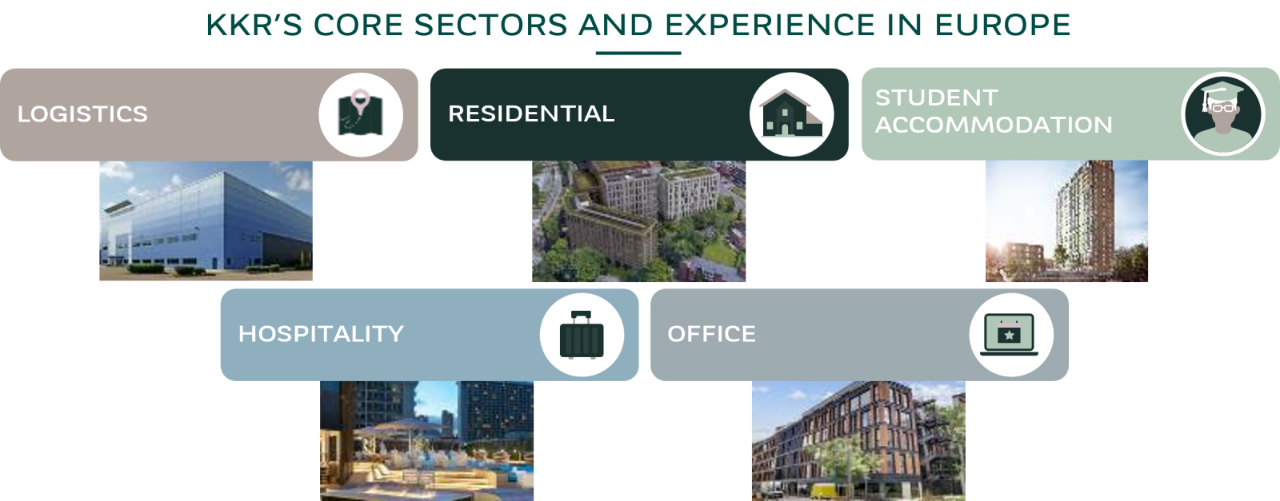

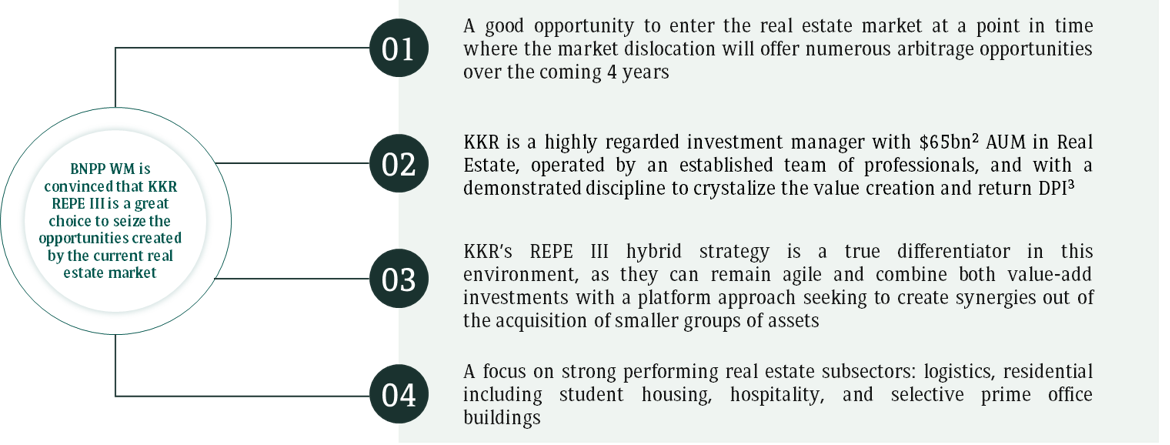

In the current investment environment, KKR is mindful of selecting assets that are essential to the economy and adaptable so that their value constantly outperforms the market. Key real estate subsectors that tick all these boxes are logistics, residential (including student housing), hospitality, and selective prime office buildings. This strategy is fully in line with our vision of how an asset manager can create high value.

KKR is a highly regarded investment manager with $65bn AUM (1) in Real Estate. They have an established Real Estate Platform in Europe, and through their “one-firm” approach, they leverage on their broad network across industries and sectors to help identify off-market attractive investment opportunities for their Real Estate funds.

