Over the past 40 years, HarbourVest has invested over $134 billion in global primary, secondary and direct co-investments.

A pioneer in the secondary market, HarbourVest launched the Dover Street secondary Program in 1991. Thanks to its more than 30 years’ experience, HarbourVest is a global leader in the secondary market.

1 - Source: HarbourVest. As of September 2023. HarbourVest Secondary Private Equity Performance since 1986. Past performance is not reliable indicator of future performance.

During this period, HarbourVest has completed over $39 billion in secondary transactions. Since 1986, HarbourVest has generated a highly compelling performance on these investments, notably an 18% net IRR as of September 2023.

This performance was mainly due to HarbourVest’s long-term value creation approach based on portfolio appreciation, resulting from the selection of the best secondary assets and the top-performing Private Equity portfolios. Thus, about 85% of the value creation was attributable to the portfolio companies’ appreciation rather than the discount at purchase.

HarbourVest Dover Street XI is a secondary Private Equity fund. The secondary market exists to provide liquidity to Private Equity investors as this asset class is by nature illiquid and has a long-term maturity. Secondary funds are buyers of commitments in Private Equity funds sold by institutional investors who want to rebalance their portfolio or get some liquidity. The secondary funds also buy assets from Private Equity funds to accompany their future growth. Therefore, secondary funds allow investors to exit earlier from their investment commitments.

