Published on 05/02/2024

320 companies commit to nature-related disclosure based on TNFD framework

The Taskforce on Nature-related Financial Disclosures (TNFD) announced a commitment by 320 companies and financial institutions to start nature-related corporate reporting, based on the recently released TNFD recommendations. The commitments, announced at the World Economic Forum’s (WEF) Annual Meeting in Davos, Switzerland, marks a significant move towards the establishment of standardized reporting on nature-related governance, strategy, risk management and targets, with companies signing on representing $4 trillion in market capitalization, and also including more than 100 financial institutions across banks and insurers as well as asset owners and managers representing $14 trillion. Each of the companies have pledged to begin providing TNFD-aligned disclosures as part of their annual corporate reporting for either the 2023, 2024 or 2025 fisal years.

Calling the commitments a “milestone moment for Nature finance and for corporate reporting,” David Craig, Co-Chair of the TNFD said: “As climate-related sustainability reporting goes mainstream through the new International Sustainability Standards Board (ISSB) standards and regulation in a growing number of countries, this is a clear signal that investors, lenders, insurers and companies are recognizing that their business models and portfolios are highly dependent on both nature and climate and need to be treated as both strategic risks and investment opportunities.”

Davos 2024: The future of sustainable business is “regeneration”

Just weeks after the COP28 climate summit in Dubai, many of the same leaders gathered for the annual World Economic Forum’s (WEF) event in Davos, Switzerland. This year's WEF meeting revolved around the pivotal theme of “Rebuilding Trust” amidst a period of "permacrisis". Government and business leaders convened to deliberate on tackling geopolitical challenges, creating growth and developing a long-term strategy for climate, nature and energy.

Exploring the impact that businesses have on climate change, the forum discussed how businesses can act more sustainably and build new economic models that will have a positive impact on the environment. Many experts highlighted the “regeneration” approach: rethinking everything from business models to supply chains, rather than making minor adjustments to merely mitigate risks instead of preventing them. Regenerative leaders are described as leaders in constant evolution, opened to new ideas to stay ahead of the curve. While experts admit that is certainly a gentler way to run a business, “regeneration” is not compared to benevolence. Instead of dealing with ESG topics in a silo, regenerative businesses would leverage the latest analytics to connect the core work, operating models and supply chains to main sustainability goals. The objective is to ensure that the entire system is fair, liveable and able to generate income over the long term. “Optimizing for resilience got many companies to where they are today. But regenerating will move them forward” concluded Alex Liu, managing Partner and Chairman at Kearney, and agenda contributor to the WEF.

Sources: BBC, Wall Street Journal, Finextra, WEF

Biden administration freezes approvals of new gas export terminals

The rumor circulating in January has been confirmed, Joe Biden announced the suspension of any new permits for the construction of liquefied natural gas (LNG) export terminals. The Biden administration stated that this pause will provide time to carefully examine the effects of LNG exports on America's energy costs, energy security, and environment. "This pause on new LNG approvals sees the climate crisis for what it is: the existential threat of our time" stated the U.S. president. This decision, requested by nearly 250 organizations and environmental groups during COP28, has been warmly welcomed by climate advocates. However, the U.S. energy sector criticizes this announcement, emphasizing that the natural gas industry creates jobs in the United States and helps secure Europe's supplies. Last year, about 50% of LNG exports were directed to Europe, which faced a shortage of Russian gas due to the embargo following the invasion of Ukraine.

As the United States becomes the world's leading LNG exporter, the topic of energy transition and climate is expected to polarize debates approaching the November presidential election. With this moratorium, Joe Biden sends a positive signal, positioning himself against Donald Trump, who questions the very principle of climate change despite the existing scientific consensus.