1As of March 31, 2023 Figures represent AUM across all KKR real estate strategies including, as applicable, Real Estate Partners Americas, Real Estate Partners Europe, Asia Real Estate Partners, Property Partners Americas, Property Partners Europe, Asia Property Partners, Real Estate Credit, estimated value of Global Atlantic assets, Real Estate NBFC, KJRM (as noted herein), KREST and co-investments.

Source: KKR – Q2 2023

2As 31 March 2023, figures represent AUM across all KKR real estate strategies including, as applicable, Real Estate Partners Americas, Real Estate Partners Europe, Asia Real Estate Partners, Property Partners Americas, Property Partners Europe, Asia Property Partners, Real Estate Credit, estimated value of Global Atlantic assets, Real Estate NBFC, KJRM (as noted herein), KREST and co-investments.

3Forecasts and targets are not guaranteed

Maxime Jouret

Global Head of Real Estate

BNP Paribas Wealth Management

Maxime Jouret is the Global Head of Real Estate at BNP Paribas Wealth Management, responsible for the real estate investment funds activity globally, including the selection of master funds, feeder funds structuration, distribution and monitoring. Maxime joined BNP Paribas Wealth Management in 2014 in Paris to develop the private real estate practice. Since joining, he has been instrumental in the strong increase of the real estate assets managed by Wealth Management on behalf of its clients. Mr Jouret is a senior member of the Private Markets team within Wealth Management. Prior to his current functions, Maxime held various positions at BNP Paribas both in Paris and in London. He began his career at Bain&Company as a consultant in the financial sector. Maxime holds an MBA from the ESSEC business school.

Contact your Relationship Manager for more information

BNP Paribas SA / Wealth Management Division (the “Placement Agent”) have solicited you in connection with a prospective investment in KKR Real Estate Partners Europe III (EUR) SCSp and/or KKR Real Estate Partners Europe III (USD) SCSp directly or indirectly through PrivAccess XVIII – Pan European Real Estate 3. In connection with this solicitation, the Placement Agent will receive cash compensation from KKR in an amount equal to 2% of the capital committed by investors that the Placement Agent introduces to KKR. Consequently, the Placement Agent has a financial incentive in the distribution of the Feeder Fund or Master to prospective investors. The Placement Agent is not a current advisory client of KKR, although the Placement Agent and/or its employees and affiliates may from time to time be investors in investment vehicles or accounts advised by KKR.

DISCLAIMER

This document is communicated by the Wealth Management métier of BNP PARIBAS SA a French limited liability company with share capital of EUR 2,468,663,292 whose registered office is located at 16 boulevard des Italiens 75009 Paris, France, registered with the Paris Trade and Companies Registry under number 662 042 449, supervised and authorised as a Bank by the European Central Bank ("ECB") and in France by the French Autorité de Contrôle Prudentiel et de Résolution (“ACPR”) and regulated by the French Autorité des Marchés Financiers (“AMF”) (hereinafter “BNP Paribas”).

KKR Real Estate Partners Europe III (EUR) SCSp (the “Master Fund”) and KKR Real Estate Partners Europe III (USD) SCSp are both Luxembourg a special limited partnerships (Société en Commandite Spéciale) (together with the Master Fund, any parallel vehicles, feeder funds and alternative investment vehicles, “KKR REPE III” or “REPE III”). Their General Partner is KKR Associates REPE III SCSp, a Luxembourg special limited partnerships (Société en Commandite Spéciale) (the “REPE III General Partner”). REPE III is managed by KKR Alternative Investment Management Unlimited Company (the “REPE III AIFM”), an Irish unlimited company with share capital and an affiliate of KKR, and authorized by the Central Bank of Ireland as an alternative investment fund manager under the European Union (Alternative Investment Fund Managers) Regulations 2013 of Ireland, as amended (the “Irish AIFM Regulations”). References herein to “KKR REPE III” or “REPE III” shall mean the Master Fund, as context requires.

PrivAccess XVIII Pan European Real Estate 3 is a compartment of PrivAccess XVIII SICAV-RAIF SCA (hereinafter “Feeder Fund”) a Luxembourg investment company with variable capital, structured under the form of a Multi-Compartment Reserved Alternative Investment Fund, registered as a corporate partnership limited by shares, notified to the CSSF. It is managed by its general partner: PrivAccess General Partner S.à r.l. and Global General Partner SA, which is an Alternative Investment Fund Manager authorised by the Luxembourg CSSF, has been appointed to manage PrivAccess XVIII PERE 3.

