Ardian is one of the world's pioneers in Private Infrastructure. Ardian has shown 19 years of consistency in delivering value, with a focus on essential services to the community in the energy transition, transportation and digital space.

Ardian's market strategy is a perfect mix of a steady data-driven approach to improving industrial processes at the assets level and a private equity approach to unlocking value to make portfolio companies appealing to prospective buyers.

Ardian is a proven leader investing across 3 sectors of expertise since inception: Energy & Utilities, Digital infrastructure and Transportation. Indeed, the Private infrastructure investments managed by Ardian in its 3 sectors have generated a return of 17% gross IRR* coupled with c. 7% average yield**.

* As of 30 September 2023, consolidated over the three latest European fund generations. Past performance is not an indicator of future performance.

** As of June 2023, yields calculated excluding exits over all European generations. In this average, portfolio yield definition: all net proceeds year N / cumulated remaining invested amount. Past performance is not an indicator of future performance.

Infrastructure is everywhere.

When we use digital tools, a datacentre is required. When we travel, we use roads, railways or airports. And finally, when we recharge our mobile phone, we use electricity, which is provided by a power plant.

3 megatrends drive demand for infrastructure, known as the 3 Ds:

Digitalisation, Decarbonisation, Deglobalisation

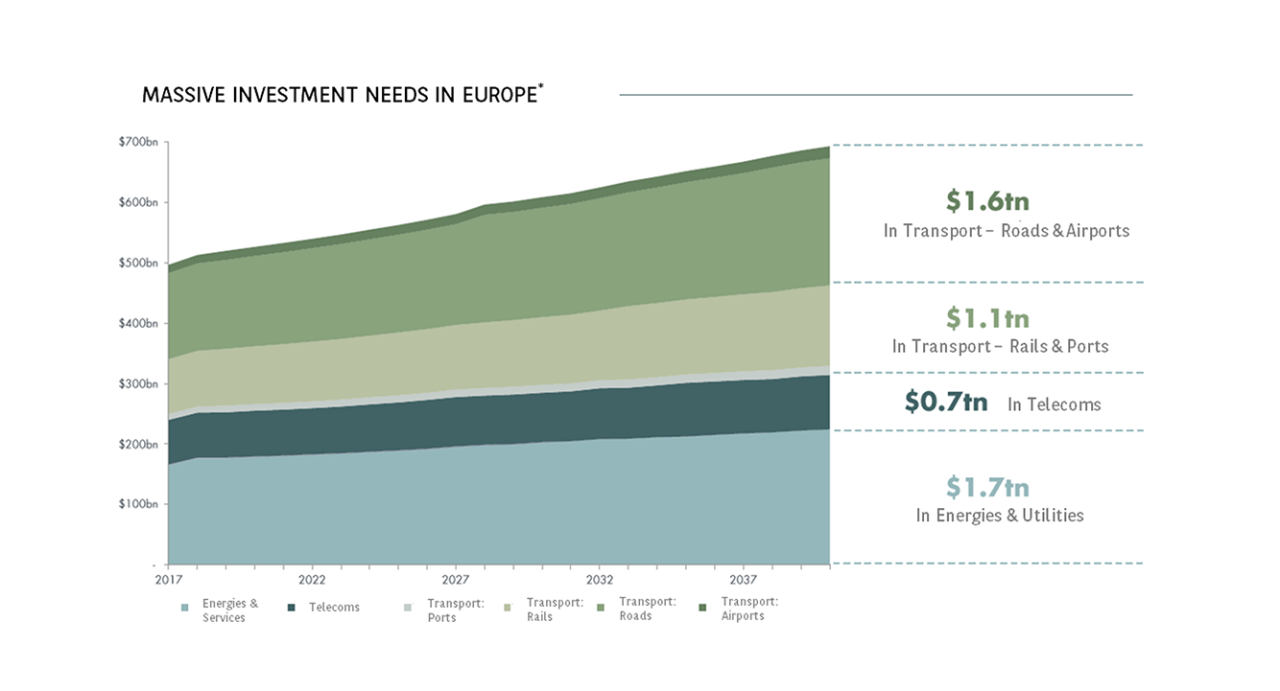

Infrastructure, an essential service to the community, was previously provided by governments and public-sector organisations. However, owing to the capital expenditure required by these massive investments coupled with high levels of government debt, private investments have become essential. This results in amazing opportunities for private capital investments.

