India - A comprehensive economic and trade agreement with India on May 6, 2025, which aims to increase bilateral trade by £25.5 billion annually, boost UK GDP by £4.8 billion, and increase wages by £2.2 billion per year by 2040.

EU - A "Post-Brexit Reset" with the European Union on May 19, 2025, which is expected to add £9 billion to the British economy by 2040, and includes a defense and security pact, cooperation on fisheries and agriculture, and access to EU procurements.

Asia-Pacific - Accession to the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) in 2024, which provides access to 11 high-growth Pacific economies with a combined GDP of £12 trillion.

These agreements are expected to reduce uncertainty, unlock growth, and increase trade opportunities for UK firms, ultimately enhancing long-term export prospects for key sectors such as aerospace, pharma, defence, engineering, and financial services, and contributing to the UK's improving economic outlook.

(2) Favorable Macro Conditions: European Fiscal Stimulus and Falling Rates

The UK's macroeconomic conditions have stabilized in 2025, following a period of high uncertainty. This improving macro backdrop is driven by European fiscal programs and supported by lower interest rates. Key indicators include:

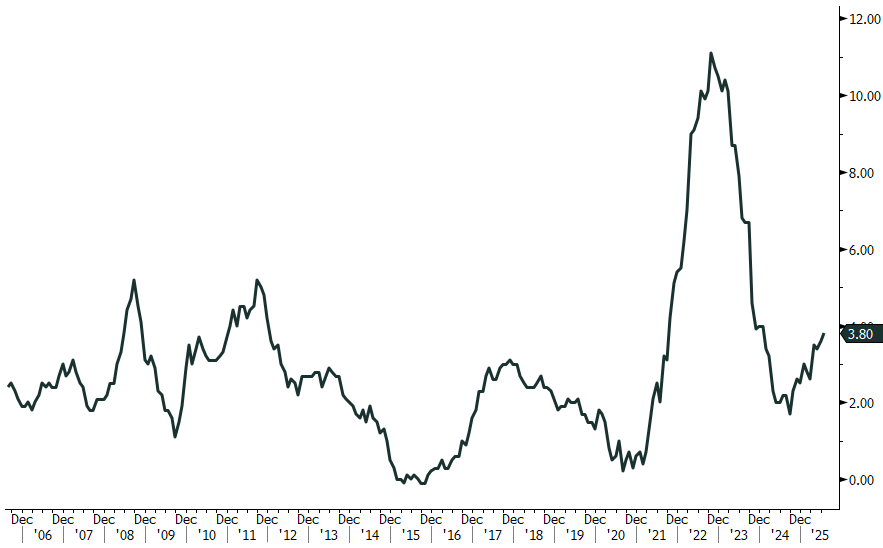

i. UK Inflation rose to 3.8% year-over-year in July, according to data released on 20 June, fueled by faster-than-expected rise in airfare prices. This leaves inflation well above the Bank of England (BoE) target of 2%, but nonetheless the BoE cut the base interest rate to 4.0% on 7th August, taking the borrowing cost to the lowest level for more than two years as it remains confident on the downward-trending trajectory of inflation. Andrew Bailey, governor of the BoE said interest rates were still on a downward path and any future cut will be made gradually and carefully.

Annual % Change in UK CPI in last 20 years.