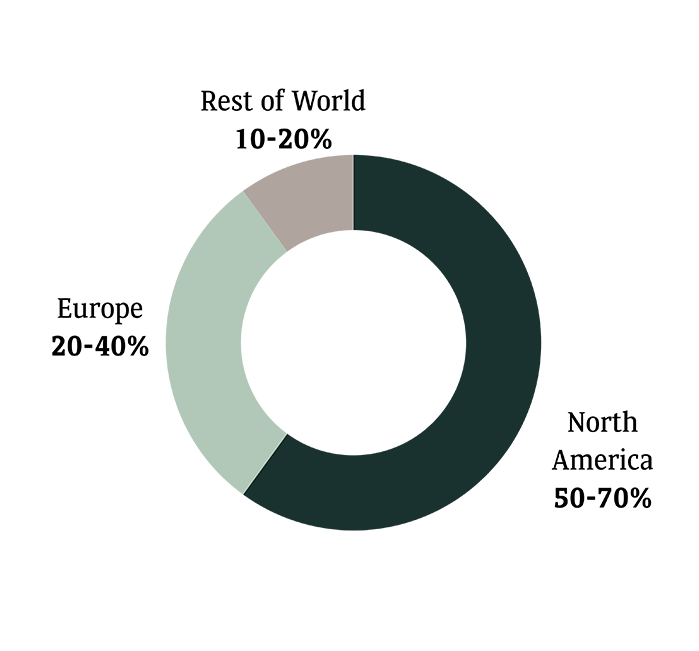

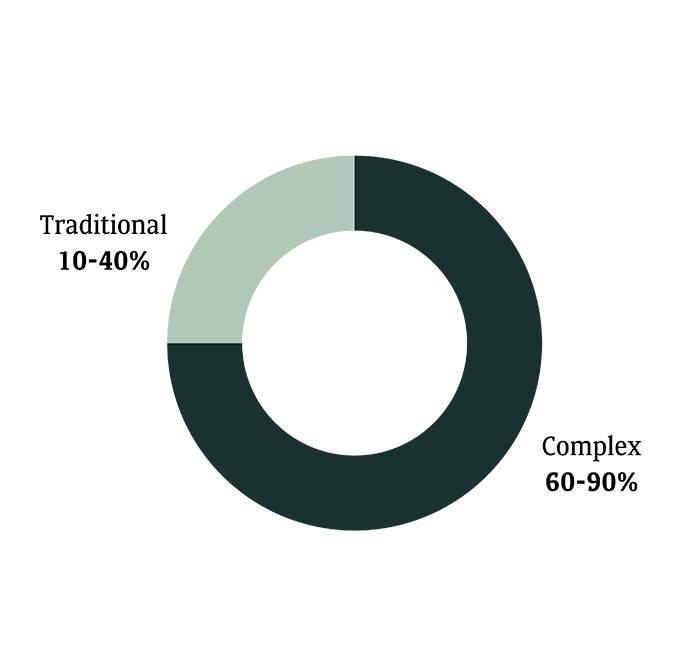

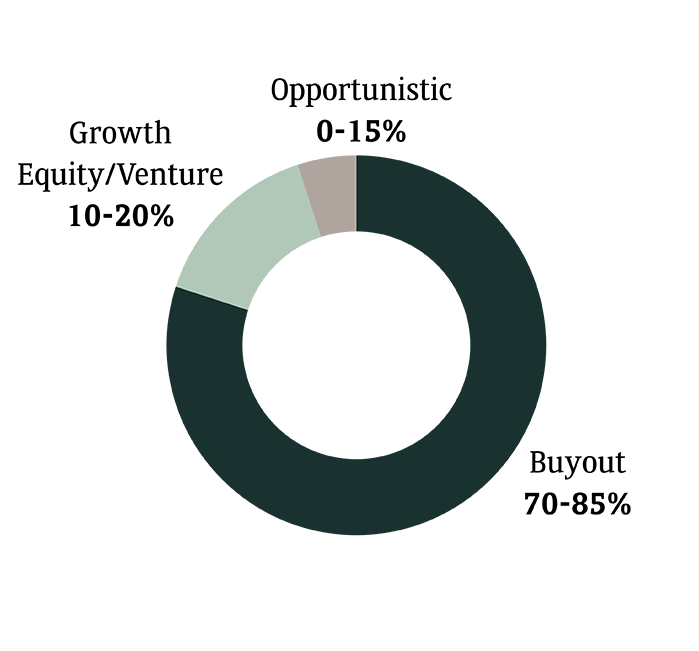

Illustrative Portfolio Construction¹

Geography

Transaction Type

Stage

Source: HarbourVest. 1 As of November 1, 2023. These amounts reflect the current expectations for the allocation of the Fund. The ultimate allocation will differ based upon market conditions and available investment opportunities over the life of the Fund. Additionally, these are not prescriptive guidelines. The investment guidelines of the Fund are contained in the offering memorandum and the limited partnership agreement.

2 Based on the fund target size of USD 12bn.

HarbourVest Dover Street XI targets a fund size of $12 billion and has already raised $10 billion. The fund made its first investment in September 2022, and has already deployed 29% as of December 2023. Consequently, entering now could provide an opportunity for our clients to benefit from the potential increase in valuations of these investments already held by the fund.

Private Equity provides diversification in a portfolio, aiming for high returns to compensate for illiquidity and a long-term maturity. In addition it continues to outperform* stock markets over the long term during different economic cycles.

Periods of economic downturn are usually good entry points for Private Equity, due to attractive acquisition prices.

Leading Private Equity managers are particularly well positioned to seize these opportunities and implement growth strategies based on operational efficiency and the ability to adapt to complex and uncertain environments.

*Past performance is not an indicator of future performance.

Global Head of Private and Alternative Investments

BNP Paribas Wealth Management

After joining BNP Paribas Wealth Management in 2004, Claire Roborel de Climens set up the Private Equity Group. In 2010 she was also appointed Head of Real Estate. In 2015, she became Head of Private and Alternative Investments, also comprising the Hedge Funds and Strategic-A (asset allocation service) activities to her scope of responsibility.

Claire is a member of various advisory boards of Global and European Private Equity and Real Estate funds. She sits on the board of Global General Partner, the AIFM manager of PERE feeder funds, and on the Supervisory Board of BNP Paribas Real Estate Investment Management France (REIM).

Prior to joining BNP Paribas Wealth Management, Claire worked for ten years for PAI Partners, a leading pan-European Private Equity firm, as a manager in the Finance Department, Investor Relations activities and then as an investor in the General Industrials sector where she was involved in many LBO transactions.

She started her career as an auditor at Ernst & Young where she worked for six years for large industrial groups and Private Equity funds.

Claire Roborel de Climens is a graduate of the EM Lyon business school.

This is a communication by the Wealth Management métier of BNP PARIBAS SA a French limited liability company with share capital of 2,294,954,818 Euros whose registered office is located at 16 boulevard des Italiens 75009 Paris, France, registered with the Paris Trade and Companies Registry under number 662 042 449, supervised and authorised as a Bank by the European Central Bank ("ECB") and in France by the French Autorité de Contrôle Prudentiel et de Résolution (“ACPR”) and regulated by the French Autorité des Marchés Financiers (“AMF”) (hereinafter “BNP Paribas”).

DOVER STREET XI AIF SCSp is a Luxembourg a special limited partnership (Société en Commandite Spéciale). Its general partner HarbourVest GP SARL, a Luxembourg private limited liability company (Société à responsabilité limitée). It is managed by HarbourVest Partners (Ireland) Limited, fully authorized and regulated by the Central Bank of Ireland as an Alternative Investment Fund Manager.

