Published on 11/03/2024

S&P forecasts $1 trillion sustainable bond issuance in 2024

Issuance volumes of green, social, sustainability, and sustainability-linked bonds (GSSSB) are expected to grow modestly to around $1 trillion, with macroeconomic pressures offset by increased transparency, and demand for energy transition projects, according to a new report released by S&P Global Ratings.

In addition to volume growth, S&P also anticipates an expansion in bond types, with a more prominent presence for "transition" and "blue" bonds, even as green bonds continue to dominate. Transition bonds provide access to the sustainable finance market for issuers in sectors that may not qualify for green bond labels but require financing for initiatives to reach climate and environmental goals. Blue bonds are targeting sustainable use of maritime resources. Overall, S&P anticipates the growth trajectory for sustainable bonds volumes to more closely mirror the broader conventional bond market as the sustainable bond market matures, following several years of outsized growth.

Sources: S&P Global, ESG Today

Singapore to require sustainable aviation fuel use on all departing flights from 2026

Singapore's Minister for Transport, Chee Hong Tat, has unveiled the Singapore Sustainable Air Hub Blueprint, introducing measures to decarbonize the country's aviation sector. The blueprint, developed by the Ministry of Transport’s Civil Aviation Authority of Singapore (CAAS), mandates departing flights to use sustainable aviation fuel (SAF) starting at 1% from 2026, with a goal to increase to 3-5% by 2030. The plan aims to reduce domestic aviation emissions by 20% from airport operations by 2030, with SAF anticipated to contribute significantly. Minister Chee Hong Tat has emphasized Singapore's balanced approach for growth and environmental sustainability in aviation, intending to catalyze sustainable aviation development globally.

Generally produced from sustainable resources, like waste oils and agricultural residues, SAF is seen as one of the key tools to help decarbonize the aviation industry in the near- to medium-term. SAF producers estimate the fuels can result in lifecycle GHG emissions reductions of as much as 85% relative to conventional fuels. However, efforts to meaningfully increase the use of SAF by airlines face significant challenges, including the low supply currently available on the market, and prices well above those of conventional fossil-based fuels. SAF currently represents less than 0.1% of jet fuel volumes.

Sources: Reuters, ESG Today, La Tribune

EU adopts new law to protect consumers against misleading green claims

The European Council announced that it has adopted a directive aimed at protecting consumers from misleading green claims and other greenwashing practices, including banning unverified generic environmental claims such as “environmentally friendly,” or “biodegradable” and those based on emissions offsetting schemes.

A recent study by the Commission found that more than half of green claims by companies in the EU were vague or misleading, and 40% were completely unsubstantiated. Key aspects of the new directive include rules aimed at making product labels clearer by banning the use of generic environmental claims not backed up with proof, and by regulating the use of non-official labels. The final text of the directive also mentions banning claims based on carbon offsetting schemes that indicate that a product has a neutral, reduced or positive impact on the environment. The monitoring related to products’ future environmental performance will be also strengthened.

Once published in the EU’s Official Journal, member states will have 2 years to integrate the rules into national law. Following the adoption, Pierre-Yves Dermagne, Belgian Deputy Prime Minister and Minister of the Economy and Employment, said: “Thanks to the directive adopted today, consumers will be better informed, better protected and better equipped to be real actors of the green transition.”

Dutch pension giant PFZW divests 98% of oil and gas companies over lack of climate action

Netherlands-based PFZW, one of the largest pension funds in Europe, announced that it has exited its investment in over 300 fossil fuel companies, including Shell, BP and TotalEnergies, over a lack of convincing decarbonization plans, with only seven remaining in its portfolio.

The announcement marks the end of a 2-year engagement process by the pension fund, which included a series of increasing criteria for the oil and gas companies in its portfolio, with an initial wave of 114 companies sold after failing to communicate emissions reduction targets, followed by companies without a stated commitment to the Paris Agreement goal, and finally those who did not produce sufficient short-, medium- and long-term plans to meet their Paris-aligned goals. Overall, PFZW exited its investments in 310 companies, selling €2.8 billion of securities. With the end of the oil and gas engagement program, PFZW said that it will now target large fossil fuel consumers, such as power companies and materials producers with a high carbon footprint, and that it will ask these companies for ambitious transition strategies.

Sources: ESG Today, Zone Bourse

BlackRock expands proxy voting capabilities to retail investors

Investment giant BlackRock has expanded its Voting Choice (proxy voting) program to individual investors, including retail investors with approximately $200 billion assets in its iShares Core S&P 500 ETF. Proxy voting is a process whereby a shareholder authorises another entity, called a "proxy", to vote on his or her behalf at a company's general meeting. This practice is commonly used when shareholders cannot physically attend a meeting, but nevertheless wish to exercise their right to vote on decisions submitted for shareholder approval.

The program, initially introduced in 2021 for certain institutional clients, now extends to over three million shareholder accounts of the S&P 500 exchange-traded fund. This move empowers retail investors to influence proxy voting choices on issues such as executive pay, climate initiatives, and governance. BlackRock aims to assess investor interest, proxy voting infrastructure, and overall user experience during the pilot phase. The expansion makes Voting Choice available to $2.6 trillion of BlackRock’s total index equity AUM, comprising roughly half of the firm’s global index equity AUM. Joud Abdel Majeid, Global Head of BlackRock Investment Stewardship, has emphasized: “Broadening access to Voting Choice is one way we empower investors by making proxy voting easier and more accessible. I’m thrilled that more than 3 million additional shareholder accounts have an efficient solution for participating in proxy voting if they choose.”

