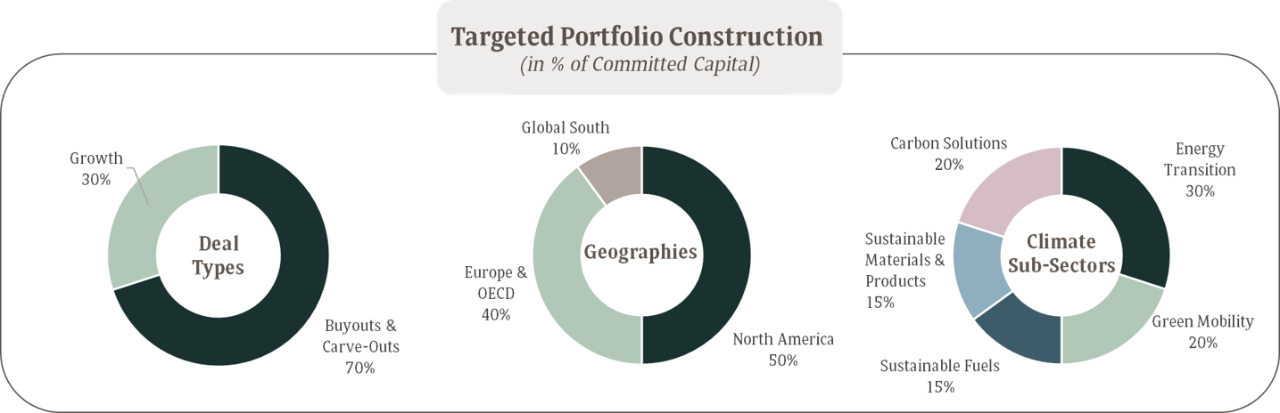

Source: TPG. Target portfolio construction is for illustrative purposes only and may not be indicative of actual portfolio construction.

There can be no assurance that target portfolio construction will be achieved.

TPG, a Leader in the Alternative Asset Space

1 Source: TPG, as of September 30th, 2024

TPG is a leading global alternative asset manager with $239 billion1 in assets under management.

With its family office roots, entrepreneurial heritage, and West Coast base, TPG has developed a distinctive approach to alternative investments based on innovation-led growth, an affinity for disruption and technology, and a distinctive culture of openness and collaboration.

TPG has built the largest private equity impact investing platforms in the industry, with $25 billion1 in assets under management as of Q3 2024.

TPG Rise Climate,

the Leading Climate Private Equity Platform

Launched in 2021, TPG Rise Climate has been purpose-built for a new era of climate investing, offering a differentiated approach to a generational investment theme, underpinned by a mission to accelerate and achieve decarbonization at scale.

![]()

A growing 40+ person team with global reach, thematic climate expertise and experienced leadership (Jim Coulter, TPG’s co-founder)

![]()

Industry leaders and policy professionals who provide differentiated insights into the market, including 3 former Cabinet members and business leaders with strong climate focus

Source: TPG. Figures are as of September 30, 2023. Rise Climate Coalition logos include all relevant logos for which there is approval to represent logo. Does not reflect all Rise Climate Coalition members. There can be no assurance any financial returns are achieved. For illustrative purposes only. Certain statements above are based on TPG’s subjective views.

TPG Rise Climate’s Track Record

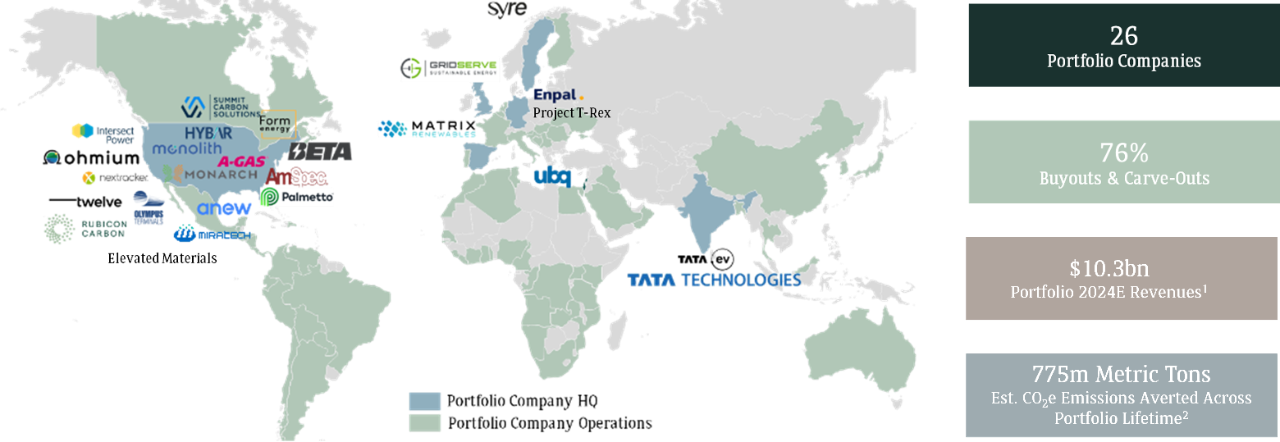

TPG Rise Climate I (2021 vintage) invested in 26 climate companies, with operations across 50 countries. The fund currently displays a 17% Levered net IRR and 1.3x Levered net multiple and has delivered more than $1bn of realized value to limited partners3

