Published on 12/01/2024

Carbon capture needs enough pipelines to circle Earth four times

The world inked a historic pact at COP28 climate talks in December to move away from using fossil fuels. But it also endorsed a key technology that could give them a lifeline: carbon capture and storage (CCS). The technology refers to a process in which a relatively pure stream of carbon dioxide is separated, compressed and transported to a storage location for long-term isolation from the atmosphere. The United States is currently the main proving ground for this type of new technologies, having invested more than $83 billion into CCS investments over the past three decades according to Bloomberg. However, the network needed to handle CO2 captured from power plants or sucked directly from the atmosphere in the US would be staggering in scope, requiring as many as 150’000 km of new pipelines. According to an Energy Department estimate, this distance would be enough to encircle the Earth four times. Moreover, building all the infrastructure needed approximates $230 billion, according to a Princeton University Andlinger Center for Energy and the Environment analysis.

To finance these new infrastructures, the Biden administration relies on the climate law (Inflation Reduction Act), which contains billions of dollars in incentives for carbon capture. This includes increasing the tax credit for power plants and other polluters who capture and store their carbon from $50 to $80 per tonne. While critics say the incentive provides a lifeline for non-economic coal-fired power plants, proponents say funding is needed to help achieve the Biden administration’s ambitious CO2 emissions targets by 2050.

Sources: Bloomberg, Andlinger Center

Low carbon transition “mega force” would drive major investment opportunities in 2024

In December, one of the world’s investment giants has identified the low-carbon transition as one of a few key “mega forces” that it expects to drive major investment opportunities this next year. Indeed, BlackRock has announced that the “massive reallocation of capital” is expected to be driven by the need to rewire energy systems in order to transition to a low carbon economy. The firm said that capital investment in the global energy system could double to $4 trillion annually through 2050 driven by the adoption of low carbon energy sources, which it expects to make up 70% of the world’s energy by 2050. In addition to decarbonization solutions, BlackRock also noted investment opportunities in climate resilience, or the preparation and adaptation to climate hazards, as well as rebuilding after climate-related damage. Specific infrastructure opportunities highlighted by the review included “energy storage, the electrification of transport, and alternative fuels for aviation and marine.”

European Union markets regulator updates proposed rules for fund names using “ESG” or “Sustainability” terms

In December, the EU markets regulator (ESMA) announced an update of its proposed guidance for the use of ESG and sustainability-related terms in investment fund names. This release includes the introduction of a new “transition” category enabling the use of labels to identify funds that include investments not currently classified as green, but are focused on transition strategies. The regulator’s objective is to protect investors from greenwashing risk, by ensuring that fund names that include terms such as “ESG” or “sustainability” fairly reflect funds’ actual investment policies and objectives. In a recent study released by ESMA, the regulator found that the proportion of funds using ESG terms up more than 4x in 10 years as fund managers launched new ESG-related products and changed the names of funds to incorporate sustainability-related terms.

The study also found a preference by fund providers for more generic ESG terms, which could make it difficult for investors to verify that investments align with the funds’ names. Therefore, ESMA has introduced a threshold of the minimum proportion of investments required to support an ESG-related fund name. To add ESG terms in the fund names, the EU regulators would require an 80% minimum proportion of investments used to meet the sustainability characteristics, the application of Paris-aligned benchmarks (PAB), as well as the application of an investment policy in alignment with the SFDR definition.

* Paris-aligned benchmarks (PAB) : reduce carbon intensity by 50% compared to the initial investment universe, as well as setting a minimum annual carbon intensity reduction of 7%

Sources: ESG Today, European Securities and Markets Authority, BNP Paribas CIB

After COP28, the future of carbon markets remains uncertain

Following the conclusion of COP28 on December 13th in Dubai, while there was a long-awaited agreement on phasing out fossil fuels, the conference encountered challenges in addressing another critical aspect of climate change mitigation: the regulation of the carbon market. Negotiators failed to reach consensus on common rules to oversee the trading of CO2 emission credits, despite recent scandals surrounding them. Carbon credits are certificates, each representing one ton of avoided or absorbed CO2, obtained through measures such as forest protection or promotion of clean energy. Acquiring these credits theoretically allows companies to offset their own emissions, often pursued to mitigate a portion of their carbon footprint.

In theory, these carbon credits can be traded on two distinct markets: a compliance market (via Compliance Emission Rights) and a voluntary market (via Voluntary Emission Rights) that operates on a more cooperative basis. While the compliance market is not yet operational, the so-called "voluntary" market is already functioning. Some companies and states have established frameworks to purchase such credits and incorporate them into their climate plans (known as Nationally Determined Contributions, NDCs). However, several studies have questioned the climate effectiveness of some of these projects.

