ACOF VII provides a timely opportunity for BNP Paribas WM clients to invest in a flexible Private Equity fund, managed by a leading global alternative investment manager. Ares invests in growth buyouts, with the unique ability to pivot into special situations during periods of recession, by investing in high-quality companies with distressed capital structures.

Targeting a fund size of $6 billion, ACOF VII will invest in its 4 core industries - Healthcare, Services, Industrials and Consumer - mainly in North America and, to a lesser extent, in Europe. Within these sectors, Ares invests in middle-market companies with inefficiencies, with the aim of driving value creation through operational growth.

Ares is one of the largest alternative investment managers in the world and one of the leading direct lenders in North America and Europe, which has led to develop a differentiated and flexible Private Equity strategy, combining buyouts and special situations. This all-weather strategy, targeting good companies with constrained capital structures, is well adapted to periods of heightened market volatility, inflation and rising interest rates.

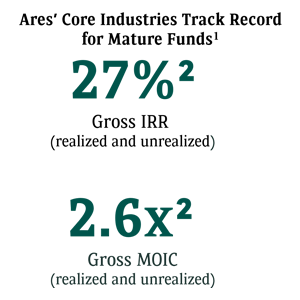

Ares’ Corporate Opportunities strategy has generated a solid 20-year track record in its 4 core industries, where its mature funds (1) have generated a gross return of 2.6x (2) the invested amount and a gross IRR of 27% (2), across both growth buyouts and distressed strategies.

This performance is mainly due to Ares’ long-term approach to value creation through operational and strategic initiatives. Thus, about 83% of the value creation was driven by the portfolio companies’ growth in operating profit.

1.“Mature Funds” performance reflects the aggregate performance of the predecessor funds that will be outside of their investment period by the time ACOF VII begins investing and consists of the track records of ACOF I (2003 vintage) to ACOF V (2017 vintage).

2. As at 31 March 2023. Past performance is not a reliable indicator of future performance. No guarantee is given on the success, profitability, return or benefit of this investment. Core Industries Growth Buyouts and Distressed performance includes all investments in ACOF’s Core Industries of (i) Healthcare, (ii) Services, (iii) Industrials and (iv) Consumer, and excludes the impact of those investments in the energy equipment & services industry and the oil, gas & consumable fuels, industry, and the renewable electricity and additional investments not included in ACOF’s Core Industries (“i.e. “other investments”).

Private Equity remains a great opportunity

Diversification

Private Equity provides diversification in a portfolio, aiming for high returns to compensate for illiquidity and a long-term maturity. In addition it continues to outperform stock markets over the long term across different economic cycles

Good Momentum

Periods of economic downturn are usually good entry points for Private Equity funds to capitalize on attractive entry valuations.

Attractive returns*

Leading Private Equity managers are well equipped to seize attractive opportunities and then implement growth strategies based on operational improvement while demonstrating a capacity to adapt to complex and uncertain environments.

*Past performance is not an indicator of future performance.

*Source : Ares Management & BNP Paribas Wealth Management – July 2023

1 As of 31 March 2023.

2. Past performance is not a reliable indicator of future performances. No guarantee is given on the success, profitability, return or benefit of this investment.

3. Core Industries Growth Buyouts and Distressed performance includes all investments in ACOF’s Core Industries of (i) Healthcare, (ii) Services, (iii) Industrials and (iv) Consumer, and excludes the impact of those investments in the energy equipment & services industry and the oil, gas & consumable fuels, industry, and the renewable electricity and additional investments not included in ACOF’s Core Industries (“i.e. “other investments”).

Claire Roborel de Climens

Global Head of Private and Alternative Investments ·

BNP Paribas Wealth Management

After joining BNP Paribas Wealth Management in 2004, Claire Roborel de Climens set up the Private Equity Group. In 2010 she was also nominated Head of Real Estate. In 2015, she became Head of the Private and Alternative Investments department, adding the Hedge Funds, Strategic-A (asset allocation service), Philanthropy Advisory and AgriFrance activities to her scope of responsibility.

Claire is a member of various advisory boards of Global and European Private Equity and Real Estate funds. She sits on the board of Global General Partner, the AIFM manager of PERE feeder funds, and on the Supervisory Board of BNP Paribas Real Estate investment Management France (REIM).

Prior to joining BNP Paribas Wealth Management, Claire worked 10 years for PAI Partners, a leading pan-European Private Equity firm, as a manager in the Finance Department, Investor Relations activities and then as an investor in the General Industrials sector where she was involved in many LBO transactions.

She started her career as an auditor at Ernst & Young where she worked for six years for large industrial groups and Private Equity funds.

Claire Roborel de Climens is a graduate of the EMLyon business school.

Contact your Relationship Manager for more information

BNP PARIBAS Wealth Management Disclaimer:

This document is communicated by the Wealth Management métier of BNP PARIBAS SA a French limited liability company with share capital of EUR 2,468,663,292 whose registered office is located at 16 boulevard des Italiens 75009 Paris, France, registered with the Paris Trade and Companies Registry under number 662 042 449, supervised and authorised as a Bank by the European Central Bank ("ECB") and in France by the French Autorité de Contrôle Prudentiel et de Résolution (“ACPR”) and regulated by the French Autorité des Marchés Financiers (“AMF”) (hereinafter BNP Paribas).

