Company profile - Symrise is a diversified chemical manufacturer enjoying a top three market position in the flavour and fragmance idusty. Its Scent & Care business produces fragances for home and personal care applications and perfumes, as well as comestic ingredients. Flavor & Nutrition sells a variety of flavors (sweet, savoury & dairy) used in food & beverages, as well as pet food palatability enhancers and probiotics.

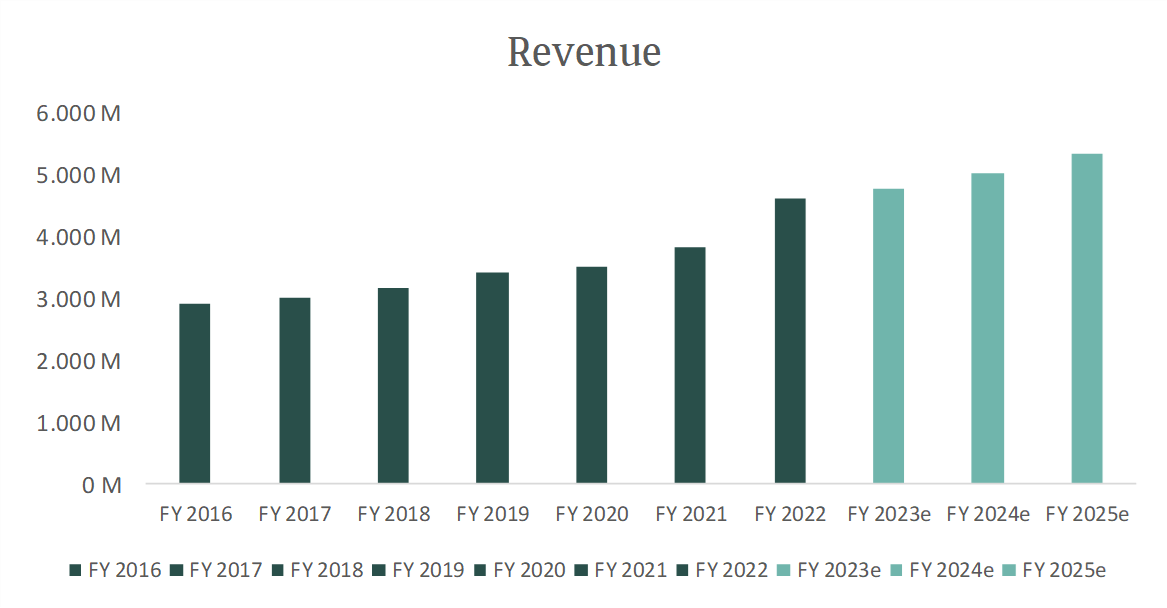

Organic growth still a standout - Symrise has delivered an organic topline CAGR of 7% over the past decade, outpacing the Speciality Ingredients space and closest peer Givaudan at 5%. With a strong core F&F business, targeted growth adjacencies, Symrise can comfortably sustain a sector leading organic growth rate. We forecast >6.5% on avregae to 2026.

More than just pet food - Pet food will continue to be a strong growth driver and differentiator for Symrise, growing at 7ù-8% on average. We see further penetration opportunities in emerging markets and in pet cas as 'COVID pets' age and require more specialised nutrition. Symrise's strategic backward integration in both pet and F&F will also be a differentiator and a barrier to entry.