Despite the high stakes, discussions during COP28 primarily focused on the transparency level and defining allowed absorption activities for generating credits. The proposal on the table in Dubai was deemed inadequate by Europeans due to its perceived lack of environmental integrity. Conversaly, some Latin American countries also opposed the text, deeming it too restrictive. This marks a missed opportunity for member states, who aimed to establish a robust regulatory framework for carbon markets, addressing the issues observed in voluntary markets.

Sources: Le Temps, Reuters, Ecosytem Marketplace, Les Echos

Artificial intelligence, an invisible « climate bomb »

In 2023, ChatGPT has burst onto the scene of many business tools, requiring some data centers to redouble their activity. But while this artificial intelligence (AI) involves massive energy consumption, the OpenAI company at the helm is increasingly opaque about the associated CO2 emissions. In its wake, the other AI giants are also becoming increasingly discreet on the subject. The entire industry prefers to gloss over this issue, as demonstrated by the absence of any mention of the ecological impacts of AI at the first global summit on the risks posed by artificial intelligence, held last November in the UK. However, some estimates of CO2 emissions are dizzying and reveal that the carbon balance of digital industry is exploding.

"Tens of thousands of models are deployed in parallel to avoid users having to wait when they ask a question" explains S. Lucioni, a specialist in the carbon impact of artificial intelligence within the start-up Hugging Face. Analyst Kasper Ludvigsen, founder of the Danish Data Science Community, estimated that if 3 billion people used the chatbot with around 30 searches a day, emissions would reach more than 1 billion tonnes of CO2 in 20 years. In this extreme scenario, AI could become as polluting as mega oil and gas projects over their entire life cycle. While the giants of the industry sow uncertainty, all the specialists say that the companies would have the capacity to calculate the CO2 emissions associated with AI.

Sources : Novethic, MIT Technology

TotalEnergies invests $300 million in India renewables market with new Adani Green Energy joint venture

- Company : TotalEnergies

- Sector : Energy

- Clover rating : 4/10

India-based renewable energy developer and operator Adani Green Energy Limited (AGEL) has announced the completion of a joint venture with French energy giant TotalEnergies, including a $300 million investment by TotalEnergies for a 50% stake in a portfolio of more than 1 GW of solar and wind projects. The new joint venture houses a portfolio of 1,050 MW of solar and wind power projects in India, including 300 MW already in operation and 500 MW under construction, as well as 250 MW of under-development assets. Adani Green is the largest renewable energy developer in India which plays a vital role in enabling the clean energy transition. It has an operating renewable portfolio of 8.4 GW spread across 12 states. The transaction will help Adani Green achieve its target of 45 GW capacity by 2030, the company said.

Sources: OutlookIndia, ESG Today

UK regulator launches investigation into Unilever over green claims

- Company : Unilever Plc

- Sector : Household & Personal products

- Clover rating : 5/10

In December, the UK’s Competition and Markets Authority (CMA) announced that it has formally launched an investigation into Unilever, examining the global consumer brand giant’s green claims, after an initial review revealed “a range of concerning practices” that the company may be overstating the environmental attributes of some its products. Following its review of companies in the fast-moving consumer goods (FMCG) sector, the regulator announced that it would begin an investigation into Unilever, with concerns including the use of “vague and broad” language that could mislead shoppers about the environmental impact of certain products. Indeed, the regulator explained that the “colours and imagery” used by Unilever “may create the overall impression that some products are more environmentally friendly than they actually are.” In a statement from a Unilever spokesperson, the company refuted and added that it will cooperate with the CMA in its probe.

Sources : ESG Today, Le Matin, ZoneBourse

Amazon cuts shipping emissions with 50% increase in rail and sea transport in Europe

- Company : Amazon.com

- Sector : Internet, Content, Software & Services

- Clover rating : 4/10

Amazon revealed that it has grown its use of rail and sea transportation by 50% in 2023 in Europe, resulting in significant reductions in carbon emissions, as well as speeding up customer deliveries and inventory transfers, according to the company. Amazon has set a goal to significantly reduce its carbon emissions by 2040 across its value chain. Scope 3 emissions, or those originating in the company’s value chain outside of its direct control, account for over 3/4 of Amazon’s emissions footprint. In the company’s recently sustainability report, Amazon revealed that it succeeded in reducing its Scope 3 emissions by 0.7% in 2022 despite growing revenues by 9%, with emissions cuts driven by areas including building construction, leased buildings and equipment and third-party transportation.

