The article discusses the growing trend of de-dollarization, where countries aim to reduce their reliance on the US dollar in international trade and currency reserves. Despite this trend, the US dollar's dominance remains strong due to high US interest rates and significant foreign investment driven by economic incentives.

However, shifts in global capital flows, particularly reduced investments in China and potential changes in US policies, could alter this dynamic. This situation presents new opportunities for other emerging markets like India, Mexico, and Vietnam.

Due to the dollar's extensive use, the United States enjoys disproportionate sway over other economies.

The goal of de-dollarization is to some extent an effort to protect national central banks from geopolitical dangers associated with the United States Dollar's position as the world's reserve currency. The term "de-dollarization" has gained popularity in recent years as countries work to lessen their reliance on the US dollar and assert greater control over their economies. The economic and geopolitical difficulties experienced by many nations because of US sanctions or influence have been a driving force behind this pattern.

There is often talk that the US dollar's dominance is being challenged on several fronts. However, as we witness in the IMF report below, the story is not one that necessarily revolves only around reserves and may exhibit various nuanced contradictions even if the underlying theme plays out.

An International Monetary Fund analysis published the 11th of June 2024 shows that the US share of global flows has climbed — not fallen — since a shortage of dollars in 2020 spooked global investors and the 2022 freezing of Russian assets stoked questions about respect for free movement of capital. The pre-pandemic US average share was just 18%, according to the IMF it now stands at almost one-third of global capital flows.

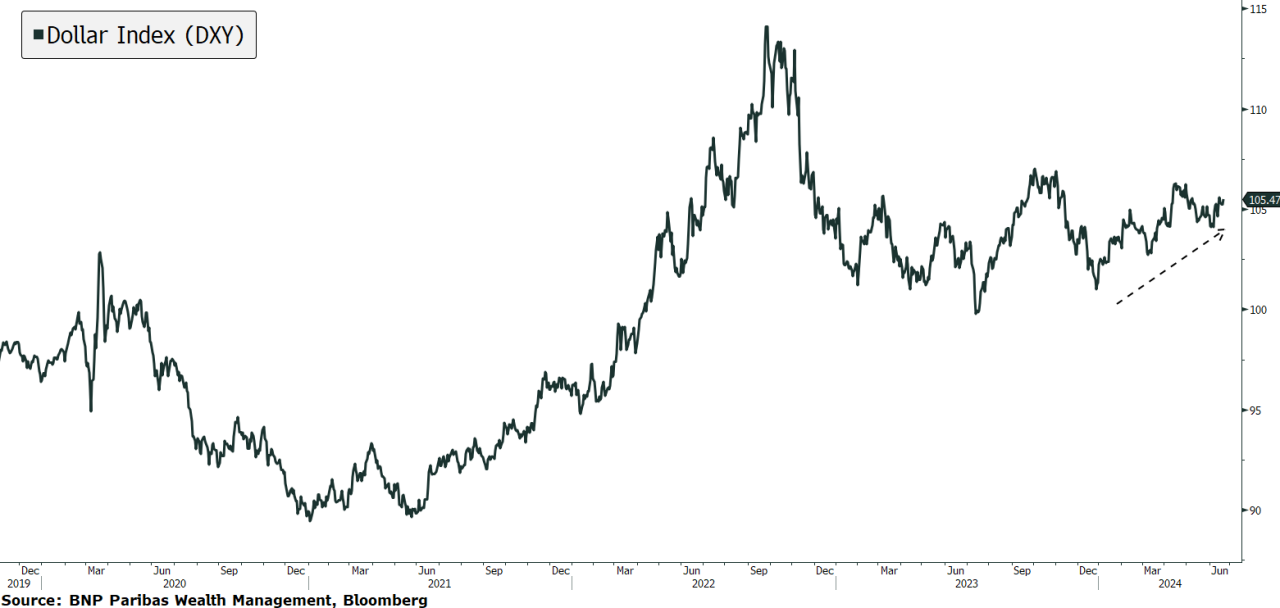

And in fact the rise of the US Dollar dominance may also be to some extent reflected by the strength of the Dollar Index, as illustrated below.