* Investment needs in Europe over the 2022-2030 period to meet the UN sustainable Development Goal. Source: Global Infrastructure Outlook 2022

Maxime Jouret

Global Deputy

Head of Private Assets

BNP Paribas Wealth Management

Maxime Jouret is Global Deputy Head of Private Assets at BNP Paribas Wealth Management, responsible for the infrastructure investment funds activity globally, including the selection of master funds, feeder funds structuration, distribution and monitoring. Maxime joined BNP Paribas Wealth Management in 2014 in Paris to develop the private real estate practice. Since joining, he has been instrumental in the strong increase of the real estate assets managed by Wealth Management on behalf of its clients. Mr Jouret is a senior member of the Private Markets team within Wealth Management. Prior to his current functions, Maxime held various positions at BNP Paribas both in Paris and in London. He began his career at Bain&Company as a consultant in the financial sector. Maxime holds an MBA from the ESSEC business school.

Contact your Relationship Manager for more information

As a result of certain European and French laws and regulations, including but without limitation the provisions of the French financial and monetary code and the General Regulation of the French financial regulator (Autorité des Marchés Financiers), which are applicable to Ardian, the following disclosure statement is required:

1. BNP Paribas and certain of its private bank affiliates participating in the offering are distributing these materials in connection with their role as placement agent for the Fund. Neither BNP Paribas nor PrivAccess XVII - Essential Infrastructure 6 is a current direct client of Ardian or a current direct investor in the Fund; however, PrivAccess XVII - Essential Infrastructure 6 expects to invest in the Fund and other BNP-sponsored vehicles have previously invested in funds managed by Ardian.

2. BNP Paribas or its affiliates receive compensation in connection with its role as placement agent, in an amount equal to 2% of the total commitments in the Fund that are subscribed by PrivAccess XVII - Essential Infrastructure 6 and directly by any BNPP Wealth Management’ client and duly accepted by Ardian into the Fund.

3. The relationship between BNP Paribas and Ardian could create potential conflicts of interests, including the fact that the compensation received by BNP Paribas creates an economic incentive to recommend and offer the interests in the Fund and in the PrivAccess XVII - Essential Infrastructure 6. It is likely that, as part of their regular business activities, BNP Paribas or its affiliates have had, and may in the future have, a variety of business relationships (e.g., consulting, advisory, valuation, personal banking and/or asset management and other services), commercial lending arrangements and investments with the Fund, Ardian or its affiliates, or other pooled investment vehicles sponsored or managed by Ardian or its affiliates, or a portfolio company of the Fund or any such other pooled investment vehicle.

4. BNP Paribas is not affiliated in any way with Ardian, other than as a fully independent contractor.

Disclaimer

This is a communication by the Wealth Management métier of BNP PARIBAS SA a French limited liability company with share capital of EUR 2 294 954 818 whose registered office is located at 16 boulevard des Italiens 75009 Paris, France, registered with the Paris Trade and Companies Registry under number 662 042 449, supervised and authorised as a Bank by the European Central Bank ("ECB") and in France by the French Autorité de Contrôle Prudentiel et de Résolution (“ACPR”) and regulated by the French Autorité des Marchés Financiers (“AMF”) (hereinafter “BNP Paribas”).

Ardian Infrastructure VI S.C.S. is a Luxembourg a simple limited partnership (Société en Commandite Simple). Its General Partner Ardian Infrastructure VI S.à.r.l a Luxembourg private limited liability company (Société à responsabilité limitée). It is managed by Ardian France, a French private limited liability company (Société Anonyme) authorised by the French Autorité des Marchés Financiers (“AMF”) as an Alternative Investment Fund Manager.