This material is confidential and intended solely for the use of the person to whom it has been delivered and must not be distributed, published or reproduced, in whole or in part nor may it be quoted or referred to in any document without the prior consent of BNP Paribas. This document is provided solely for the purpose of providing general information and shall not constitute an offer, a solicitation or an investment advice nor shall it form the basis of or be relied upon in connection with any subscription or commitment. In addition, this document and its content shall not in any way be construed as an advertisement, inducement or recommendation of any kind or form whatsoever. For the purposes herein, “BNP Paribas” means BNP Paribas SA and its respective affiliates and related corporations.

Although the information provided herein may have been obtained from published or unpublished sources considered to be reliable, and while all reasonable care has been taken in the preparation of this document, none of BNP Paribas, KKR, the REPE III General Partner, the REPE III AIFM, REPE III, nor any of their affiliates or related entities make any representation or warranty, express or implied, as to its accuracy or completeness and does not accept responsibility for any inaccuracy, error or omission nor any liability for the use of or reliance on this document or any part of the information contained herein. KKR has not participated and will not participate in the preparation of, nor is it or will be responsible for, the contents of any of this document or any related agreements, instruments or accompanying sales documentation, does not make any representation to any recipient with respect to the adequacy or sufficient of the information contained in this document, and has not endorsed or made any recommendations, representations or warranties with respect to the fairness, correctness, accuracy, reasonableness or completeness of any of the information contained in this document, and KKR expressly disclaims any responsibility or liability therefor. KKR has no responsibility to update any of the information provided in this document.

Past performance is not a reliable indicator of future performance. none of BNP Paribas, KKR, the REPE III General Partner, the REPE III AIFM, REPE III, nor any of their affiliates or related entities are giving any warranties, guarantee or representation as to the expected or projected success, profitability, return, performance, result, effect, consequence or benefit (either legal, regulatory, tax, financial accounting or otherwise) of any security.

Prior to making any commitment, the investor should take advice from his legal, tax and financial advisors. Subscribers should be in a position to fully understand the features of the subscription and be financially able to bear a loss of their investment and be willing to accept such risk. Save as otherwise expressly agreed in writing, BNP Paribas is not acting as financial adviser of, or in any fiduciary capacity to, the subscriber in any subscription.

None of Kohlberg Kravis Roberts & Co. L.P. (“KKR”) or its affiliates have endorsed Privaccess XVIII – Pan European Real Estate 3 or make any representations warranties or recommendations with respect to the Feeder Fund or are otherwise responsible for the formation or operation of the Feeder Fund. The offering of interests in the Feeder Fund is not an offering of interests in REPE III. None of KKR, REPE III, the REPE III General Partner or any of their respective affiliates have approved the content of this document or made any representation or warranty with respect to the fairness, accuracy, or reasonableness of any of the information contained herein including, without limitation, any information regarding KKR, the fund, the general partner of the fund or their respective affiliates, and they expressly disclaim any responsibility or liability in respect thereof. No such party bears any responsibility for updating any information contained herein.

The Feeder Fund will invest, directly or indirectly, in the Master Fund; however, investors in the Feeder Fund will not be direct investors in the Master Fund or any portfolio entity in which the Feeder Fund directly or directly through the Master Fund, invests or commites to invest, and will have no voting rights or direct interest in the Master Fund and will have no standing or recourse against KKR, the Master Fund, the REPE III General Partner, the REPE III AIFM or any of their affiliates or any of their respective officers, directors, employees, members, partners, shareholders, controlling persons of the foregoing. Purchasers of interests in the Feeder Fund will not be parties to the Master Fund’s limited partnership agreement and will not have any rights thereunder and may not bring a direct action against KKR, REPE III, the REPE III General Partner, the REPE III AIFM or any of their respective officers, directors, employees, members, partners, shareholders, controlling persons or affiliates for any breach thereof or as a result of an investment in the Feeder Fund. Although the Feeder Fund will, as a limited partner of the Master Fund have rights and privileges with respect to the Master Fund in such capacity as a limited partner, none of KKR, REPE III, the REPE III General Partner or any of their respective affiliates is responsible to the Feeder Fund or its underlying investors. None of the Feeder Fund, the conduit manager or the placement agent or their affiliates or any investors in the Feeder Fund have the right to participate in the control, management or operations of the Master Fund, or has any discretion over the management of the Master Fund. The offering of interests in the Feeder Fund does not constitute and should not be considered as a direct or indirect offering of interests in the Master Fund or any KKR fund which can only be made by the Confidential Private Placement Memorandum of the Master Fund (the “REPE III Memorandum”). The terms of the Master Fund may be subject to continuing negotiation with prospective investors and may be different from those summarized herein or provided in the materials referenced herein. All information contained herein concerning REPE III may be supplemented from time to time.

