What’s the story?

Stocks tied to the artificial intelligence (AI) theme experienced increased volatility starting on Monday, 27th January, after investors feared disruptions from Chinese AI startup DeepSeek. The open-source startup offering a similar chatbot app to OpenAI’s ChatGPT is sending shockwaves as it claims its AI model is much more cost-effective, outperforming US competitors. Since then, Chinese tech giant Alibaba has also launched its own new AI model claiming it can beat DeepSeek.

In other words, the global race to produce a better and better AI model is heating up and productions costs are becoming a focal point, forcing the industry's biggest players to re-evaluate their strategies.

Why it matters and what does it mean for investors?

The first conclusions are that low-cost models should be positive for AI adoption. In essence, it echoes Jevons' paradox, where technological progress through DeepSeek’s cost-effective models could boost overall AI demand, thereby increasing the need for AI equipment and services. For that reason, we remain overall positive on AI stocks, but there are nuances to which stocks should benefit most from this technological advancement.

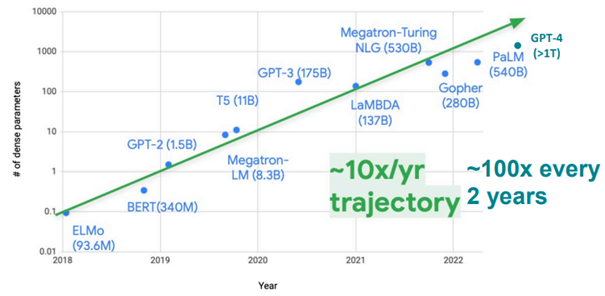

AI models are set to continue evolving, becoming more powerful and moving AI towards mass adoption, in our view. Technological progress is a strong positive.

Figure 1. AI models are growing 10x per year, or 100x every two years.