PrivAccess XV – Secondary Opportunities XI is a compartment of PrivAccess XV (hereinafter “Feeder Fund“) a Luxembourg investment company with variable capital, structured under the form of a Multi-Compartment Reserved Alternative Investment Fund, registered as a corporate partnership limited by shares, notified to the CSSF. It is managed by its general partner: PrivAccess General Partner S.à r.l. and Global General Partner SA, which is an Alternative Investment Fund Manager authorised by the Luxembourg CSSF, has been appointed to manage the Feeder Fund.

This material is confidential and intended solely for the use of the person to whom it has been delivered and must not be distributed, published or reproduced, in whole or in part nor may it be quoted or referred to in any communication without the prior consent of BNP Paribas. This communication is provided solely for the purpose of providing general information and shall not constitute an offer, a solicitation or an investment advice nor shall it form the basis of or be relied upon in connection with any subscription or commitment. In addition, this communication and its content shall not in any way be construed as an advertisement, inducement or recommendation of any kind or form whatsoever. For the purposes herein, “BNP Paribas” means BNP PARIBAS SA and its respective affiliates and related corporations.

Although the information provided herein may have been obtained from published or unpublished sources considered to be reliable, and while all reasonable care has been taken in the preparation of this communication, BNP Paribas does not make any representation or warranty, express or implied, as to its accuracy or completeness and does not accept responsibility for any inaccuracy, error or omission nor any liability for the use of or reliance on this communication or any part of the information contained herein. Past performance is not a reliable indicator of future performance. BNP Paribas is not giving any warranties, guarantee or representation as to the expected or projected success, profitability, return, performance, result, effect, consequence or benefit (either legal, regulatory, tax, financial accounting or otherwise) of any security.

Prior to making any commitment, the investor should take advice from his legal, tax and financial advisors. Subscribers should be in a position to fully understand the features of the subscription and be financially able to bear a loss of their investment and be willing to accept such risk. Save as otherwise expressly agreed in writing, BNP Paribas is not acting as financial adviser of, or in any fiduciary capacity to, the subscriber in any subscription.

This communication contains only a summary of certain sustainability related aspects of the Feeder Fund and is not purported to be complete, nor does it constitute an offer to invest in the Feeder Fund. It is not intended to be complete and will be qualified in its entirety by reference to the Issuing Document, which should be read in its entirety, in particular as regards the pre-contractual disclosure obligations under the SFDR, including how applicable sustainability risk factors are integrated into the decision-making process and their impact on returns. The descriptions or terms regarding sustainability-related aspects of the Feeder Fund in the Issuing Document shall prevail. See SFDR related disclosures in the Issuing Document which has been communicated to you before your potential commitment into the Feeder Fund and which will remain available after your commitment into the Feeder Fund on the page https://services-uk.sungarddx.com/LogOn/128060

Any communication containing additional information concerning the Feeder Fund and in particular the Issuing Document, the annual reports (which are made available to the investors on a regulatory basis after its investment in the Feeder Fund), the subscription document and the Master Fund documentation are available in English upon request from your relationship manager and from PrivAccess General Partner S.à r.l. (contact details below). If you want more information, especially on the structure of the Feeder Fund and the risks associated with an investment in this Feeder Fund, we advise you to read these documents.

PrivAccess General Partner S.à r.l. – 50, avenue J.F. Kennedy,

L-1855 Luxembourg – Grand-Duchy of Luxembourg

contact@ggp.bnpparibas.com – 00 352 4242 2000

The summary of investor rights is available on the public page https://wealthmanagement.bnpparibas/lu/en/global-general-partner/Summary-of-investors-rights.html

An investment in the Feeder Fund should be conditioned upon the previous reading and understanding of its Issuing Document and its Subscription Agreement, which are available in English only, and – in relation to the offer to non-professional investors in Italy, Germany, Belgium and Luxembourg - its KIDs, which are available in the relevant language; such documents describe the rights and obligations of the investors. Therefore, prospective subscribers should not rely on any other information not contained in such Issuing Document, Subscription Agreement and Key Information Document (KID).

Under no circumstances will the Feeder Fund, PrivAccess General Partner S.a.r.l, Global General Partner SA, BNP Paribas, DOVER STREET XI AIF SCSp, HarbourVest GP SARL, HarbourVest Partners (Ireland) Limited, pay or reimburse any current or future taxation in the subscribers’ country of origin, residence or domiciliation or wherever subsequent to the subscription, holding, conversion, sale or liquidation of ordinary shares in the Feeder Fund. The subscriber will be responsible for such payment or reimbursement.