Ares Corporate Opportunities Fund VII Parallel (Lux Foreign), SCSp is a Luxembourg special limited partnership (Société en Commandite Spéciale) (the “Master Fund”). It is managed by its co-general partners: ACOF Lux Management VII S.à r.l., a Luxembourg private limited liability company (société à responsabilité limitée) having its registered office at 14-16, avenue Pasteur, 2310 Luxembourg, the Grand Duchy of Luxembourg and registered with the Luxembourg RCS under number B274820 (the “Lux Co-General Partner”) and ACOF Management VII, L.P., a Delaware limited partnership, (the “Delaware Co-General Partner” and together and when acting jointly with the Lux Co-General Partner, the “Master Fund’s General Partner”). The Master Fund’s General Partner has appointed Vistra Fund Management S.A., a public limited liability company (société anonyme) whose registered office is located at 16, rue Eugène Ruppert, L-2453, Luxembourg, Grand Duchy of Luxembourg and is registered with the RCS under number B202832, as manager to manage and operate the Master Fund (the “Master Fund’s AIFM”). The Master Fund’s AIFM is authorized by the Luxembourg financial supervisory authority (the Commission de Surveillance du Secteur Financier - “CSSF”) to manage alternative investment funds and is responsible for the portfolio and risk management of the Master Fund, in compliance with the European Directive 2011/61/EU of 8 June 2011 on Alternative Investment Fund Managers.

PrivAccess XV – Corporate Opportunities 7 is a compartment of PrivAccess XV (hereinafter “Feeder Fund“) a Luxembourg investment company with variable capital, structured under the form of a Multi-Compartment Reserved Alternative Investment Fund, registered as a corporate partnership limited by shares, notified to the CSSF. It is managed by its general partner: PrivAccess General Partner S.à r.l., and Global General Partner SA, which is an Alternative Investment Fund Manager authorised by the Luxembourg CSSF, appointed to manage the Feeder Fund.

This material is confidential and intended solely for the use of the person to whom it has been delivered and must not be distributed, published or reproduced, in whole or in part nor may it be quoted or referred to in any document without the prior consent of BNP Paribas. This document is provided solely for the purpose of providing general information and shall not constitute an offer, a solicitation or an investment advice nor shall it form the basis of or be relied upon in connection with any subscription or commitment. In addition, this document and its content shall not in any way be construed as an advertisement, inducement or recommendation of any kind or form whatsoever. For the purposes herein, “BNP Paribas” means BNP PARIBAS SA and its respective affiliates and related corporations.

Although the information provided herein may have been obtained from published or unpublished sources considered to be reliable, and while all reasonable care has been taken in the preparation of this document, BNP Paribas does not make any representation or warranty, express or implied, as to its accuracy or completeness and does not accept responsibility for any inaccuracy, error or omission nor any liability for the use of or reliance on this document or any part of the information contained herein. Past performance is not a reliable indicator of future performance. BNP Paribas is not giving any warranties, guarantee or representation as to the expected or projected success, profitability, return, performance, result, effect, consequence or benefit (either legal, regulatory, tax, financial accounting or otherwise) of any security.

Prior to making any commitment, the investor should take advice from his legal, tax and financial advisors. Subscribers should be in a position to fully understand the features of the subscription and be financially able to bear a loss of their investment and be willing to accept such risk. Save as otherwise expressly agreed in writing, BNP Paribas is not acting as financial adviser of, or in any fiduciary capacity to, the subscriber in any subscription.

This document contains only a summary of certain sustainability related aspects of the Feeder Fund and is not purported to be complete nor does it constitute an offer to invest in the Feeder Fund. It is not intended to be complete and will be qualified in its entirety by reference to the Issuing Document, which should be read in its entirety, in particular as regards the pre-contractual disclosure obligations under the SFDR, including how applicable sustainability risk factors are integrated into the decision-making process and their impact on returns. The descriptions or terms regarding sustainability-related aspects of the Feeder Fund in the Issuing Document shall prevail. See SFDR related disclosures in the Issuing Document and on the page https://services-uk.sungarddx.com/LogOn/128060.

Any document containing additional information concerning the Feeder Fund and in particular the Issuing Document, the annual reports (which are made available to the investors on a regulatory basis after its investment in the Feeder Fund), the subscription document and the Master Fund documentation are available in English upon request from your relationship manager and from PrivAccess General Partner S.à r.l. (contact details below). If you want more information, especially on the structure of the Feeder Fund and the risks associated with an investment in this Feeder Fund, we advise you to read these documents.

PrivAccess General Partner S.à r.l. – 50, avenue J.F. Kennedy,

L-1855 Luxembourg – Grand-Duchy of Luxembourg

contact@ggp.bnpparibas.com – 00 352 4242 2000

The summary of investor rights is available on the page https://wealthmanagement.bnpparibas/lu/en/global-general-partner/Summary-of-investors-rights.html.

