plan has been passed. The latest budget surplus in the US (first since 2017) also adds further momentum to President Trump’s agenda. Our base case on trade is for a 10% minimum tariff across all countries. However, given the importance of these tariffs for fiscal revenues and President Trump’s position, we could end up seeing a baseline average reciprocal tariff rate of 15–20%, which is in-line with the deals announced thus far,

How will the new US tariffs on 1st August impact inflation?

Tariff passthrough will be key

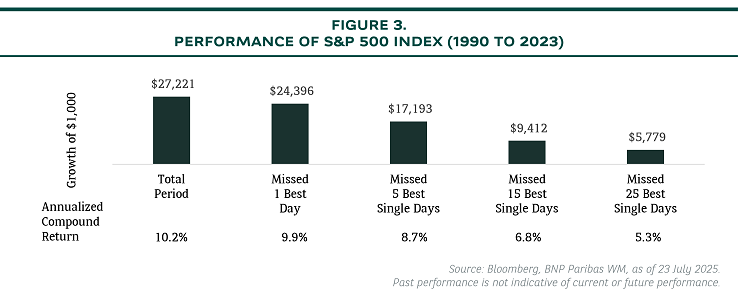

New tariffs will be collected from goods reaching the US shores on 1st August onwards. Current US inventories suggest that pre-tariff goods are likely to run off between June and August 2025. Tariff-focused surveys show that majority of impacted firms intend to increase prices swiftly, with a 1 to 3 months lag between cost hit and price action. Some may even plan to do so earlier, in anticipation of the costlier new inventory. In fact, the US June CPI report showed unambiguous evidence of tariff pass-through to goods prices, though the overall print was limited by yet more weakness in discretionary services categories and vehicle prices. The magnitude of pass-through can also be key. All players including importer, exporter and consumer are likely to absorb some of the price hike. Overall, stronger pass-through and inflationary effects are likely to manifest in the July–September period. The upcoming inflation prints for July and August will likely confirm this.

How will the US tariff influence the Fed’s interest rate path?

US Fed likely to cut rates in September and December this year

The Federal Reserve has always maintained their stance of a data dependent approach before further normalization of interest rates. As we draw closer towards the 1st August tariff extension deadline, the overall effective tariff rate by the US should be much clearer, which should be at its highest since 1943. As mentioned earlier, inflationary impacts are likely to manifest in Q3 this year, hence the next few months of inflation prints will give the Fed a clear indication on the impact of tariffs on the economy. Within the Federal Reserve, some dovishness is developing, while rumours of replacing Fed Chair Jerome Powell has also fueled an increase in rate cut expectations. Overall, we continue to believe that the Fed is slightly behind the curve as of today. Hence, we are still of the view of two cuts this year, September and December 2025, before another two cuts in the first half of 2026, bringing us to a terminal rate of 3.5%.

Should investors be concerned about further tariff uncertainty?

Trade Policy uncertainty is coming down after peaking on 2nd April

Despite the increasing amount of headline news mentioning tariffs, we are beginning to see lower uncertainty over US tariffs. In fact, we are closer to the end than the start of the tariff saga. Trade uncertainty most likely peaked on 2nd of April, ‘Liberation Day”. The level of uncertainty has eased off significantly following positive developments between US and China. The trade truce with China could extend beyond August 12 as both countries continue to iron out sensitive topics revolving around rare earth metals and semiconductors export. We should continue to see a decrease in trade uncertainty as we gain more clarity on the levels of tariffs, which would be key to allow businesses to make capex plans. Nevertheless, questions remain over deals involving transshipment of goods, as the Trump administration it is not clear how easy it will be to make a clear distinction between trade re-routing to evade tariffs, which is already illegal, and trade reallocation. On the growth front, our base case is still for a slowdown in the US (which is revised higher versus the start of the year), rather than a recession. Given that trade uncertainty is still elevated despite retreating, and not to forget ongoing geopolitical tensions, volatility may resume anytime. After all, the VIX index did come off a high of 60 back during “Liberation Week” to the current level of 16.

How should investors position to hedge against volatility?

Diversification to bulletproof your portfolio

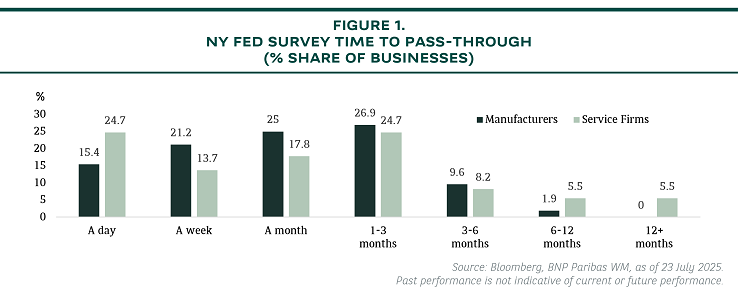

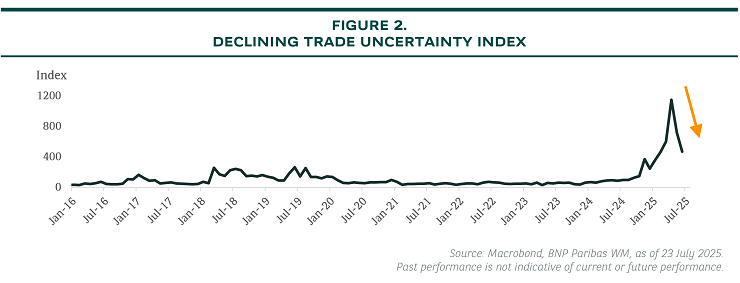

Volatile periods can be particularly challenging for investors. The Trump uncertain factor is unlikely to go away even after the conclusion of this reciprocal tariffs episode. Therefore, it is important to remain disciplined in such market conditions. Strategic asset allocation should be at the core of every investor. Our theme “Diversification is the only free lunch”, has paid off year-to-date as overweight Non-US equities, gold, alternatives and dollar diversification have boosted risk-adjusted returns.

This strategy is likely to ensure long term stability through exposure to a range of asset classes inclusive of alternatives, commodities and non-cyclical strategies. Tactical asset allocation to achieve alpha will also be crucial in ensuring that the portfolio is adjusted based on the latest change in market views. Importantly, time in the market beats timing the market. Studies done have shown that by just missing 1-5 best days even during an extended time period of 20+ years, investors lose up to 2% of annual compounded returns. Hence, staying invested will be key.