Source: TPG. 1. Collective Portfolio Revenues as of September 2024 as sourced from portfolio company management. Includes Elevated Materials & Olympus Terminals, which are signed but not yet closed. Project TRex is in late-stage diligence, therefore not yet signed or closed. There can be no assurance that any investments either signed or in the pipeline will ultimately be consummated. Estimates are inherently uncertain and subject to change. Actual results may vary. | 2. Estimated at the portfolio company level and not adjusted for TRC ownership stake; over the TRC hold period, inclusive of terminal value and lifetime impact attribution for investments enabling physical infrastructure and durable products. 3. As of September 30, 2024 (3Q24). Net multiples are adjusted for returned principal that is eligible for reinvestment. Past performance does not guarantee future results, which may vary. Please refer to the full TPG Rise Climate track record for performance information for all TPG Rise Climate investments, including unlevered performance, and an explanation of assumptions underlying performance.

TPG Rise Climate II’s

Targeted Portfolio Construction

TPG Rise Climate II seeks to build a diversified portfolio of 20 to 25 companies, mainly in the form of buyouts and corporate carve-outs. The focus is therefore on mature, profitable companies that provide proven solutions across three major climate sectors:

- Clean Electrons (energy transition and green mobility)

- Clean Molecules & Materials (sustainable fuels and sustainable materials & products)

- Negative Emissions (carbon solutions)

Introducing BNP Paribas Wealth Management's

Private Equity Senior Management

Claire Roborel de Climens

Global Head of Private and Alternative Investments · BNP Paribas Wealth Management

Since joining BNP Paribas Wealth Management in 2004, Claire Roborel de Climens has set up the Private Equity Group. In 2010 she was also nominated Head of Real Estate. In 2015, she became Head of the Private and Alternative Investments department, adding the Hedge Funds, Strategic-A (asset allocation service), Philanthropy Advisory and AgriFrance activities to her scope of responsibility.

Claire sits on the board of Global General Partner, the AIFM manager of Private Assets feeder funds, as well as on the Advisory Boards of various international Private Equity, Infrastructure and Real Estate funds.

Prior to joining BNP Paribas Wealth Management, Claire worked ten years for PAI Partners, a leading pan-European Private Equity firm, as a manager in the Finance Department, Investor Relations activities and then as an investor in the General Industrials sector where she was involved in many LBO transactions.

She started her career as an auditor at Ernst & Young where she worked for six years for large industrial groups and Private Equity funds. Claire Roborel de Climens is a graduate of the EMLyon business school.

DISCLAIMER

This confidential document is communicated by the Wealth Management métier of BNP PARIBAS SA a French limited liability company with share capital of EUR 2,261,621,342 whose registered office is located at 16 boulevard des Italiens 75009 Paris, France, registered with the Paris Trade and Companies Registry under number 662 042 449, supervised and authorised as a Bank by the European Central Bank ("ECB") and in France by the French Autorité de Contrôle Prudentiel et de Résolution (“ACPR”) and regulated by the French Autorité des Marchés Financiers (“AMF”) (hereinafter “BNP Paribas”).

TPG Rise Climate II Europe, SCSp is a Luxembourg special limited partnership (société en commandite spéciale), established under the laws of the Grand Duchy of Luxembourg and qualifies as a closed-ended alternative investment fund pursuant to the Luxembourg Law of 12 July 2013 on alternative investment fund managers as amended (the "AIFM Law"), (the "Master Fund"). Its General Partner is TPG Rise Climate GenPar II EU, SARL, a Luxembourg private limited liability company (société à responsabilité limitée). It is managed by ONE Fund Management S.A., a Luxembourg public limited company (société anonyme) authorised by the the Luxembourg financial regulator, the Commission de Surveillance du Secteur Financier (“CSSF”), , to act as alternative investment manager to the Master Fund for the purposes of AIFM Law and Directive 2011/61/EU.

PrivAccess XV – Climate Opportunities 2 is a compartment of PrivAccess XV SICAV-RAIF SCA (hereinafter “Feeder Fund”) a Luxembourg investment company with variable capital, structured under the form of a Multi-Compartment Reserved Alternative Investment Fund, registered as a corporate partnership limited by shares, notified to the CSSF. It is managed by its general partner: PrivAccess General Partner S.à r.l., and Global General Partner SA, which is an Alternative Investment Fund Manager authorised by the Luxembourg CSSF, has been appointed to manage the Feeder Fund.