Sources: NBC News, Novethic, The New York Times

Ontario Teachers’ Pension Plan sets expectation for climate competency on company boards

Ontario Teachers’ Pension Plan (OTPP), one of Canada’s largest investors with over $249 billion asset under management, announced the release of its 2024 Proxy Voting Guidelines. OTPP has a long-standing history of adopting leading corporate governance practices, acting as a responsible steward of its assets, and using its voice to drive change. One of the key changes this year includes expectations for board audit committees on climate change. According to OTPP, shareholders expect “companies to clearly communicate and measure their climate commitments.” The new OTPP guidelines now require audit committee members to have climate expertise and directors to consider climate impact when reviewing budgets, performance, and M&A activity. The changes add to OTPP’s prior climate-related guidelines, including expectations for companies to report based on the International Sustainability Standards Board’s (ISSB) SASB standards and the TCFD recommendations, disclosure of targets and metrics and performance on managing climate risk, and the performance of credible scenario analysis in order to enable climate risk oversight assessment.

Stricter Nutri-scores: disengage or improve their recipes, the dilemma of manufacturers

In 2024, Nutri-scores will become stricter but more efficient in terms of public health. With letters from A to E, the Nutri-scores is a labelling system that aims to inform the consumer about the health benefits or disadvantages of foods sold in stores. This labelling system is already deployed in six European countries: Germany, Belgium, Spain, France, Luxembourg, the Netherlands and Switzerland.

Since January 1st, the Nutri-score calculation method has evolved towards stricter nutrition labelling. Six years after its implementation, the indicator has been updated to respond to both food industry transformations and health recommendations. For this, the thresholds of nutrients to favor, or on the contrary to avoid, have been modified, resulting in a more severe rating of many foods. According to studies, the new labelling should put an end to parades such as the addition of fibers or sweeteners to artificially inflate the Nutri-score. Therefore, nearly 1/3 of the references could suffer a drop in score. Although this new challenge encourages manufacturers to improve the composition of their products, some of them would consider abandoning the indicator on packaging, such as Bjorg in 2023. A strategy of disengagement is considered as risky because the Nutri-score is now the benchmark for many consumers in Europe.

ExxonMobil sues shareholders against climate resolution

- Company : Exxon Mobil Corporation

- Sector : Energy

- Clover rating : 1/10

For the first time, the oil giant filed a lawsuit with a Texas court against two of its shareholders, the organization Follow This and the fund Arjuna capital. These activist investors want the company to commit to a medium-term greenhouse gas reduction schedule, including its suppliers in its action plan. ExxonMobil would, however, attempt to prevent a proposal to reduce greenhouse gas emissions from being put to a shareholder vote at its May general meeting. Unlike its competitors, ExxonMobil simply announced its carbon neutrality in 2050, without indicating the path it intended to take to achieve it. For this first legal action, the case was assigned to Reed O'Connor, a Texan judge reputed to rule in favour of conservative cases.

Sources: Novethic, Financial Times, The Guardian

Whirlpool adds onsite wind and solar at U.S. plants

- Company : Whirlpool Corporation

- Sector : Capital Goods

- Clover rating : 7/10

In January, home appliance manufacturer Whirlpool announced that it has entered into agreements with One Energy to add onsite wind and solar power at two of its Ohio-based plants. This new project would allow the creation of more than 40 MW of renewable energy and marking one of the largest behind-the-meter renewable energy projects in the United States. Whirlpool has set several objectives such as using 100% renewable energy by 2030. Once completed these projects will ensure the Clyde and Findlay plants receive at least 70% of their energy needs from onsite renewable energy. The solar and wind projects are expected to be online and operational by early 2025.

