Published on 03/11/2023

The climate crisis, the 1st global risk ahead of cybersecurity and geopolitical instability

The annual Axa Future Risks Report describes a “polycrisis world” in its 2023 edition. The world’s leading insurer surveyed more than 3 500 risk experts in 50 countries and 20 000 people in 15 countries. The aim is to identify among 25 risks the five they consider most impactful for society in the next 5 to 10 years. This year, climate change has again topped the risk rankings and became for the first time the main threat in all the studied geographical areas. Although feeling of vulnerability is increasing, the confidence index to limit the consequences of the new global crises is also rising. To meet today’s challenges, most of surveyed experts advocate global engagement. A month before COP28, the call for stronger cooperation could find a particular echo. However, while companies have been fearing greenwashing for years, greenblushing could soon take over. “Some companies are avoiding communicating about their ESG activities to avoid the backlash seen last year in the US, where some states had decided to opt out of companies demonstrating their ESG leadership” highlights the report. Caught between two opposing sides, companies are still struggling to align themselves with a common strategy that would best serve their interests.

Sources: Bloomberg, Business Green, Novethic, AXA Future Risks Report 2023

A month before the COP28, $1 trillion business coalition calls for plans to phase out fossil fuels

A group of over 130 companies, representing approximately $1 trillion in global revenue, announced the release of an open letter to governments attending the upcoming UN COP28 climate conference, urging them to set timelines for phasing out fossil fuel production and use, and to massively increase the global deployment of renewable energy capacity this decade. The letter, coordinated by climate-focused nonprofit We Mean Business, was signed by companies including IKEA, Nestlé, Ørsted, Unilever and Volvo Cars, and said that the companies are already “feeling the impacts and cost of increasing extreme weather events resulting from climate change.” While celebrating the rapid growth of clean energy solutions, the letter noted that emissions continue to rise globally, and pointed to the continued burning of fossil fuels as the primary factor causing climate change. The letter also highlights the economic opportunity presented by the energy transition, citing the IEA’s estimate that the “transition to net zero could boost global GDP by 4% by 2030.”

Sources: We Mean Business Coalition, Reuters, ESG Today, Libération

World's largest asset manager takes interest in mining stocks

“If you’re focused on sustainability, if you’re focused on the energy transition, don’t overlook the metals and mining industry. There is a huge value opportunity” said Evy Hambro, global head of thematic and sector investing at BlackRock Inc. In October, he pointed to a growing focus on reducing carbon emissions in metals production, a more disciplined approach to spending than in previous booms, and a rapid decrease in the cost of capital as governments throw money at miners amid concerns about supply security. Industry executives, analysts and specialist investors have for several years been predicting a bull market as the shift to a lower-carbon economy drives a wave of demand for the metals needed for electricity grids, electric-vehicle batteries and solar panels.

“The story isn’t about now, the story is about what’s happening over the next 10 to 15 years,” Hambro said, arguing that the sector could certainly be undervalued. BlackRock is also advising metals companies to invest in decarbonization as investors are willing to pay premiums for companies that are lower carbon producers. Regarding the US and the European steel industries, Blackrock analysts tend to observe a higher premium paid for US players that have much lower carbon intensity compared to their European peers.

Sources: Bloomberg, Yahoo.Finance

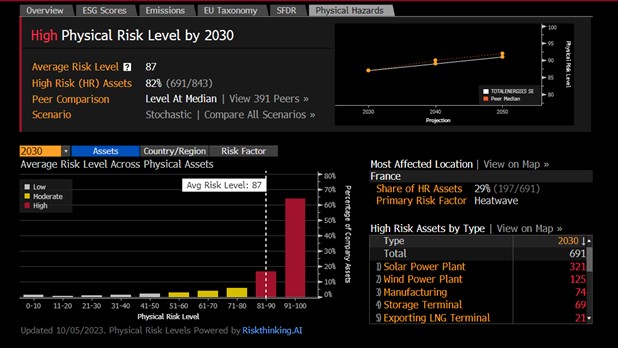

Bloomberg launches indicators to measure exposure to physical climate risk

Business and financial markets information service provider Bloomberg and climate financial risk data analytics provider Riskthinking.AI announced in October the launch of new science-based physical risk indicators, aimed at enabling companies and investors to assess and understand exposure to climate-related risks such as floods, droughts and wildfires. According to the companies, the launch of the new indicators comes as regulators are moving to require disclosure of climate-related risks, and as measuring exposure to extreme weather events is becoming increasingly to important to investors as well.

The indicators combine Bloomberg’s data on more than 1 million physical assets – such as manufacturing sites, energy plants, mining operations, office buildings, and retail sites – across nearly 50 000 companies, with Riskthinking.AI’s granular dataset of global climate change projections and proprietary methodology to calculate companies’ physical risk exposure level. The methodology enables users to drill down to the individual assets of a parent company to analyze specific threats, and combined with Bloomberg’s global supply chain data, the indicators also help reveal physical vulnerabilities of key suppliers.

