Agility track-record

1. Past performance is not a reliable indicator of future performances. No guarantee is given on the success, profitability, return or benefit of this investment.

As of 31/12/2023. Track record of BNP Paribas Agility Co-Invest fund’s team, investing for BNP Paribas Principal Investments from 2008 until 2018 and the for BNP Paribas Agility Capital and now for BNP Paribas Asset Management.

Targets and goals are indicative only. There is no guarantee that those targets and goals will be achieved.

BNP Paribas has been investing in private equity, for its own account via its balance sheet, for several decades. In 2008, it set up a dedicated team which co-invests as a minority investor alongside top-tier private equity fund managers in Europe.

Following a request from several institutional investors, BNP Paribas decided in 2020 to open up this private equity co-investment strategy to third-party investors by launching the BNP Paribas Agility Co-Invest fund series.

The second fund in this series, Agility Co-Invest 2, is targeting a size of €700m to €900m, of which €300m will be committed by BNP Paribas for its own account. The fund is seeking to build a diversified portfolio spanning several sectors and investing in different sized companies in Europe.

The fund will draw on the BNP Paribas Group’s unique deal origination capabilities and its relationship with around 200 private equity firms to select co-investment opportunities alongside leading private equity firms, such as Ardian, PAI Partners, IK and KKR.

The fund invests mainly in Western and Northern Europe, in different sized companies, generally valued above €50 million, and finally across different sectors, in particular healthcare, business services, food & consumer and industrials.

Lastly, we have an agile portfolio construction approach.

We are looking for a strong base of resilient assets, in addition to value and growth deals to drive performance.

1. Past performance is not a reliable indicator of future performances. No guarantee is given on the success, profitability, return or benefit of this investment.

As of 31/12/2023. Track record of BNP Paribas Agility Co-Invest fund’s team, investing for BNP Paribas Principal Investments from 2008 until 2018 and then for BNP Paribas Agility Capital and now for BNP Paribas Asset Management.

Performance goals are indicative only. There is no guarantee that these goals will be achieved.

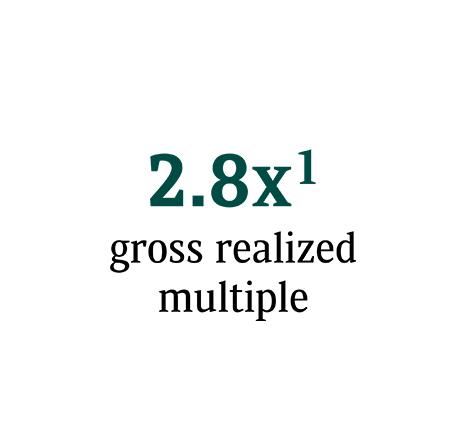

Since our team was created in 2008, we have invested more than €1 billion in 71 equity transactions.

Of these investments, 20 have been realised, with a total gross multiple of 2.8 times the invested amount, resulting in a 33% gross IRR.

The first BNP Paribas Agility Co-Invest fund, launched in 2020, deployed more than €600 million in equity through investments in 40 companies.

Albeit a recent fund, it has already achieved a gross multiple of 1.3 times, and a 14% gross IRR on these investments.

Diversification

Private Equity provides diversification in a portfolio, aiming for high returns to compensate for illiquidity and a long-term maturity. In addition it continues to outperform stock markets over the long term during different economic cycles.

Good Momentum

Periods of economic downturn are usually good entry points for Private Equity, particularly funds offering growth and transformation strategies based on operational improvement and digitalisation.

Attractive returns*

In this environment of volatility, inflation and rising interest rates, which accentuate performance disparities, it is essential to remain selective and invest with a top-performing and very experienced Private Equity firm.

*Past performance is not a reliable indicator of future performances. No guarantee is given on the success, profitability, return or benefit of this investment.

Claire Roborel de Climens

Global Head of Private and Alternative Investments · BNP Paribas Wealth Management

Since joining BNP Paribas Wealth Management in 2004, Mrs. Roborel de Climens has set up the Private Equity Group and in 2010 was also nominated Head of the Real Estate activity. In 2015, she was named Head of the Private and Alternative Investments department, adding Hedge Funds, Strategic-A (asset allocation service), Philanthropy Advisory and AgriFrance activities to her responsabilities.

Claire is member of the Advisory Board of many Global and European Private Equity and Real Estate funds. She is Board member of Global General Partner, the AIFM manager of PERE feeder funds and member of the Supervisory Board BNP Paribas Real Estate investment Management France (REIM).

Prior to joining BNP Paribas Wealth Management, Claire worked 10 years for PAI Partners, a leading pan-European Private Equity firm, as a manager in the Finance Department, Investor Relations activities and then as an investor in the General Industrials sector where she was involved in many LBO transactions.

She started her career in Audit at Ernst & Young where she worked for 6 years for large industrial groups and Private Equity funds.

Mrs Roborel de Climens is a graduate of the EMLyon business school.

