Could stars be aligned for European small caps?

European small capitalisation stocks have lagged large caps since the market lows of October 2022. This could be about to change. We highlight below 3 reasons for a potential catch-up.

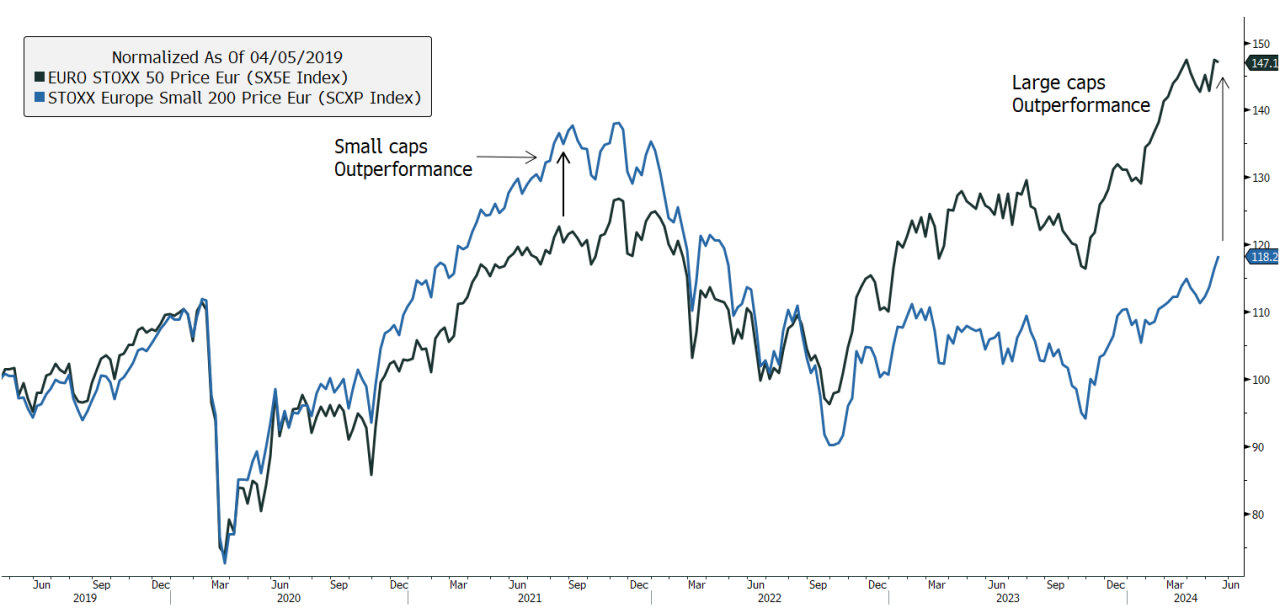

Smaller capitalisation companies in Europe have largely underperformed their large cap peers since the stock market lows of October 2022.

It hasn’t always been that way. In fact, following the stock market fall of March 2020, small caps in Europe went on to outperform large caps in the following 18 months.

Chart 1: European small caps have underperformed large caps since October 2022.

Sources: BNP Paribas (Suisse) SA, Bloomberg data.

In our view, fears of deteriorating global growth have kept a lid on the performance of European small caps. We could however now be entering a more favourable period for smaller companies.

Here are three key reasons why small caps might soon outperform:

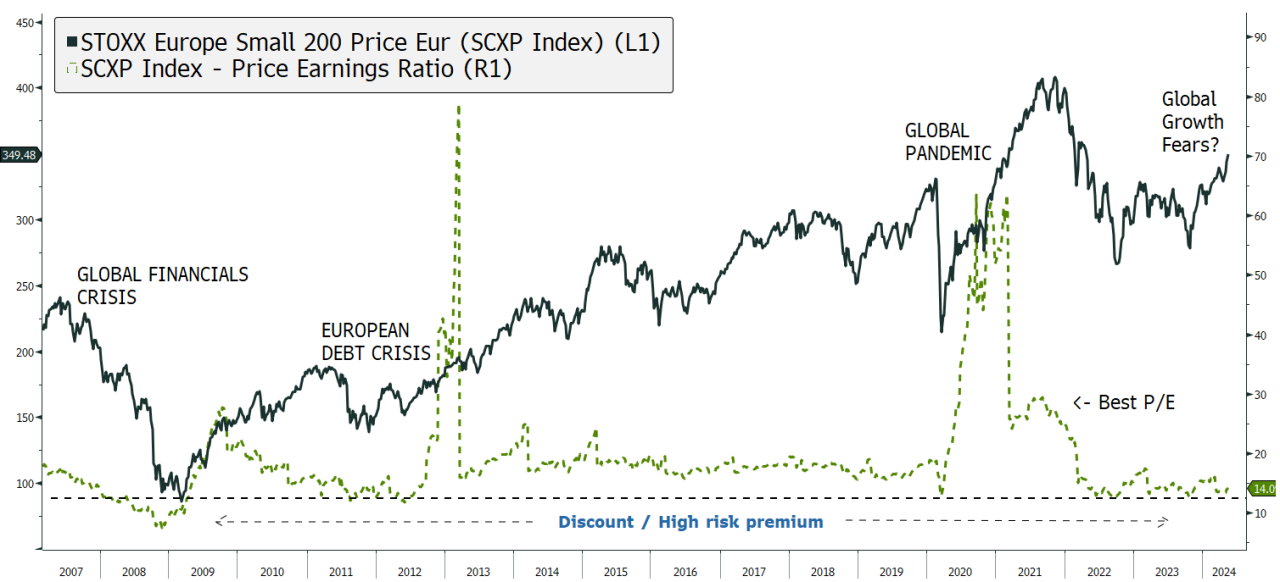

1. Attractive valuation versus history

European small caps are currently trading at historically low price-to-earnings (P/E) ratios. This has generally historically preceded periods of strong performance. The chart below shows that the Stoxx Europe Small Caps 200 Index has rarely traded at such an attractive valuation level. Such P/E level was last seen, in:

- Autumn 2022: bear market bottom

- March 2020: Covid-19 market panic

- Summer 2012: European debt crisis

- 2008 to early 2009: Global Financial Crisis

Chart 2: European small cap valuation hovers around its lowest level in 15 years.

Sources: BNP Paribas (Suisse) SA, Bloomberg data.

On top of the low price-to-earnings valuation (and discount versus large caps), we see additional positive catalysts:

- An increasing number of small-caps companies are doing share buybacks: looking at the MSCI Europe Small Caps Index, 15% of companies did share buybacks in 2023, while the number was only 10% in 2019. And the outlook for further share buybacks looks robust, in our view.

- European small caps have lower net debt to EBITDA ratios compared to large caps, which could spur M&A activity and balance sheet expansion.

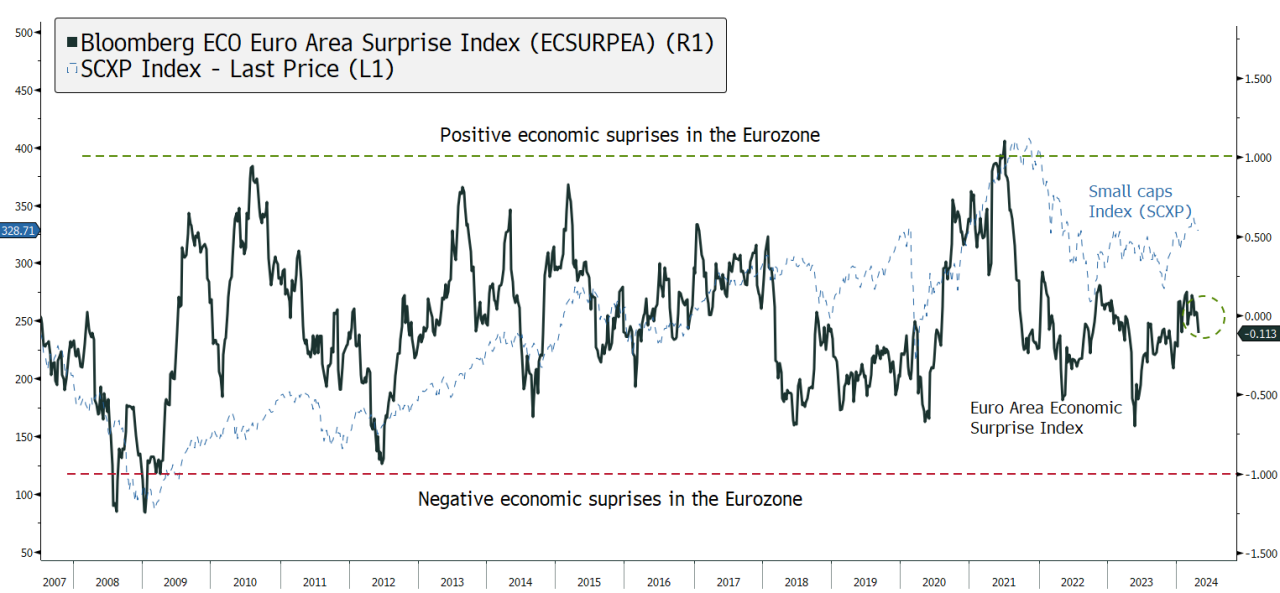

2. Supportive economic backdrop

Better than expected economic data coming out of Europe is a recent sign that suggests a positive turn in the economic cycle. Historically, this has led to small caps outperforming large caps, as the formers are particularly sensitive to the economic cycle.

Chart 3: The Eurozone Economic Surprise Index, which measures the extent to which economic data exceeds or falls short of consensus estimates, suggests momentum has improved since mid-2023.

Sources: BNP Paribas (Suisse) SA, Bloomberg data.

This improved economic outlook is also reflected in solid earnings growth and upward revisions for small cap companies.

3. Rapid artificial intelligence (AI) adoption

Many European small cap companies are well positioned to benefit from AI technological advancements, in our view. AI efforts amongst smaller companies are increasing growth and profitability. Some European small caps are active in semiconductors, data centers, and software. Given their limited size and business-to-business corporate model, those are less familiar to investor than larger companies; they are nonetheless likely to be significant AI beneficiaries.

In conclusion, a catch-up in the performance of small caps versus large caps in Europe could be driven by a growth pickup, a closing of the current valuation gap and AI adoption benefits. We recommend that investors consider incorporating additional European small-cap equities into their investment portfolios.

This article is brought to you by the Advisory Solutions Team.

Contributors: Maxime Bonnet - Head of Advisory Solutions, Paul de La Baume - Investment Advisor