Sources: ESG Today, Renewables Now

Pandora shifts to recycled gold, silver as it makes jewelry more sustainable

- Company : Pandora

- Sector : Luxury & Leisure

- Clover rating : 6/10

Jewelry brand Pandora will switch to using 100% recycled gold and silver in its trademark bracelets, necklaces and other pieces by the second half of 2024, around a year ahead of schedule. In 2020, the Danish company set the goal to completely transition to recycled gold and silver by 2025. Last year, 97% of its supply was recycled. Pandora estimates it will avoid 58 000 metric tons of carbon-dioxide emissions each year, which it says is similar to driving 6 000 cars around the world. Pandora CEO Alexander Lacik says that while the jewelry industry has “conservative ways of doing things”, the young consumers Pandora targets prefer brands they believe are more ethical. In 2023, the Danish company was the largest seller of jewelry by volume in the world and Pandora’s efforts are helping to lift sourcing standards across the industry.

Sources: Wall Street Journal, Reuters

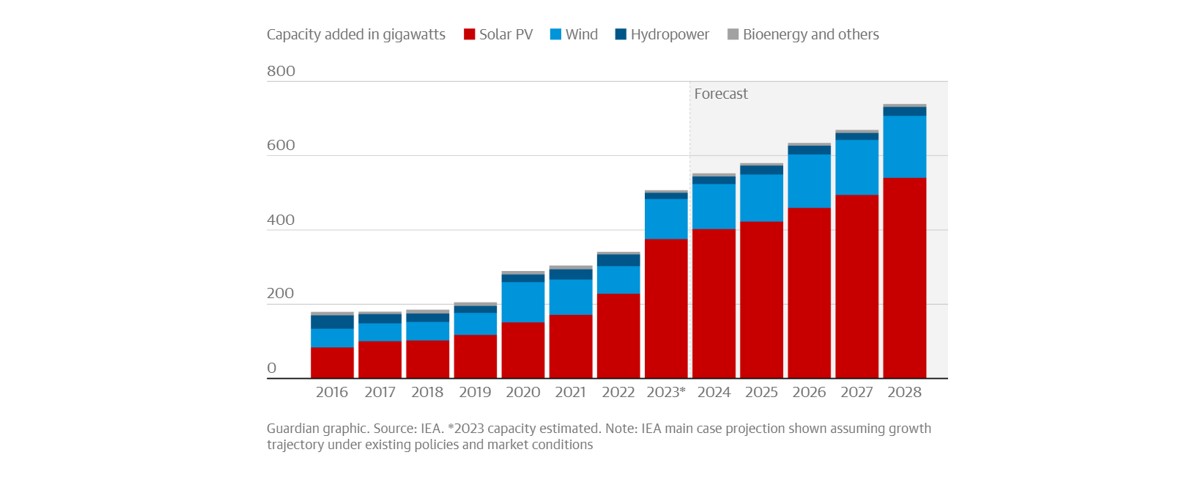

World’s renewable energy capacity grew at record pace in 2023

Global renewable energy capacity grew by the fastest pace recorded in the last 20 years in 2023, which could put the world within reach of meeting a key climate target by the end of the decade, according to the International Energy Agency (IEA). Additions to the world’s renewable energy grew by 50% last year to 510 gigawatts (GW) in 2023, the 22nd year in a row that renewable capacity additions set a new record, according to figures from the IEA. The “spectacular” growth offers a “real chance” of global governments meeting a pledge agreed at the Cop28 climate talks to triple renewable energy capacity by 2030, the IEA added.

The IEA’s latest report found that solar power accounted for 3/4 of the new renewable energy capacity installed worldwide last year. Most of the world’s new solar power was built in China, which installed more solar power last year than the entire world commissioned the year before, despite cutting subsidies in 2020 and 2021. Record rates of growth across Europe, the US and Brazil have put renewables on track to overtake coal as the largest source of global electricity generation by early 2025, the IEA said. By 2028, it forecasts renewable energy sources will account for more than 42% of global electricity generation. However, the IEA’s executive director, Fatih Birol, warns that the most important challenge for the international community remains the rapid scaling up of renewable energy financing in the most emerging and developing economies. “Success in meeting the tripling goal will hinge on this,” Birol said.

Sources: The Guardian, L’Express, IAE