Contact your Relationship Manager

This document is communicated by the Wealth Management métier of BNP PARIBAS SA a French limited liability company with share capital of EUR 2,468,663,292 whose registered office is located at 16 boulevard des Italiens 75002 Paris, France, registered with the Paris Trade and Companies Registry under number 662 042 449, supervised and authorised as a Bank by the European Central Bank ("ECB") and in France by the French Autorité de Contrôle Prudentiel et de Résolution (“ACPR”) and regulated by the French Autorité des Marchés Financiers (“AMF”) (hereinafter BNP Paribas).

BNP Paribas Agility Co-Invest Fund 2 S.L.P. is a French professional specialized fund incorporated as limited partnerships (fonds professionnel spécialisé prenant la forme de sociétés en commandite simple dénommée “société de libre partenariat”) (“the Fund”). It is managed by BNP Paribas Asset Management Europe, a private limited company (société par actions simplifiée unipersonelle), whose registered office is at 1 boulevard Haussmann 75009 Paris, France, with a share capital of 170 573 424,00 euros, registered with the French trade and companies register (Registre du commerce et des sociétés) under number 319 378 832, an alternative investment fund manager approved under the AIFMD by the AMF under number GP-96002 on 19 April 1996 and acting as the AIFM, manager (gérant) (the "Management Company"). The Management Company has been appointed by BNPP Agility Co-Invest 2 GP, a private limited company (Société par actions simplifiée unipersonnelle), whose registered office is at 1 boulevard Haussmann, 75009 Paris, with a share capital of 15 000 euros, registered with the French trade and companies register (Registre du commerce et des sociétés) under number 981 161 870, acting as the non-managing general partner (associé commandité non-gérant) of the Fund (the "General Partner").

The Fund is registered with the Paris trade and companies register (Registre de Commerce et des Sociétés, Paris) under number 981 998 834 as a French limited partnership (société en commandite simple dénommée société de libre partenariat), whose registered office is at 1 boulevard Haussmann, 75009 Paris.

This material is confidential and intended solely for the use of the person to whom it has been delivered and must not be distributed, published or reproduced, in whole or in part nor may it be quoted or referred to in any document without the prior consent of BNP Paribas. This document is provided solely for the purpose of providing general information and shall not constitute an offer, a solicitation or an investment advice nor shall it form the basis of or be relied upon in connection with any subscription or commitment. In addition, this document and its content shall not in any way be construed as an advertisement, inducement or recommendation of any kind or form whatsoever. For the purposes herein, “BNP Paribas” means BNP Paribas SA and its respective affiliates and related corporations.

Although the information provided herein may have been obtained from published or unpublished sources considered to be reliable, and while all reasonable care has been taken in the preparation of this document, BNP Paribas does not make any representation or warranty, express or implied, as to its accuracy or completeness and does not accept responsibility for any inaccuracy, error or omission nor any liability for the use of or reliance on this document or any part of the information contained herein. Past performance is not a reliable indicator of future performance. BNP Paribas is not giving any warranties, guarantee or representation as to the expected or projected success, profitability, return, performance, result, effect, consequence or benefit (either legal, regulatory, tax, financial accounting or otherwise) of any security.

Prior to making any commitment, the investor should take advice from his legal, tax and financial advisors. Subscribers should be in a position to fully understand the features of the subscription and be financially able to bear a loss of their investment and be willing to accept such risk. Save as otherwise expressly agreed in writing, BNP Paribas is not acting as financial adviser of, or in any fiduciary capacity to, the subscriber in any subscription.

This document contains only a summary of certain sustainability related aspects of the Fund and is not purported to be complete nor does it constitute an offer to invest in the Fund. It is not intended to be complete and will be qualified in its entirety by reference to the Limited Partnership Agreement of the Fund, which should be read in its entirety, in particular as regards the pre-contractual disclosure obligations under the SFDR, including how applicable sustainability risk factors are integrated into the decision-making process and their impact on returns. The descriptions or terms regarding sustainability-related aspects of the Fund in the Limited Partnership Agreement shall prevail.

An investment in the Fund should be conditioned upon the previous reading and understanding of its Limited Partnership Agreement and its Subscription Agreement which are available in English only. Therefore, prospective subscribers should not rely on any other information not contained in such Limited Partnership Agreement and, Subscription Agreement.

Under no circumstances will the Fund, the Management Company, the General Partner or BNP Paribas pay or reimburse any current or future taxation in the subscribers’ country of origin, residence or domiciliation or wherever subsequent to the subscription, holding, conversion, sale or liquidation of ordinary shares in the Fund. The subscriber will be responsible for such payment or reimbursement.

No measures have been nor will be taken in any country or territory for the purposes of allowing a public offering of the investment described in this document, or the holding or distribution of any document relating to this investment. These shares are not recommended by any federal or state securities commission or any other regulatory authority. Furthermore, the foregoing authorities have not confirmed the accuracy or determined the adequacy of this document. BNP Paribas, the Fund and the Management Company and the General Partner are separate legal entities and none of them is representing or acting as an agent for the other.

This document is not for distribution to US Persons. The interest in the Fund will be offered and sold by BNP Paribas only outside the United States to persons who are not US Persons, in accordance with Regulation S.

By accepting this documentation, the subscriber agrees to be bound by the foregoing limitations.

BNP Paribas SA (2024). All rights reserved.