No measures have been nor will be taken in any country or territory for the purposes of allowing a public offering of the investment described in this communication, or the holding or distribution of any document relating to this investment. These ordinary shares are not recommended by any federal or state securities commission or any other regulatory authority. Furthermore, the foregoing authorities have not confirmed the accuracy or determined the adequacy of this communication. BNP Paribas, PrivAccess General Partner S.à r.l, Global General Partner SA, DOVER STREET XI AIF SCSp, HarbourVest GP SARL, HarbourVest Partners (Ireland) Limited are separate legal entities and none of them is representing or acting as an agent for the other. Global General Partner SA and/or PrivAccess General Partner S.a.r.l. may decide at any time to terminate the arrangements made for the marketing of the Feeder Fund.

This communication is not for distribution to US Persons and US Persons are not eligible to apply to become Shareholders in the Feeder Fund. The ordinary shares of the Feeder Fund will be offered and sold only outside the United States to persons who are not US Persons, in reliance on Regulation S.

The Feeder Fund has been notified, under the relevant provisions of the AIFMD, for marketing in Italy towards professional investors (as defined in Italy pursuant to art. 6, parr. 2-quinquies and 2-sexies, of the Legislative Decree n. 58/1998 as amended – “TUF” - and its implementing measures) and other categories of investors as identified pursuant to art. 14. 2 of the regulation implementing art. 39 of TUF adopted by the Italian Treasury with Decree n. 30 of 5 March 2015, as amended by Decree n. 19 of 13 January 2022 (and, in particular, pursuant to art. 14.2.b), to non professional investors who – within the context of the provision of investment advisory services – subscribe for or acquire shares of the Feeder Fund for an initial amount not lower than 100,000 Euros (initial amount not lower than the equivalent in US Dollars of 100,000 Euros for this Feeder Fund) (always provided that, by effect of such subscription or acquisition, the total amount of their investments in reserved AIFs does not exceed 10% of their financial portfolio; the initial participation amount is not fractionable).

In relation to the offer to non-professional investors in Italy – the Key Information Document (KID) in Italian of the Feeder Fund have been communicated to you before your potential commitment into the Feeder Fund (and in particular through dedicated URLs) and will remain available after your commitment into the Feeder Fund on the page https://services-uk.sungarddx.com/LogOn/128060 and the information on “Facilities available to retail investors” (both in English and in Italian) are available or on the public page

More globally and in relation to the offer to non-professional investors in Belgium, Germany, Luxembourg and Italy, the Key Information Documents (KID) written in French, Flemish, German, Italian and English have been communicated to you before your potential commitment into the Feeder Fund (and in particular through dedicated URLs) and will remain available after your commitment into the Feeder Fund on the page https://services-uk.sungarddx.com/LogOn/128060

The Issuing Document of the Feeder Fund is also available for investors only on the same page https://services-uk.sungarddx.com/LogOn/128060

By accepting this documentation, the subscriber agrees to be bound by the foregoing limitations.

BNP Paribas SA (2024). All rights reserved.

Additional important information

NONE OF HARBOURVEST PARTNERS (IRELAND) LIMITED (“HARBOURVEST”) OR ITS AFFILIATES HAVE ENDORSED PRIVACCESS XV – SECONDARY OPPORTUNITIES XI, OR MAKE ANY REPRESENTATIONS WARRANTIES OR RECOMMENDATIONS WITH RESPECT TO PRIVACCESS XV – SECONDARY OPPORTUNITIES XI, OR ARE OTHERWISE RESPONSIBLE FOR THE FORMATION OR OPERATION OF PRIVACCESS XV – SECONDARY OPPORTUNITIES XI. THE OFFERING OF INTERESTS IN PRIVACCESS XV – SECONDARY OPPORTUNITIES XI IS NOT AN OFFERING OF INTERESTS IN DOVER STREET XI AIF SCSP (the “MASTER Fund”). WITH RESPECT TO THE OFFER MADE TO SUBSCRIBE IN PRIVACCESS XV – SECONDARY OPPORTUNITIES XI NONE OF HARBOURVEST, THE MASTER FUND, THE GENERAL PARTNER OF THE MASTER FUND OR ANY OF THEIR RESPECTIVE AFFILIATES HAVE APPROVED THE CONTENT OF THIS DOCUMENT OR MADE ANY REPRESENTATION OR WARRANTY WITH RESPECT TO THE FAIRNESS, ACCURACY, OR REASONABLENESS OF ANY OF THE INFORMATION CONTAINED HEREIN INCLUDING, WITHOUT LIMITATION, ANY INFORMATION REGARDING HARBOURVEST, THE MASTER FUND, THE GENERAL PARTNER OF THE MASTER FUND OR THEIR RESPECTIVE AFFILIATES, AND THEY EXPRESSLY DISCLAIM ANY RESPONSIBILITY OR LIABILITY TOWARD ANY INVESTOR IN PRIVACCESS XV – SECONDARY OPPORTUNITIES XI IN RESPECT THEREOF. NO SUCH PARTY BEARS ANY RESPONSIBILITY FOR UPDATING ANY INFORMATION CONTAINED HEREIN.