An investment in the Feeder Fund should be conditioned upon the previous reading and understanding of its Issuing Document and its Subscription Agreement, which are available in English only, and – in relation to the offer to non-professional investors in Italy, Germany and Belgium - its KIDs, which are available in the relevant language; such documents describe the rights and obligations of the investors. Therefore, prospective subscribers should not rely on any other information not contained in such Issuing Document, Subscription Agreement and Key Information Document (KID).

Under no circumstances will the Feeder Fund, PrivAccess General Partner S.a.r.l, Global General Partner SA, BNP Paribas, Ares Corporate Opportunities Fund VII Parallel (Lux Foreign), SCSp, ACOF Lux Management VII S.à r.l., ACOF Management VII, L.P., or Vistra Fund Management S.A. pay or reimburse any current or future taxation in the subscribers’ country of origin, residence or domiciliation or wherever subsequent to the subscription, holding, conversion, sale or liquidation of ordinary shares in the Feeder Fund. The subscriber will be responsible for such payment or reimbursement.

No measures have been nor will be taken in any country or territory for the purposes of allowing a public offering of the investment described in this document, or the holding or distribution of any document relating to this investment. These ordinary shares are not recommended by any federal or state securities commission or any other regulatory authority. Furthermore, the foregoing authorities have not confirmed the accuracy or determined the adequacy of this document. BNP Paribas, PrivAccess General Partner S.à r.l, Global General Partner SA, ACOF Lux Management VII S.à r.l., ACOF Management VII, L.P., and Vistra Fund Management S.A. are separate legal entities and none of them is representing or acting as an agent for the other.

This document is not for distribution to US Persons and US Persons are not eligible to apply to become Shareholders in the Feeder Fund. The ordinary shares of the Feeder Fund will be offered and sold only outside the United States to persons who are not US Persons, in reliance on Regulation S.

The Feeder Fund has been notified, under the relevant provisions of the AIFMD, for marketing in Italy towards professional investors (as defined in Italy pursuant to art. 6, parr. 2-quinquies and 2-sexies, of the Legislative Decree n. 58/1998 as amended – “TUF” - and its implementing measures) and other categories of investors as identified pursuant to art. 14. 2 of the regulation implementing art. 39 of TUF adopted by the Italian Treasury with Decree n. 30 of 5 March 2015, as amended by Decree n. 19 of 13 January 2022 (and, in particular, pursuant to art. 14.2.b), to non professional investors who – within the context of the provision of investment advisory services – subscribe for or acquire shares of the Feeder Fund for an initial amount not lower than 100,000 Euros (initial amount not lower than the equivalent in US Dollars of 100,000 Euros for this Feeder Fund) (always provided that, by effect of such subscription or acquisition, the total amount of their investments in reserved AIFs does not exceed 10% of their financial portfolio; the initial participation amount is not fractionable).

In relation to the offer to non-professional investors in Italy – the Key Information Document (KID) in Italian of the Feeder Fund are available at the page https://services-uk.sungarddx.com/LogOn/128060 and the information on “Facilities available to retail investors” (both in English and in Italian) are available on the page https://wealthmanagement.bnpparibas/lu/en/global-general-partner/facilities-made-available-to-investors-in-italy-.html.

BNP Paribas S.A. is subject to a Securities and Exchange Commission exemption order regarding guilty pleas entered on June 30, 2014, and July 9, 2014, by BNP Paribas S.A. in the Supreme Court of the State of New York, County of New York, and the United States District Court for the Southern District of New York, respectively. A copy of such order is available at https://www.sec.gov/rules/ic/2014/ic-31188.pdf.

By accepting this documentation, the subscriber agrees to be bound by the foregoing limitations.

BNP Paribas SA (2023). All rights reserved.

Placement Agent Marketing Rule Disclosures

BNP Paribas SA (the “Placement Agent”) is acting as placement agent for the Fund. The Placement Agent is not a current advisory client of ARES; however, the Placement Agent and/or affiliates and employees of the Placement Agent may be investors in investment funds advised by ARES, some of which may have negotiated beneficial economic terms in connection therewith (e.g., reduced compensation percentages). For providing solicitation and other services with respect to certain investors who invest in the Fund, the Placement Agent will receive cash compensation in the form of fees generally based on the amount of capital commitments that will ultimately be borne directly or indirectly by ARES rather than the Fund; however, in certain cases the Fund is expected to bear certain out-of-pocket expenses related to the Placement Agent’s engagement and solicitation of investors. As a result, the Placement Agent has a material incentive and potential conflict of interest to recommend an investment in the Fund. The Placement Agent seeks to manage any such potential conflicts of interest that could result from this incentive under a framework of procedures and policies deployed to manage potential conflicts of interests, in compliance with its applicable laws and regulations. The Placement Agent also expects, from time to time, to do business with and earn fees or commissions from affiliates of ARES, as well as with other third party fund sponsors that may have similar or different investment objectives from the Fund, including the provision of advisory and placement services. Accordingly, potential investors should recognize that the Placement Agent’s participation as placement agent for interests in the Fund will potentially be influenced in certain circumstances by its interest in such compensation, including differentials in compensation are offered by ARES or other sponsors for which the Placement Agent acts as placement agent.