This material is confidential and intended solely for the use of the person to whom it has been delivered and must not be distributed, published or reproduced, in whole or in part nor may it be quoted or referred to in any document without the prior consent of BNP Paribas. This confidential document is provided solely for the purpose of providing general information and shall not constitute an offer, a solicitation or an investment advice nor shall it form the basis of or be relied upon in connection with any subscription or commitment. In addition, this confidential document and its content shall not in any way be construed as an advertisement, inducement or recommendation of any kind or form whatsoever. For the purposes herein, “BNP Paribas” means BNP PARIBAS SA and its respective affiliates and related corporations.

Although the information provided herein may have been obtained from published or unpublished sources considered to be reliable, and while all reasonable care has been taken in the preparation of this confidential document, BNP Paribas does not make any representation or warranty, express or implied, as to its accuracy or completeness and does not accept responsibility for any inaccuracy, error or omission nor any liability for the use of or reliance on this confidential document or any part of the information contained herein. Past performance is not a reliable indicator of future performance. BNP Paribas is not giving any warranties, guarantee or representation as to the expected or projected success, profitability, return, performance, result, effect, consequence or benefit (either legal, regulatory, tax, financial accounting or otherwise) of any security.

Prior to making any commitment, the investor should take advice from his legal, tax and financial advisors. Subscribers should be in a position to fully understand the features of the subscription and be financially able to bear a loss of their investment and be willing to accept such risk. Save as otherwise expressly agreed in writing, BNP Paribas is not acting as financial adviser of, or in any fiduciary capacity to, the subscriber in any subscription.

This confidential document contains only a summary of certain sustainability related aspects of the Feeder Fund and is not purported to be complete nor does it constitute an offer to invest in the Feeder Fund. It is not intended to be complete and will be qualified in its entirety by reference to the Issuing Document, which should be read in its entirety, in particular as regards the pre-contractual disclosure obligations under the SFDR, including how applicable sustainability risk factors are integrated into the decision-making process and their impact on returns. The descriptions or terms regarding sustainability-related aspects of the Feeder Fund in the Issuing Document shall prevail. See SFDR Sustainability-Related Disclosures (i) in the Issuing Document which has been communicated to you before your potential commitment into the Feeder Fund and which will remain available after your commitment into the Feeder Fund on the page https://services-uk.sungarddx.com/LogOn/128060, and (ii) in the SFDR Sustainability-related Disclosures which are available before your potential commitment into the Feeder Fund on the pages https://mywealth.bnpparibas.lu/content/dam/wealth/common/ggp/Summary-Website_Sustainability-Related_Disclosures_FR-IT-DE-SP-NL.pdf and https://mywealth.bnpparibas.lu/content/dam/wealth/common/ggp/Website_Sustainability-Related_Disclosures-PrivAccessXV-Climate_Opportunities_2.pdf which will remain available after your commitment into the Feeder Fund on the page https://services-uk.sungarddx.com/LogOn/128060.

Any document containing additional information concerning the Feeder Fund and in particular the Issuing Document, the annual reports (which are made available to the investors on a regulatory basis after its investment in the Feeder Fund), the subscription document and the Master Fund documentation are available in English upon request from your relationship manager and from PrivAccess General Partner S.à r.l. (contact details below). If you want more information, especially on the structure of the Feeder Fund and the risks associated with an investment in this Feeder Fund, we advise you to read these documents.

PrivAccess General Partner S.à r.l. – 50, avenue J.F. Kennedy,

L-1855 Luxembourg – Grand-Duchy of Luxembourg

contact@ggp.bnpparibas.com – 00 352 4242 2000

The summary of investor rights is available here or on the page https://wealthmanagement.bnpparibas/lu/en/global-general-partner/Summary-of-investors-rights.html

An investment in the Feeder Fund should be conditioned upon the previous reading and understanding of its Issuing Document and its Subscription Agreement, which are available in English only, and – in relation to the offer to non-professional investors in Italy, Germany, Belgium and Luxembourg - its KIDs, which are available in the relevant language; such documents describe the rights and obligations of the investors. Therefore, prospective subscribers should not rely on any other information not contained in such Issuing Document, Subscription Agreement and Key Information Document (KID).

Under no circumstances will the Feeder Fund, PrivAccess General Partner S.a.r.l, Global General Partner SA, BNP Paribas, the Master Fund, TPG Rise Climate GenPar II EU, and ONE Fund Management S.A., pay or reimburse any current or future taxation in the subscribers’ country of origin, residence or domiciliation or wherever subsequent to the subscription, holding, conversion, sale or liquidation of ordinary shares in the Feeder Fund. The subscriber will be responsible for such payment or reimbursement.