INVESTORS IN PRIVACCESS XV – SECONDARY OPPORTUNITIES XI WILL NOT BE INVESTORS IN THE MASTER FUND OR ANY PORTFOLIO COMPANY IN WHICH PRIVACCESS XV – SECONDARY OPPORTUNITIES XI DIRECTLY OR INDIRECTLY THROUGH THE MASTER FUND, INVESTS OR COMMITS TO INVEST, AND WILL HAVE NO VOTING RIGHTS OR DIRECT INTEREST IN, AND WILL HAVE NO STANDING OR RECOURSE AGAINST, THE MASTER FUND OR THE GENERAL PARTNER OF THE MASTER FUND, HARBOURVEST OR ANY OF THEIR AFFILIATES OF ANY PARTNERS, OFFICERS, DIRECTORS, EMPLOYEES OR MEMBERS OF THE FOREGOING. INVESTORS IN PRIVACCESS XV – SECONDARY OPPORTUNITIES XI WILL NOT BE PARTIES TO THE LIMITED PARTNERSHIP AGREEMENT OF THE MASTER FUND AND WILL NOT HAVE ANY RIGHTS THEREUNDER AND MAY NOT BRING AN ACTION AGAINST THE FUND, THE GENERAL PARTNER OF THE MASTER FUND OR HARBOURVEST OR THEIR AFFILIATES FOR ANY BREACH THEREOF. ALTHOUGH PRIVACCESS XV – SECONDARY OPPORTUNITIES XI WILL, AS AN INVESTOR IN DOVER STREET XI AIF SCSP HAVE RIGHTS AND PRIVILEGES WITH RESPECT TO THE MASTER FUND IN SUCH CAPACITY, NONE OF THE MASTER FUND, THE GENERAL PARTNER OF THE MASTER FUND, HARBOURVEST OR ANY OF THEIR RESPECTIVE AFFILIATES IS RESPONSIBLE TO PRIVACCESS XV – SECONDARY OPPORTUNITIES XI’S INVESTORS. NONE OF PRIVACCESS XV – SECONDARY OPPORTUNITIES XI, BNP PARIBAS SA OR THEIR AFFILIATES OR ANY INVESTORS IN PRIVACCESS XV – SECONDARY OPPORTUNITIES XI HAVE THE RIGHT TO PARTICIPATE IN THE CONTROL, MANAGEMENT OR OPERATIONS OF THE MASTER FUND, OR HAS ANY DISCRETION OVER THE MANAGEMENT OF THE MASTER FUND.

HARBOURVEST IMPORTANT INFORMATION AND RISK FACTORS RELATED TO THE DOVER STREET XI AIF SCSP

This is a marketing communication. This document contains confidential and proprietary information and should not be disseminated without express written consent from HarbourVest. The Fund will not be registered as an investment company under the U.S. Investment Company Act of 1940, as amended (the “1940 Act”). As a result, investors will not receive the protections of the Investment Company Act of 1940 afforded to investors in registered investment companies (i.e. “mutual funds”).

This communication does not constitute an offer to sell or the solicitation of an offer to buy interests in the Fund or any other fund or investment product sponsored by HarbourVest, or investment services provided by, HarbourVest Partners L.P. or its affiliates. Such an offer may be made only to qualified investors by means of delivery of a confidential Private Placement Memorandum or similar materials that contain a description of the material terms of such investment. No sale will be made in any jurisdiction in which the offer, solicitation, or sale is not authorized or to any person to whom it is unlawful to make the offer, solicitation, or sale. Offers and sales of interests in the Fund may not be registered under the laws of any jurisdiction. The information in this communication is highly confidential and must be read in conjunction with the Private Placement Memorandum of the Fund. This communication does not purport to contain all the information relevant to evaluating an investment in the Fund described herein.

An investment in the Fund involves a high degree of risk and therefore should be undertaken only by prospective investors capable of evaluating the risks of the Fund and bearing the risks such an investment represents. There is no guarantee that the investment strategy will be successful or that the Fund will achieve its objective or the suggested returns. Past performance is not a reliable indicator of future results and there can be no assurance that any HarbourVest fund will achieve comparable results. If you make a decision to invest, you will be buying units / shares in the Fund and will not be investing directly in the underlying assets of the Fund. There can be no assurances that trends will continue.