Sources: Yahoo Finance, ESG Today, l’AGEFI

Edible insects and exotic plants may be the future of food

Lab-grown meat and insects could be included in our menus in future decades, as the world grapples with challenges to food security. Indeed, climate change has made weather more volatile and hotter in many parts of the world, damaging corn crops in the US, slashing wheat crop forecasts in Australia and even accelerating the spread of deadly pests in China. Meanwhile, conflict between major wheat exporters Russia and Ukraine has compounded a food crisis in Africa, sending prices soaring. However, these new and developing areas of food technology could help provide nutrition to people in areas stricken by natural disaster or even solve the issue of feeding astronauts venturing into deep space, according to a panel of experts at Sydney’s inaugural South by South West (SXSW) festival. As the need for sustainable and reliable food production becomes increasingly apparent, the panelists have highlighted four key developments including lab-grown meat, vertical farming, exotic plants or even edible insects. “Creepy crawlies are not only tasty — they’re good for you, too” according to Joseph Yoon, founder of Brooklyn Bugs. He said they contain all 19 essential amino acids, and may be used as a low-cost, high-nutrition and environmentally-friendly way to feed the world. However, the panelists stressed that the biggest barrier would remain converting attitudes.

Source: Bloomberg, Yahoo.Finance

Coca-Cola launches 100% recycled plastic bottles in Canada

- Company : The Coca Cola Company

- Sector : Food, Beverage & Tobacco

- Clover rating : 4/10

In October, the Coca-Cola Company announced the launch of 100% recycled plastic bottles in Canada, including the 500 ml bottles of the flagship brands Coca-Cola, Sprite and Fanta, (excluding caps and labels). Indeed, the country has set the objective of using 100% recycled plastic by early 2024. According to the company, this move will save £7.6 million of new plastic in 2024 and reduce CO2 emissions by nearly 7 000 metric tons annually. Coca-Cola said that the new launch will support its World Without Waste goal of making bottles with 50% recycled content by 2030. Announced in 2018, the sustainable packaging platform also includes a goal to collect and recycle the equivalent of a bottle or can for every one the company sells globally by 2030, and to make 100% of its packaging recyclable by 2025. The company now offers 100% recycled plastic bottles in over 40 markets.

Sources : ESG Today, Coca Cola Company

EasyJet sign deal to offset flight emissions with DAC carbon capture technology

- Company : easyJet

- Sector : Transportation

- Clover rating : 4/10

Aerospace giant Airbus announced that easyJet has become the first airline globally to join its Airbus Carbon Capture Offer’s carbon removal initiative, utilizing Direct Air Carbon Capture and Storage (DAC) to help achieve the airline’s aviation decarbonization goals. The aviation industry accounted for nearly 3% of global energy-related CO2 emissions in 2022 and emissions have been steadily climbing to over 1 billion tons before the pandemic. The DAC technology is one of the preferred solutions by the aviation industry to reduce its carbon footprint. The technology filters and removes CO2 emissions directly from the air using high powered extraction fans. Once removed from the air, the CO2 is separated and stored in underground reservoirs. CO2 emissions released into the atmosphere during aircraft operations cannot be directly eliminated at source, but with DAC, an equivalent amount can be extracted from the air. The International Energy Agency says that captured CO2, rather than being stored in underground reservoirs, could be used to create synthetic aviation fuels which will reduce the industry’s emissions.

Nestlé launches program to provide climate risk insurance to coffee farmers

- Company : Nestlé

- Sector : Food, Beverage & Tobacco

- Clover rating : 5/10

Global food and beverage company Nestlé announced today the launch of a pilot program to provide weather insurance to smallholder farmers in its Nescafé brand’s supply chain. The company said that the new program comes as climate change pressures coffee-growing areas, with smallholder farmers exposed to the risk of irregular weather conditions affecting their crops. The new program aims to provide farmers with financial protection to cope with unpredictable weather patterns, using satellite-based climate data to determine if coffee output has been impacted by too much, or not enough, rainfall during key crop cycle phases, and issuing payments automatically to affected farmers, according to the severity of the weather. Launched in collaboration with climate insurance specialist Blue Marble, the program is being piloted with more than 800 smallholder coffee farmers in Indonesia. Based on the results of the program, Nestlé said that it will determine whether to expand the initiatives to other Nescafé sourcing locations.

Sources: Business Insurance, ESG Today

Emerging world needs $1.5 trillion for green buildings, IFC reports

International Finance Corporation (IFC), the world’s largest global development institution focused on the private sector in low-income countries, is currently looking to develop a guarantee facility for private investors to boost finance for greener construction in emerging markets. In a report released in October, the IFC identifies a $1.5 trillion investment opportunity to cut emissions in the building sector in emerging markets. Global construction value chains account for about 40% of energy and industrial-related CO2 emissions globally, with that number set to increase by about 13% by 2035, the IFC study finds. Two-thirds of these emissions come from emerging markets, which also depend on construction activity for economic development. The IFC highlighted some decarbonization technologies that are already available for the construction industry. For example, a Senegalese subsidiary of French cement maker Vicat SA is looking to use alternative fuels from biomass and recycled tires to help cut emissions by about 300,000 tons of CO2 equivalent per year by 2030.

Governments are lagging behind on the issue, according to the IFC. About 110 countries have no mandatory building energy codes, the report said. Last year roughly two and a half billion square meters of floor space were built without any energy related performance standards, equivalent to all the buildings in Spain. Finance is another drag on progress to decarbonize buildings. Global private debt financing for decarbonizing construction using ‘green’ financial instruments reached a record high in 2021 of about $230 billion, but emerging markets only issued about 10% of that total, the IFC finds.

Sources: The Economic Times, Bloomberg