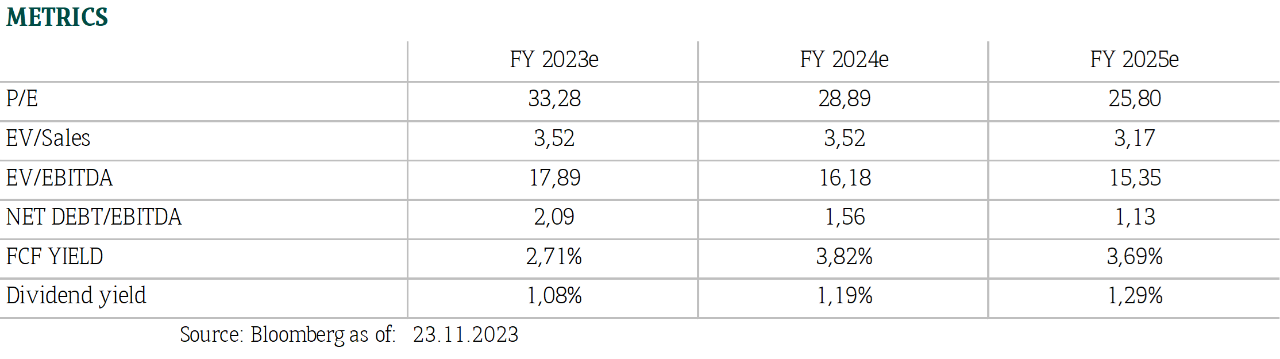

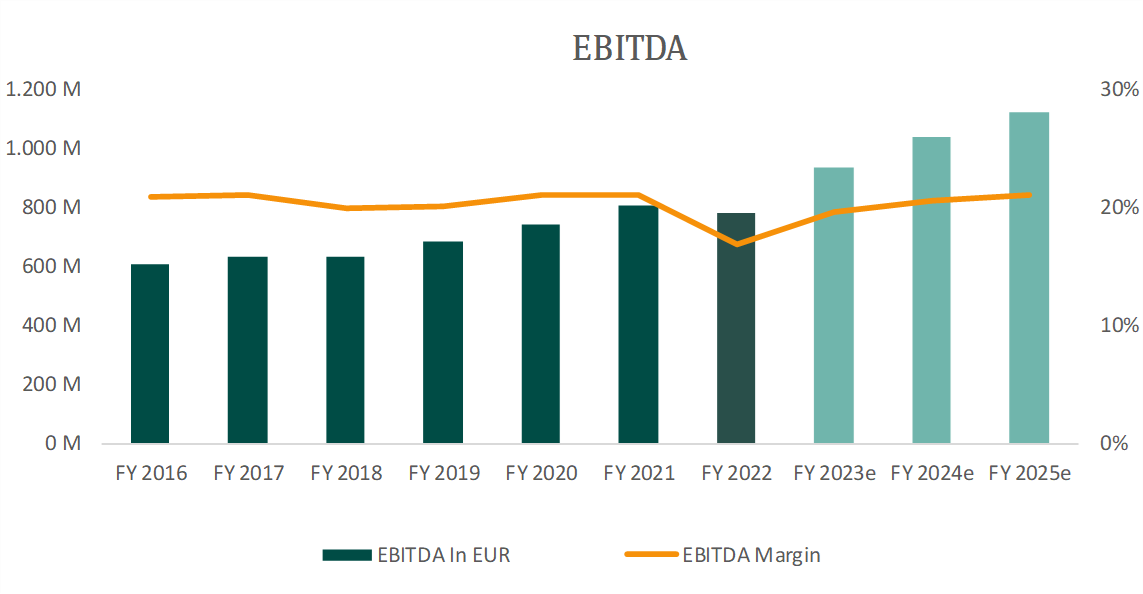

But more to go to bridge the gap on margins - One of the longs tanding debates has been Symrise's inferior margin profile vs best-in-class peers. We see margin support from structural (mix, self-help) and 'cyclical' (input deflation) drivers in 2024. Growth will always be a key priority, but we also see opportunities for efficiencies which, combined with mix, should support our ~230bps margin expansion by 2026 vs 2023.

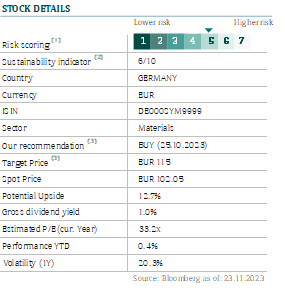

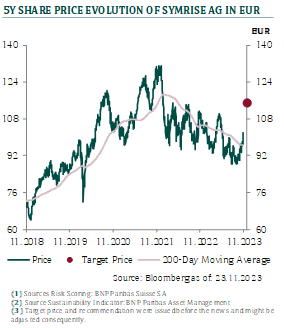

Context - With sector headwinds easing (destocking, inflation and rising interest rates) and structural growth drivers intact, we think now is a good time to revisit the sector. Symrise is a top pick thanks to its differentiated and sector leading organic growth profile. We see both structural and 'cyclical' drivers of margin expansion in 2024 which will help to narrow the gap to best-in class peer Givaudan.

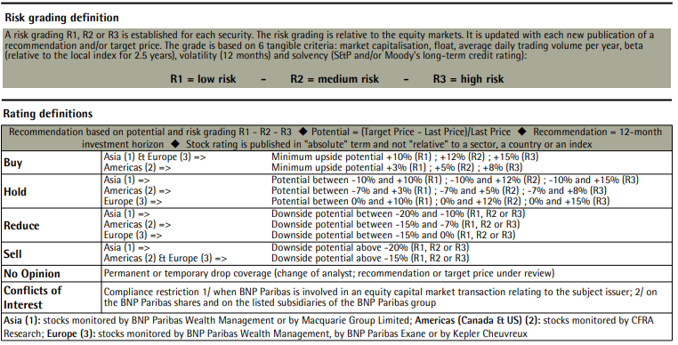

Valuation looks compelling vs peers - Shares have pulled back to ~25x 2024 PE, at an 19% discount to its LT history and 14% discount to Givaudan. With superior growth and narrowing margin gap, we believe this discount is unjustified. We keep Symrise in our Buy List as we consider Symrise as a strategic leader in the sector thanks to its differentiated portfolio. We have buy opinion with EU 107 target price which can expand further as margins increase and a new ordering cycle comes through.