Past performance information is presented in a manner that HarbourVest believes to be comprehensive and appropriate for prospective investors to assess the performance of the respective HarbourVest funds. Notwithstanding the foregoing, HarbourVest can make available, upon request, annualised performance information relating to any closed HarbourVest funds referenced herein for the preceding 5 years (or, if the respective funds were less than 5 years old, for the whole period since inception) based on complete 12-month periods.

Risks Related to the Structure and Terms of the Private Equity Funds. Investments in a fund of funds structure may subject investors to additional risks which would not be incurred if such investor were investing directly in a fund. Such risks may include but are not limited to (i) multiple levels of expense; and (ii) reliance on third-party management. In addition, private equity funds may issue capital calls, and failure to meet the capital calls can result in consequences including, but not limited to, a total loss of investment. The Fund may make investments that may not be advantageously disposed of prior to the date on which the Fund is dissolved. Although HarbourVest expects that the investments will be disposed of prior to dissolution or be suitable for distribution in-specie at dissolution, HarbourVest has a limited ability to extend the term of the Fund, and the Fund may have to sell, distribute, or otherwise dispose of investments at a disadvantageous time as a result of dissolution. Fund charges will be incurred in multiple currencies, meaning that payments may increase or decrease as a result of currency exchange fluctuations. The Fund may be subject to substantial fees including transaction fees. These fees are paid out by the Fund, which will impact on the overall return of the Fund. No secondary public market for the sale of units / shares in the Fund exists, nor is one likely to develop. The ability to redeem units / shares will be limited and subject to certain restrictions and conditions as described in the Fund’s Private Placement Memorandum. Performance is subject to taxation which depends on the personal situation of each investor and which may change in the future.

Risk of Loss. The investment opportunity is available only for sophisticated investors who are aware of the risks of investing in private funds and an investor must have the financial ability to understand and willingness to accept the extent of their exposure to the risks and lack of liquidity inherent in an investment in any fund described in this communication. There can be no assurance that the operations of a HarbourVest-managed fund or account will be profitable or that a HarbourVest-managed fund or account will be able to avoid losses or that cash from operations will be available for distribution. The possibility of partial or total loss of capital of a portfolio exists, and prospective investors should not subscribe unless they can readily bear the consequences of a complete loss of their investment. Diversification does not protect against losses. Capital is at risk and risk management does not remove risks or prevent losses.

Leverage. A HarbourVest-managed fund or account may use leverage in their investment strategy. Leverage may take the form of loans for borrowed money or derivative securities and instruments that are inherently leveraged, including options, futures, forward contracts, swaps and repurchase agreements. A fund or account may use leverage to acquire, directly or indirectly, new investments. The use of leverage by a fund or account can substantially increase the market exposure (and market risk) to which such fund’s or account’s investment portfolio may be subject.

Illiquidity of Interests; Limitations on Transfer; No Market for Interests. An investor in a HarbourVest-managed closed-end fund or account will generally not be permitted to transfer its interest without the consent of the general partner of such fund. Furthermore, the transferability of an interest will be subject to certain restrictions contained in the governing documents of a closed-end fund and will be affected by restrictions imposed under applicable securities laws. A HarbourVest-managed open-end fund or account will generally provide limited liquidity events for investors, subject to certain restrictions contained in the governing documents of an open-end fund and will be affected by restrictions imposed under applicable securities laws. There is currently no market for the interests in HarbourVest-managed funds or accounts, and it is not contemplated that one will develop. The interests should only be acquired by investors able to commit their funds for an indefinite period of time, as the term of the closed-end fund could continue for over 14 years. In addition, there are very few situations in which an investor may withdraw from a private equity closed-end fund. The possibility of total loss of an investment in a fund exists and prospective investors should not invest unless they can readily bear such a loss.

Availability of Suitable Investments. The business of identifying and structuring investments of the types contemplated by HarbourVest-managed funds or accounts is competitive and involves a high degree of uncertainty. Furthermore, the availability of investment opportunities generally will be subject to market conditions and competition from other groups as well as, in some cases, the prevailing regulatory or political climate. It is possible that competition for appropriate investment opportunities may increase, which may reduce the number of opportunities available and/or adversely affect the terms upon which the investments can be made. General economic conditions, including interest rates, the availability of financing, the price of assets and participation of other investors in the financial markets may adversely affect the value and number of investments made by the Fund. No assurance can be given that the stability of the financial markets in which the Fund may make investments will not be subject to significant deterioration.