References to “Gross IRR” and “Gross MOIC”, in respect of KKR performance presented herin, represent the aggregate, compound, annual internal rate of return or multiple of invested capital, respectively, calculated on the basis of cash flows to and from all partners, but disregarding the payment by limited partners (or, in the case of unrealized investments, accrual) of carried interest, management fees and organizational expenses payable by limited partners (whether actually paid or, including in respect of carried interest on unrealized investments, accrued), which will reduce returns and, in the aggregate, are expected to be substantial.Calculations of Gross IRR at the fund level use the date of contribution by fund investors to the fund for the relevant investment (i.e., the due date for the relevant capital call notice). Generally, with respect to funds that borrow on a temporary basis prior to calling capital, if calculations of Gross IRR at the fund level used the dates of each investment rather than the dates of each contribution by fund investors, then the Gross IRR would be lower since internal rate of return calculations are time-weighted and the relevant calculations would incorporate longer periods of time during which capital is deployed.

Recipients should note that the carried interest, management fee and organizational expense terms of REPE III may differ from those of any of the funds presented and, depending on the circumstances, may be higher (resulting in reduced net returns). Recipients should note that the fund expense terms of REPE III could differ from those of REPE I and REPE II and, depending on the circumstances, could be higher (resulting in reduced returns for the Feeder Fund). Certain recently established KKR funds, including REPE I and REPE II, require a return of all organizational expenses and management fees that have been contributed to date prior to paying any carried interest to the relevant general partner. As a result, in these more recent funds, a disproportionate amount of investment proceeds will be returned to limited partners earlier in the life of these funds. Consequently, the Net IRRs and Net MOICs for these funds will appear higher in the early years of their lives than if only an allocable portion of organizational expenses and management fees were returned prior to paying carried interest to the relevant general partner.

As noted herein, certain hypothetical data and estimates presented herein are based upon assumptions made by KKR professionals. KKR makes no representation or warranty as to the reasonableness of the assumptions made or that all assumptions used have been stated or fully considered. Actual performance may differ substantially from the forecasted performance presented. Changes in the assumptions may have a material impact on the forecasted performance presented. The data presented represents the assumptions and estimates of the KKR Real Estate investment team and is believed by KKR to be reliable; however, KKR does not guarantee or give any warranty as to the accuracy, adequacy, timeliness or completeness of such assumptions. Nothing contained herein may be relied upon as a guarantee, promise or forecast or a representation as to the future.

Participation of KKR Private Equity, KKR Credit, KKR Capital Markets, KKR Advisors, Senior Advisors, Executive Advisors, Industry Advisors, Real Estate Consultants, KKR Capstone employees or KKR’s managed portfolio entities in the REPE III’s investment activities is subject to applicable law and inside information barrier policies and procedures, which may restrict or limit the involvement of such personnel in certain circumstances and the ability of KKR Real Estate to leverage such integration with KKR. Discussions with Senior Advisors, Executive Advisors, Industry Advisors, KKR Advisors and employees of KKR’s managed portfolio entities are also subject to inside information barrier policies and procedures, which could restrict or limit discussions and/or collaborations with KKR Real Estate.

References to “assets under management” or “AUM” represent the assets under management that are reported by KKR & Co. Inc. (NYSE: KKR) as a public company. This definition of AUM includes assets managed or advised by KKR from which KKR is entitled to receive a fee or carried interest from fund investors and other investment vehicles, capital committed by KKR as a general partner to its funds, and a pro rata portion of the AUM of certain third-party managers based on KKR’s ownership percentage in them. KKR’s definition of AUM is not based on any definition of AUM that may be set forth in the agreements governing the investment funds, vehicles or accounts that KKR manages or calculated pursuant to any regulatory definitions.