Sources: ESG Today, Railway Technology

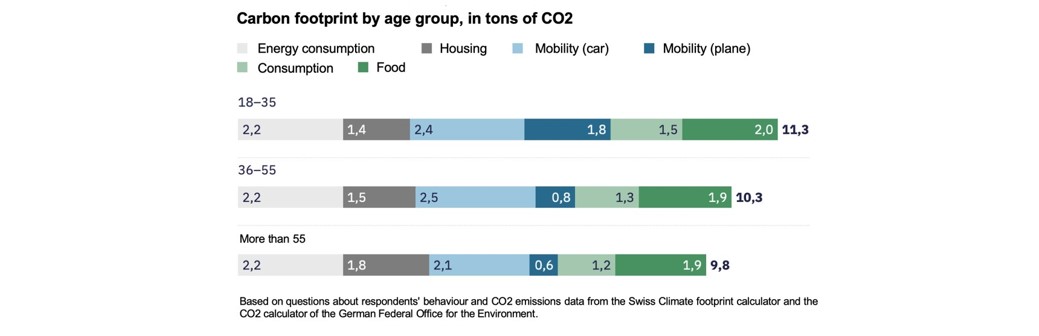

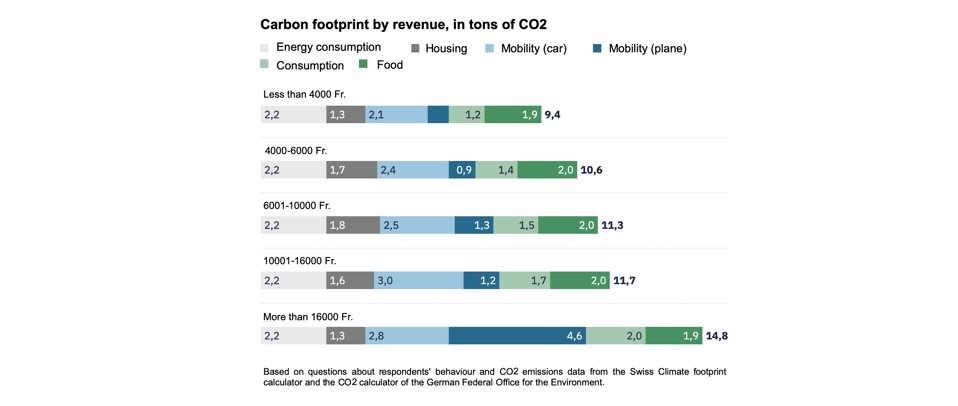

Focus on the carbon footprint of Swiss citizens

A recent study conducted by the Sotomo research institute on behalf of the energy solutions company Helion provides a comprehensive insight into the ecological footprint of various population groups. The study's conclusions reveal surprising results, shedding light on the impact of individual choices on the environment. The average carbon footprint per Swiss citizen stands at nearly 10.5 tons per year. Among different age groups, young adults aged 18 to 35 claim the title of the largest carbon footprint, emitting approximately 11.3 tons of CO₂ per year. This disparity is primarily attributed to the heightened preference of young individuals for air travel, a habit more pronounced among them than their older counterparts. However, the results actually highlight that only a small portion of the younger generation engages in frequent air travel and excessive consumption. This minority significantly elevates the overall average, causing the climate balance of the youth to "explode.

As demonstrated in past studies, the analysis confirms that affluent Swiss citizens have a more significant impact on the climate. The results show that individuals earning a monthly income exceeding 16,000 CHF have the largest carbon footprint among the studied population groups, reaching nearly 14.8 tons per year. A detailed analysis reveals that this high footprint is primarily attributed to a higher frequency of air travel and shopping-related expenditures. However, no significant distinction is observed in terms of housing. According to the authors, this finding is explained by the tendency of high-income individuals to reside in well-insulated new buildings, often equipped with eco-energy solutions such as solar installations or heat pumps, partially offsetting their overconsumption.

Finally, the analysis also reveals that individual responsibility regarding carbon footprint is often underestimated. Although many fellow citizens claim to be making efforts, such as reducing meat consumption or air travel, only 50% of the population is willing to adjust their lifestyle more rigorously. As a reminder, a carbon footprint of 2 tons per person per year represents the target necessary to limit global warming to less than 2°C by the end of the century.