Reliance on the General Partner and Investment Manager. The success of HarbourVest-managed funds or accounts will be highly dependent on the financial and managerial expertise of the fund’s or account’s general partner and/or investment manager and their expertise in the relevant markets. The quality of results of the general partner and/or investment manager will depend on the quality of their personnel. There are risks that death, illness, disability, change in career or new employment of such personnel could adversely affect results of the fund or account. With respect to commingled funds, the limited partners will not make decisions with respect to the acquisition, management, disposition or other realization of any investment, or other decisions regarding the commingled fund’s businesses and portfolio.

Potential Conflicts of Interest. The activities of a HarbourVest-managed fund or account may conflict with the activities of other HarbourVest-managed funds or accounts. The Fund will be competing for investments with other parties.

Dover Strategy Risks. The Fund will acquire interests in underlying funds through secondary market transactions. Secondary market transactions may impose higher costs than other investments and may require the Fund to assume contingent liabilities associated with events occurring prior to the Fund’s investment. In addition, the Fund will make secondary market transactions based on information that may be incomplete or inaccurate. The Fund may invest in leveraged buyouts of companies; such leveraged buyouts are inherently sensitive to declines in portfolio company revenues and increases in portfolio company expenses and to increases in interest rates. The Fund and its investments can make growth equity and venture capital investments, which involve a high degree of business and financial risk that can result in substantial losses. The Fund and its investments can invest in securities of financially troubled companies or companies involved in work-outs, liquidations, reorganizations, recapitalizations, bankruptcies, and similar transactions and securities of highly leveraged companies. While these investments could offer the potential for high returns, they also bring with them correspondingly greater risks. A portion of the Fund’s assets are expected to be invested outside of the United States. Non-US securities involve certain factors not typically associated with investing in US securities, including risks related to greater price volatility in and less liquidity of some non-US securities markets. This risk could be greater for investments made in developing and emerging countries.

Complete information on the risks of investing in a Fund are set out in the relevant Fund’s Private Placement Memorandum.

Please refer to the website https://www.harbourvest.com/eu-sfdr-disclosure/ for further information in relation to certain sustainability-related aspects of the Fund

· For additional legal and regulatory information related to HarbourVest offices and countries please refer to https://www.harbourvest.com/important-office-and-country-disclosures/

For information regarding the collection, use and sharing of personal data in accordance with Regulation (EU) 2016/679 (the “General Data Protection Regulation” or the “GDPR”), please refer to the https://www.harbourvest.com/privacy-policy/.

PERFORMANCE INFORMATION

The source of certain performance information is HarbourVest. In considering the performance information contained herein, prospective investors should bear in mind that past performance is not a reliable indicator of future results, and there can be no assurance that an investment sponsored (or an account managed) by HarbourVest will achieve comparable results or be able to implement its investment strategy or meet its performance objectives. The funds that made these investments may have had different terms and investment objectives than those proposed or modeled herein.

Certain information included herein has been obtained from sources that HarbourVest believes to be reliable (including, without limitation, the data needed for the calculation of performance returns in respect of any investment shown herein), but the accuracy of such information cannot be guaranteed. Additionally, amounts contained in these materials are generally unaudited and may be flash or preliminary amounts reported. HarbourVest will also present certain information based on prior period reporting, adjusted for current period activity. Figures reported to HarbourVest may be adjusted for the purposes of determining the estimated fair value of such investment in accordance with HarbourVest’s valuation policy. Underlying investment data presented by HarbourVest herein is as of the date stated and may rely on best available data known by HarbourVest as of such date. For additional information please contact your HarbourVest representative.

Any data presented about investments prior to 1998 is related to transactions that occurred when the HarbourVest team was affiliated with Hancock Venture Partners, Inc.

Ported Performance: HarbourVest’s founders began making venture capital investments for John Hancock Financial Services in late 1970s. In 1982 they formed Hancock Venture Partners, Inc, which was fully owned by John Hancock Mutual Life Insurance Company, to independently develop and manage third-party private equity capital. In January 1997, the Hancock Venture Partners management team formed a new independent management company, HarbourVest Partners, LLC. All then-employees of Hancock Venture Partners became owners and/or employees of HarbourVest Partners, LLC. HarbourVest Partners, LLC has no affiliation with John Hancock Financial Services.

The foregoing performance information includes realized and unrealized investments. Unrealized investments are valued by HarbourVest in accordance with the valuation guidelines contained in the applicable partnership agreement. Actual realized returns on unrealized investments will depend on, among other factors, future operating results, the value of the assets and market conditions at the time of disposition, any related transaction costs, and the timing and manner of sale, all of which may differ from the assumptions on which the valuations used in prior performance data contained herein are based. Accordingly, the actual realized returns on these unrealized investments may differ materially from returns indicated herein.