This document contains only a summary of certain sustainability related aspects of the Feeder Fund and is not purported to be complete nor does it constitute an offer to invest in the Feeder Fund. It is not intended to be complete and will be qualified in its entirety by reference to the Issuing Document, which should be read in its entirety, in particular as regards the pre-contractual disclosure obligations under the SFDR, including how applicable sustainability risk factors are integrated into the decision-making process and their impact on returns. The descriptions or terms regarding sustainability-related aspects of the Feeder Fund in the Issuing Document shall prevail. See SFDR related disclosures in the Issuing Document and here or on the page https://services-uk.sungarddx.com/LogOn/128060

Any document containing additional information concerning the Feeder Fund and in particular the Issuing Document, the annual reports (which are made available to the investors on a regulatory basis after its investment in the Feeder Fund), the subscription document and the Master Fund documentation are available in English upon request from your relationship manager and from PrivAccess General Partner S.à r.l. (contact details on the next page). If you want more information, especially on the structure of the Feeder Fund and the risks associated with an investment in this Feeder Fund, we advise you to read these documents.

PrivAccess General Partner S.à r.l. - 50, avenue J.F. Kennedy,

L-1855 Luxembourg - Grand-Duchy of Luxembourg

contact@ggp.bnpparibas.com - 00 352 4242 2000

The summary of investor rights is available here or on the page

https://wealthmanagement.bnpparibas/lu/en/global-general-partner/Summary-of-investors-rights.html

An investment in PrivAccess XVIII Pan European Real Estate 3 should be conditioned upon the previous reading and understanding of its Issuing Document and its Subscription Agreement which are available in English only and – in relation to the offer to non-professional investors in Italy, Germany and Belgium - its KIDs, which are available in the relevant language; such documents describe the rights and obligations of the investors. Therefore, prospective subscribers should not rely on any other information not contained in such Issuing Document, Subscription Agreement, and Key Information Document (KID).

Under no circumstances will PrivAccess XVIII REPE 3, PrivAccess General Partner S.a.r.l, Global General Partner SA, BNP Paribas, REPE III, the REPE III General Partner or the REPE III AIFM pay or reimburse any current or future taxation in the subscribers’ country of origin, residence or domiciliation or wherever subsequent to the subscription, holding, conversion, sale or liquidation of ordinary shares in PrivAccess XVIII REPE 3 or in REPE III. The subscriber will be responsible for such payment or reimbursement.

No measures have been nor will be taken in any country or territory for the purposes of allowing a public offering of the investment described in this document, or the holding or distribution of any document relating to this investment. These ordinary shares are not recommended by any federal or state securities commission or any other regulatory authority. Furthermore, the foregoing authorities have not confirmed the accuracy or determined the adequacy of this document. BNP Paribas, PrivAccess General Partner S.à r.l, Global General Partner SA, the REPE III General Partner, the REPE III AIFM are each separate legal entities and none of them is representing or acting as an agent for the other.

Alternative Investment Management Unlimited Company entities are separate legal entities and none of them is representing or acting as an agent for the other.

This document is not for distribution to US Persons and US Persons are not eligible to apply to become Shareholders in PrivAccess XVIII REPE 3. The ordinary shares of PrivAccess XVIII REPE 3 will be offered and sold only outside the United States to persons who are not US Persons, in reliance on Regulation S.

The Feeder Fund has been notified, under the relevant provisions of the AIFMD, for marketing in Italy towards professional investors (as defined in Italy pursuant to art. 6, parr. 2-quinquies and 2-sexies, of the Legislative Decree n. 58/1998 as amended – “TUF” - and its implementing measures) and other categories of investors as identified pursuant to art. 14. 2 of the regulation implementing art. 39 of TUF adopted by the Italian Treasury with Decree n. 30 of 5 March 2015, as amended by Decree n. 19 of 13 January 2022 (and, in particular, pursuant to art. 14.2.b), to non professional investors who –within the context of the provision of investment advisory services – subscribe for or acquire shares of the Feeder Fund for an initial amount not lower than 100,000 Euros (initial amount not lower than 100,000 Euros for this Feeder Fund) (always provided that, by effect of such subscription or acquisition, the total amount of their investments in reserved AIFs does not exceed 10% of their financial portfolio; the initial participation amount is not splittable).