PrivAccess XVII - Essential Infrastructure 6 is a compartment of PrivAccess XVII (hereinafter “Feeder Fund“) a Luxembourg investment company with variable capital, structured under the form of a Multi-Compartment Reserved Alternative Investment Fund, registered as a corporate partnership limited by shares, notified to the CSSF. It is managed by its general partner: PrivAccess General Partner S.à r.l. and Global General Partner SA, which is an Alternative Investment Fund Manager authorised by the Luxembourg CSSF, has been appointed to manage the Feeder Fund.

This material is confidential and intended solely for the use of the person to whom it has been delivered and must not be distributed, published or reproduced, in whole or in part nor may it be quoted or referred to in any document without the prior consent of BNP Paribas. This communication is provided solely for the purpose of providing general information and shall not constitute an offer, a solicitation or an investment advice nor shall it form the basis of or be relied upon in connection with any subscription or commitment. In addition, this communication and its content shall not in any way be construed as an advertisement, inducement or recommendation of any kind or form whatsoever. For the purposes herein, “BNP Paribas” means BNP PARIBAS SA and its respective affiliates and related corporations.

Although the information provided herein may have been obtained from published or unpublished sources considered to be reliable, and while all reasonable care has been taken in the preparation of this communication, BNP Paribas does not make any representation or warranty, express or implied, as to its accuracy or completeness and does not accept responsibility for any inaccuracy, error or omission nor any liability for the use of or reliance on this communication or any part of the information contained herein. Past performance is not a reliable indicator of future performance. BNP Paribas is not giving any warranties, guarantee or representation as to the expected or projected success, profitability, return, performance, result, effect, consequence or benefit (either legal, regulatory, tax, financial accounting or otherwise) of any security.

Prior to making any commitment, the investor should take advice from his legal, tax and financial advisors. Subscribers should be in a position to fully understand the features of the subscription and be financially able to bear a loss of their investment and be willing to accept such risk. Save as otherwise expressly agreed in writing, BNP Paribas is not acting as financial adviser of, or in any fiduciary capacity to, the subscriber in any subscription.

This communication contains only a summary of certain sustainability related aspects of the Feeder Fund and is not purported to be complete nor does it constitute an offer to invest in the Feeder Fund. It is not intended to be complete and will be qualified in its entirety by reference to the Issuing Document, which should be read in its entirety, in particular as regards the pre-contractual disclosure obligations under the SFDR, including how applicable sustainability risk factors are integrated into the decision-making process and their impact on returns. The descriptions or terms regarding sustainability-related aspects of the Feeder Fund in the Issuing Document shall prevail. See SFDR Sustainability-Related Disclosures (i) in the Issuing Document which has been communicated to you before your potential commitment into the Feeder Fund and which will remain available after your commitment into the Feeder Fund on the page https://services-uk.sungarddx.com/LogOn/128060, and (ii) in the SFDR Sustainability-related Disclosures which are available before your potential commitment into the Feeder Fund on the pages https://mywealth.bnpparibas.lu/content/dam/wealth/common/ggp/PrivAccess-XVII-Essential-Infra-6-Sustailability-Disclosures.pdf and https://mywealth.bnpparibas.lu/content/dam/wealth/common/ggp/PrivAccess-XVII-Essential-Infra-6-Sustailability-Disclosures-Summary.pdf which will remain available after your commitment into the Feeder Fund on the page https://services-uk.sungarddx.com/LogOn/128060.

Any document containing additional information concerning the Feeder Fund and in particular the Issuing Document, the annual reports (which are made available to the investors on a regulatory basis after its investment in the Feeder Fund), the subscription document and the Master Fund documentation are available in English upon request from your relationship manager and from PrivAccess General Partner S.à r.l. (contact details below). If you want more information, especially on the structure of the Feeder Fund and the risks associated with an investment in this Feeder Fund, we advise you to read these documents.

PrivAccess General Partner S.à r.l. – 50, avenue J.F. Kennedy,

L-1855 Luxembourg – Grand-Duchy of Luxembourg

contact@ggp.bnpparibas.com – 00 352 4242 2000

The summary of investor rights is available on the public page

https://wealthmanagement.bnpparibas/lu/en/global-general-partner/Summary-of-investors-rights.html.