In certain cases, a HarbourVest fund or account, or the partnerships in which it invests, may utilize a credit facility or other third-party financing. This is generally to bridge capital calls from limited partners or to fund a portion of an investment and may also be used to facilitate transactions involving the recapitalization of portfolio investments. This may make the resulting IRR and multiples higher or lower than the IRR or multiples that would have been presented had drawdowns from partners or available cash been initially used to acquire or pay for the investment.

IRRs are calculated from the date of a fund’s first cash flow from a limited partner, which may include capital contributions in connection with fund formation, as may occur with certain AIF-Related Funds, and therefore can be earlier than the date of the first capital call from a limited partner for the purpose of investment. The start date for IRR calculations can also be later than the date of initial investment when a credit facility or other third-party financing is used to fund such investment.

Performance is expressed in US dollars, unless otherwise noted. Returns do not include the effect of any withholding taxes. Cash flows are converted to US dollars at historic daily exchange rates, unless otherwise indicated. The return to investors whose local currency is not the US dollar may increase or decrease as a result of currency fluctuations.

Fees and Expenses (Net and Gross): Actual management fees and carried interest will vary and are established in negotiations with the limited partners of a Fund or separate account client. Management fees may range from an average of 0.1% to 1.25% per year of committed, called, or invested capital over the expected life of a Fund, pursuant to the limited partnership agreement or investment management agreement. Fees for Funds in extension years may be reduced, including to nil. Fund investors will typically bear all the costs and expenses relating to the operations of a Fund and its general partners (or similar managing fiduciary). A Fund shall bear its pro rata share of any such expenses incurred in connection with any portfolio investment to the extent the same portfolio investment is being made by other Funds. Organization expenses of a Fund will also typically be borne by Fund investors. When a Fund is generally expected to invest alongside a Fund primarily intended for European-based investors, which takes into account the regulatory requirements of the Alternative Investment Fund Managers Directive (an “AIF Related Fund”), organization expenses may be aggregated and allocated pro-rata between a Fund and its AIF Related Fund based on the relative commitments of the partners of the Fund and the partners of its AIF Related Fund (unless HarbourVest, as general partner, determines in good faith that a different share is appropriate). Fees and expenses are also described in HarbourVest’s Form ADV, Part 2A brochure.

Performance Returns: Performance returns information (Total Value / Funded, TV/TC (Total Value / Total Cost), TVPI (Total Value Paid-In), Portfolio IRR (Internal Rate of Return), TWR (Time Weighted Return), and IRR) shown net of fees and expenses are based on the Fund's Limited Partner ("LP") cash flow after all management fees, commissions, fund operating expenses, and carried interest. These returns reflect the combined return for all LPs in a fund and do not necessarily reflect an individual LP’s actual return. Where applicable, a final LP cash flow is based on the fair market value of all LP capital accounts as determined by the Fund or account's General Partner ("GP") in accordance with the Firm's valuation policy. Net IRR and Net TVPI are calculated based on daily LP cash flows.

Gross performance returns, if shown, are based on the annual return calculated using daily cash flows from the Fund(s) to and from the various partnerships or companies held by the Fund, either directly or through a special purpose vehicle in which the Fund invested during the period specified, inclusive of the effects of fund-level leverage which is used to achieve those returns, to the extent such a fund is a levered fund. Gross performance returns are presented before management fees, carried interest, and other expenses borne by investors in the Fund(s), inclusive of the effects of fund-level leverage which is used to achieve those returns, to the extent such a fund is a levered fund. For investments which have utilized leverage in a currency other than the U.S. Dollar, the investment and portfolio performance metrics reflect debt drawdowns and outstanding debt at exchange rates as of the report date, and debt repayments at exchange rates as of transaction dates. An actual portfolio would bear such fees and expenses. If such fees and expenses were deducted from performance, returns would be lower. For example, if a fund appreciated by 10% a year for five years, the total annualized return for five years prior to deducting fees and expenses at the end of the five-year period would be 10%. If total fund fees and expenses were 1% for each of the five years, the total annualized return of the fund for five years at the end of the five-year period would be 8.90%. These returns reflect the fees, expenses, and carried interest of the underlying fund investments (where applicable), certain expenses of any special purpose vehicle that held an interest in the underlying fund (where applicable), and the upfront costs, fees, expenses, and interest expense of the fund’s leverage facilities, to the extent such a fund is a levered fund, but do not reflect the management fees, carried interest, and other expenses borne by investors in the Fund(s), which will reduce returns. The specific payment terms and other conditions of the management fees, carried interest, and other expenses of a Fund are set forth in the governing documents of the Fund.

Certain data metrics included (Distributed / Funded, Distributed Paid In Capital) are components of performance and should not be viewed as performance results.