No measures have been nor will be taken in any country or territory for the purposes of allowing a public offering of the investment described in this confidential document, or the holding or distribution of any document relating to this investment. These ordinary shares are not recommended by any federal or state securities commission or any other regulatory authority. Furthermore, the foregoing authorities have not confirmed the accuracy or determined the adequacy of this confidential document. BNP Paribas, PrivAccess General Partner S.à r.l, Global General Partner SA, TPG Rise Climate GenPar II EU, and ONE Fund Management S.A. are separate legal entities.

This confidential document is not for distribution to US Persons and US Persons are not eligible to apply to become Shareholders in the Feeder Fund. The ordinary shares of the Feeder Fund will be offered and sold only outside the United States to persons who are not US Persons, in reliance on Regulation S.

The Feeder Fund has been notified, under the relevant provisions of the AIFMD, for marketing in Italy towards professional investors (as defined in Italy pursuant to art. 6, parr. 2-quinquies and 2-sexies, of the Legislative Decree n. 58/1998 as amended – “TUF” - and its implementing measures) and other categories of investors as identified pursuant to art. 14. 2 of the regulation implementing art. 39 of TUF adopted by the Italian Treasury with Decree n. 30 of 5 March 2015, as amended by Decree n. 19 of 13 January 2022 (and, in particular, pursuant to art. 14.2.b), to non professional investors who – within the context of the provision of investment advisory services – subscribe for or acquire shares of the Feeder Fund for an initial amount not lower than the equivalent in USD of 100,000 Euros (initial amount not lower than the equivalent in USD of 100,000 Euros for this Feeder Fund) (always provided that, by effect of such subscription or acquisition, the total amount of their investments in reserved AIFs does not exceed 10% of their financial portfolio; the initial participation amount is not fractionable).

In relation to the offer to non-professional investors in Italy – the Key Information Document (KID) in Italian of the Feeder Fund have been communicated to you before your potential commitment into the Feeder Fund (and in particular through dedicated URLs) and will remain available after your commitment into the Feeder Fund on the page https://services-uk.sungarddx.com/LogOn/128060 and the information on “Facilities available to retail investors” (both in English and in Italian) are available or on the public page https://wealthmanagement.bnpparibas/lu/en/global-general-partner/Information-about-the-facilities-Italy.html

In relation to the offer to potential investors in Belgium - the ordinary shares in the Feeder Fund may only be offered in Belgium (i) under the AIFM’s passport to “professional investors” (within the meaning of the AIFM Directive), or (ii) in reliance of the private placement conditions as set forth in article 5, §1 of the Belgian law of 19 April 2014 on alternative collective investment undertakings and their managers (the “Belgian AIFM Law”). By way of private placement, the ordinary shares in the Feeder Fund may only be offered, sold, resold or otherwise transferred, directly or indirectly, in Belgium to “professional clients” and eligible counterparties within the meaning of Directive 2014/65/EU, as well as retail investors who will each invest a minimum amount of at least EUR 100,000 (or the equivalent in another currency) each and per ordinary share class, provided that higher requirements in terms of minimum commitment for the subscription of ordinary shares in the Feeder Fund are provided for in the Feeder Fund’s Issuing Document. This document may not be used in connection with an offer or sale of securities in Belgium unless permitted by law. This document is made available to you in Belgium on the condition and with your express declaration that (i) you are a “professional investor” within the meaning of the AIFM Directive, or (ii) you are a “professional client” or an eligible counterparty within the meaning of Directive 2014/65/EU, or (iii) you are not a “professional investor” within the meaning of the AIFM Directive or a “professional client” or an eligible counterparty within the meaning of Directive 2014/65/EU and you will invest a minimum amount of EUR 100,000 (or the equivalent in another currency) per ordinary share class, provided that higher requirements in terms of minimum commitment for the subscription of the ordinary shares in the Feeder Fund are provided for in the Feeder Fund’s Issuing Document.

This document is addressed to you and may not be transmitted, nor may any content thereof be transmitted, to any other person. Neither this document nor any part of it constitutes an offer or an invitation to subscribe for ordinary shares in the Feeder Fund.

More globally and in relation to the offer to non-professional investors in Belgium, Germany, Luxembourg and Italy, the Key Information Documents (KID) written in French, Flemish, German, Italian and English have been communicated to you before your potential commitment into the Feeder Fund (and in particular through dedicated URLs) and will remain available after your commitment into the Feeder Fund on the page https://services-uk.sungarddx.com/LogOn/128060

The Issuing Document of the Feeder Fund is also available for investors only on the same page https://services-uk.sungarddx.com/LogOn/128060.

By accepting this documentation, the subscriber agrees to be bound by the foregoing limitations.

BNP Paribas SA (2025). All rights reserved