An investment in the Feeder Fund should be conditioned upon the previous reading and understanding of its Issuing Document and its Subscription Agreement, which are available in English only, and – in relation to the offer to non-professional investors in Italy, Germany, Belgium and Luxembourg - its KIDs, which are available in the relevant language; such documents describe the rights and obligations of the investors. Therefore, prospective subscribers should not rely on any other information not contained in such Issuing Document, Subscription Agreement and Key Information Document (KID).

Under no circumstances will the Feeder Fund, PrivAccess General Partner S.a.r.l, Global General Partner SA, BNP Paribas, Ardian Infrastructure VI, Ardian Infrastructure VI Sarl, Ardian France pay or reimburse any current or future taxation in the subscribers’ country of origin, residence or domiciliation or wherever subsequent to the subscription, holding, conversion, sale or liquidation of ordinary shares in the Feeder Fund. The subscriber will be responsible for such payment or reimbursement.

No measures have been nor will be taken in any country or territory for the purposes of allowing a public offering of the investment described in this communication, or the holding or distribution of any document relating to this investment. These ordinary shares are not recommended by any federal or state securities commission or any other regulatory authority. Furthermore, the foregoing authorities have not confirmed the accuracy or determined the adequacy of this communication. BNP Paribas, PrivAccess General Partner S.à r.l, Global General Partner SA, Ardian Infrastructure VI, Ardian France entities are separate legal entities and none of them is representing or acting as an agent for the other.

Global General Partner SA and/or PrivAccess General Partner S.a.r.l. may decide at any time to terminate the arrangements made for the marketing of the Feeder Fund.

This communication is not for distribution to US Persons and US Persons are not eligible to apply to become Shareholders in the Feeder Fund. The ordinary shares of the Feeder Fund will be offered and sold only outside the United States to persons who are not US Persons, in reliance on Regulation S.

The Feeder Fund has been notified, under the relevant provisions of the AIFMD, for marketing in Italy towards professional investors (as defined in Italy pursuant to art. 6, parr. 2-quinquies and 2-sexies, of the Legislative Decree n. 58/1998 as amended – “TUF” - and its implementing measures) and other categories of investors as identified pursuant to art. 14. 2 of the regulation implementing art. 39 of TUF adopted by the Italian Treasury with Decree n. 30 of 5 March 2015, as amended by Decree n. 19 of 13 January 2022 (and, in particular, pursuant to art. 14.2.b), to non professional investors who – within the context of the provision of investment advisory services – subscribe for or acquire shares of the Feeder Fund for an initial amount not lower than 100,000 Euros (initial amount not lower than 100,000 Euros for this Feeder Fund) (always provided that, by effect of such subscription or acquisition, the total amount of their investments in reserved AIFs does not exceed 10% of their financial portfolio; the initial participation amount is not fractionable).

In relation to the offer to non-professional investors in Italy – the Key Information Document (KID) in Italian of the Feeder Fund have been communicated to you before your potential commitment into the Feeder Fund (and in particular through dedicated URLs) and will remain available after your commitment into the Feeder Fund on the page https://services-uk.sungarddx.com/LogOn/128060 and the information on “Facilities available to retail investors” (both in English and in Italian) are available or on the public page https://wealthmanagement.bnpparibas/lu/en/global-general-partner/Information-about-the-facilities-Italy.html.

More globally and in relation to the offer to non-professional investors in Belgium, Germany, Luxembourg and Italy, the Key Information Documents (KID) written in French, Flemish, German, Italian and English have been communicated to you before your potential commitment into the Feeder Fund (and in particular through dedicated URLs) and will remain available after your commitment into the Feeder Fund on the page https://services-uk.sungarddx.com/LogOn/128060.

The Issuing Document of the Feeder Fund is also available for investors only on the same page https://services-uk.sungarddx.com/LogOn/128060.

By accepting this documentation, the subscriber agrees to be bound by the foregoing limitations.

BNP Paribas SA (2024). All rights reserved.