Could high dividend and share buyback stocks offer a margin of safety?

Here are the top reasons why we believe high-dividend stocks and those with substantial buyback programs offer excellent value and provide the visibility investors are eagerly seeking.

In a nutshell, why invest in stocks with high dividends and / or share buyback?

- Supportive economic environment with strong corporate earnings and focus on cost management, resulting in higher company profits.

- The current historically high interest rates create new higher return expectations for investors, notably in the form of known or distributable cash flows.

- Returning cash to shareholders and the associated returns ‘visibility’ is looked-after.

Major reasons to invest in stocks with high dividends and large buyback programs:

1. Positive historical track record

Historically, companies with high dividends and share buybacks have done well.

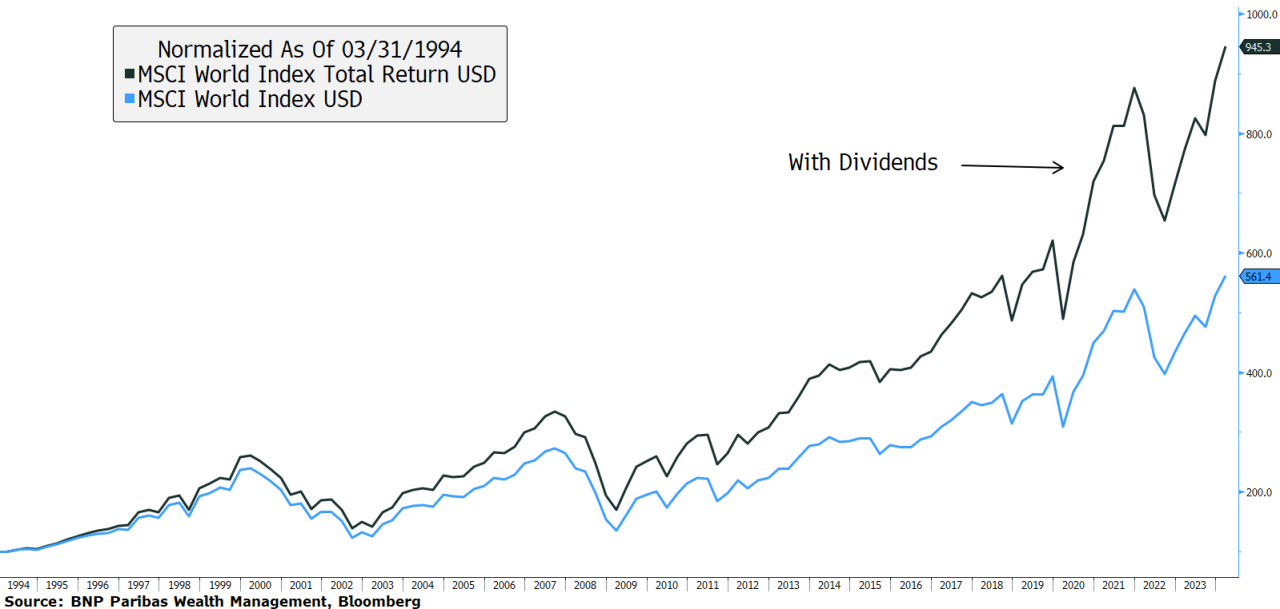

High dividend companies have a phenomenal track record on average. In the last 30 years, dividends have accounted for approximately 40% of total equity returns; a large percentage that illustrates the strengths of companies paying regular (and growing) dividends and their corresponding attractive returns in the long term.

Chart 1: Dividends have accounted for approximately 40% of total equity returns in the last 30 years (MSCI World).