In relation to the offer to non-professional investors in Italy – the Key Information Document (KID) in Italian of the Feeder Fund are available on the page https://services-uk.sungarddx.com/LogOn/128060 and the information on “Facilities available to retail investors” (both in English and in Italian) are available or on the page https://wealthmanagement.bnpparibas/lu/en/global-general-partner/facilities-made-available-to-investors-in-Italy-.html

BNP Paribas S.A. is subject to a Securities and Exchange Commission exemption order regarding guilty pleas entered on June 30, 2014, and July 9, 2014, by BNP Paribas S.A. in the Supreme Court of the State of New York, County of New York, and the United States District Court for the Southern District of New York, respectively. A copy of such order is available at https://www.sec.gov/rules/ic/2014/ic-31188.pdf

By accepting this documentation, the subscriber agrees to be bound by the foregoing limitations.

BNP Paribas SA (2023). All rights reserved

PLACEMENT AGENT MARKETING RULE DISCLOSURES

Pursuant to a contractual relationship between Kohlberg Kravis Roberts & Co. L.P. (“KKR”), and BNP Paribas SA / Wealth Management Division (the “Placement Agent”), the Placement Agent, along with certain of its affiliates, is providing certain placement or other solicitation services with respect to your investment in KKR Real Estate Partners Europe III (EUR) SCSp, a Luxembourg special limited partnership (the “EUR Fund”) and/or KKR Real Estate Partners Europe III (USD) SCSp, a Luxembourg special limited partnership (the “USD Fund” and individually or collectively with the EUR Fund, as applicable, the “Fund”), directly or indirectly through PrivAccess XVIII – Pan European Real Estate 3 (the “Feeder Fund”). The Placement Agent is not a current advisory client of KKR, although the Placement Agent and/or its employees and affiliates may be investors in any investment vehicle advised by KKR.

Conflicts of Interest

Various potential conflicts of interest may exist and/or arise from its current and future business activities and relationships with KKR, its affiliates and investors (including those solicited by us) and portfolio companies of KKR-managed funds and accounts (“Portfolio Companies”), to the extent applicable. The following discussion briefly summarizes certain of these potential conflicts. Additional information is available from the Placement Agent upon request.

Due to the cash compensation (see below) that is to be paid to Placement Agent in respect of commitments made to the Fund in respect of investors that Placement Agent introduces to the Feeder Fund and the Fund, the Placement Agent has an economic incentive to solicit investors to commit capital to the Fund including through the Feeder Fund, resulting in a potential conflict of interest on our part.

The Placement Agent and/or its affiliates may also have other ongoing relationships and may have future additional relationships with KKR and its affiliates, KKR’s clients, Portfolio Companies and investors (including those solicited by the Placement Agent). The Placement Agent and its personnel may from time to time invest in Portfolio Companies and/or companies that have interests different from or adverse to the Fund or other KKR clients and/or their Portfolio Companies.

Under the above arrangement with KKR, the Placement Agent is also entitled to be indemnified from and against any actual and direct liabilities, losses, damages, costs or expenses (including legal fees) arising out of its services, including any claims, demands, actions, suits or proceedings in which it may be involved, or threatened to be involved in connection with its engagement by KKR. In connection therewith, the Fund may be required to reimburse the Placement Agent or to reimburse KKR where KKR has made such payments to the Placement Agent for any expenses incurred in the defense of, or in response to, any such actions. Its agreement with KKR includes certain carve outs to the above indemnification and reimbursement obligations including where such losses arise solely out of its bad faith, fraud, willful misconduct, gross negligence or a material breach of its agreement with KKR.

None of the Placement Agent or its affiliates, officers, employees, shareholders or agents are officers, employees, members, partners or agents of KKR, the Fund or their respective affiliates and may not be viewed as such. The Placement Agent is not an affiliate of KKR for the purposes of the U.S. Investment Advisers Act of 1940, as amended.

Compensation

For the services described above, the Placement Agent will receive an amount equal to up to 2.0% of your total capital commitment (the “Placement Fee”).

The cost to you of any investment by you in the Fund is not increased by the cash compensation paid by KKR to the Placement Agent. The Placement Fee will be offset by a reduction in management fees charged by the Fund during the time the Fund is paying the cash compensation to the Placement Agent in respect of any investment by you in the Fund including through the Feeder Fund. Therefore, the cash compensation will not on a net basis reduce your investment in the Fund.