Sources: Business Wire, ESG Today

Johan Rockström wins ‘Environmental Nobel Prize’ for identifying the boundaries of Earth’s life-support

In February, the Swedish scientist Johan Rockström has been awarded the Tyler Prize, often referred to as the environmental Nobel Prize, for his groundbreaking research on the Earth's life-support systems. Rockström's Planetary Boundaries framework defines 9 critical planetary systems, such as the ozone layer, freshwater resources, biodiversity, and climate stability, that help regulate environmental conditions. His work reveals that humanity has surpassed six of the nine boundaries, placing the Earth outside its safe operating space. Rockström emphasizes the urgent need for collective global action to address these challenges.

In an interview, Rockström also expresses concern about the rise of nationalist and short-term populist movements, emphasizing the importance of political leadership in countering this trend. In particular, he warns against the re-election of Donald Trump, citing skepticism toward science and global collaboration. Rockström also acknowledges the pivotal role of the U.S. in climate action and highlights the significance of China's actions, given its status as the largest current CO2 emitter. Therefore, the Swedish urges both governments and companies to play a crucial role in climate action, in particular by calling for a transition away from fossil fuels and a simultaneous transformation of the world's food systems. Recognizing the need for economic resources behind the green transition, Rockström praises policies like the Inflation Reduction Act and Europe's emission trading scheme. The scientist proposes paying farmers for ecosystem services and implementing policies like a universal moratorium on tropical rainforest deforestation and global pricing on methane and CO2 emissions.

Sources : The Wall Street Journal, Earth Commission, Stockholm Resilience Center

Cambodia 'upcycler' turns tonnes of plastic bottles into brooms

In a small warehouse in Cambodia's capital, a group of workers sit and spin waste plastic bottles into strips, turning them into bristles for brooms, of which they churn out 500 each day. For the past 11 months they have transformed around 40 tonnes of discarded plastic bottles, about 5,000 bottles per day, by "upcycling" them into brooms they say are more robust than regular brushes. Those sell for 10,000 riel ($2.50) and 15,000 riel ($3.75) each. Plastic strips from the empty bottles are collected into a bundle on a machine, before being softened in hot water and sliced evenly to be sewn with metal wires into the ends of a bamboo stick. Cambodian entrepreneur Has Kea, 41, wants to reduce plastic pollution in his community, in a city that produces up to 38,000 tonnes of all types of waste each day, according to its environmental department. Kea buys empty plastic bottles from trash collectors and garbage depots. With the seemingly endless supply, he is confident about the longevity of his business.

He is also open to competitors stepping in to the market. "This also help reduce pollution to the environment and encourages people to collect plastic bottles to sell to us at a higher price, which in turn, could earn them a better living," he said.

Walmart hits goal to reduce 1 billion tons of supply chain emissions 6 years ahead of 2030 target

- Company : Walmart Inc.

- Sector : FOOD & STAPLES RETAILING

- Clover rating : 4/10

Retail giant Walmart announced in February that it has achieved its goal to cut greenhouse gas emissions by 1 billion metric tons across its product supply chain, hitting the milestone accomplishment 6 years ahead of its 2030 target. The target was initially set by Walmart in 2017, at the launch of the company’s Project Gigaton, its initiative to engage suppliers, as well as NGOs and other stakeholders, in climate action to reduce or avoid a gigaton of GHG emissions from Walmart’s global value chain by 2030. Walmart reported that to date, more than 5,900 suppliers have signed on to the initiative. In a post highlighting the achievement, Walmart Chief Sustainability Officer, Kathleen McLaughlin, said that the company is working to improve and expand Project Gigaton. The objective is to improve estimates of the Scope 3 footprint, identify addressable and uncontrollable value chain emissions, and determine cost-effective and technically feasible emissions reduction interventions.

Sources: Wall Street Journal, ESG Today, Altivia

AXA to vote against companies lobbying against climate goals

- Company : Axa

- Sector : INSURANCE

- Clover rating : 7/10

In February, Global asset manager AXA Investment Managers (AXA IM) announced that it has updated its corporate governance & voting policy with more stringent ESG expectations for companies, including a pledge to target high emissions companies lobbying against the goals of the Paris Agreement. According to AXA IM, the new policy comes amidst an intensifying political backlash against climate-related regulation, contrasting with the urgent need for effective policy intervention to enable a just and orderly transition, highlighting the importance of climate lobbying issues. The announcement marks a further strengthening of AXA IM’s ESG expectations for companies, including setting a timeline to divest from climate laggards, and requirements for senior management incentive pay to incorporate ESG and climate elements. In addition to the climate lobbying expectations, other key changes announced by AXA IM to its policy included advocating for fairer compensation structures, with the firm not supporting pay increases for senior executives when the increases appear to be higher than those for the wider workforce. Finally, AXA IM also announced a commitment to begin disclosing the rationale for all votes against ESG-related shareholder proposals.

Apple hit with $2 billion EU antitrust fine in Spotify case

- Company : Apple Inc.

- Sector : INFRASTRUCTURE & PLATFORM ENABLERS

- Clover rating : 5/10

In February, Apple was fined $2 billion by the European Commission for limiting competition from music streaming rivals through restrictions on its App Store. This marked Apple's first penalty for violating EU rules because of unfair trading conditions. The initial fine of €40 million was increased with a substantial lump sum added as a deterrent, a novel move by the EU's antitrust authorities. The Commission accused Apple of preventing Spotify from informing users about payment options outside the App Store, based on a 2019 complaint by Spotify. The Commission directed Apple to cease such practices. Despite Apple's plan to appeal, a ruling from the General Court in Luxembourg, Europe's second-highest court, is expected to take several years. During this period, Apple must pay the fine and adhere to the EU's directives.

Sources: Zone Bourse, Reuters, Wall Street Journal

Why global support for climate action is “systematically underestimated”

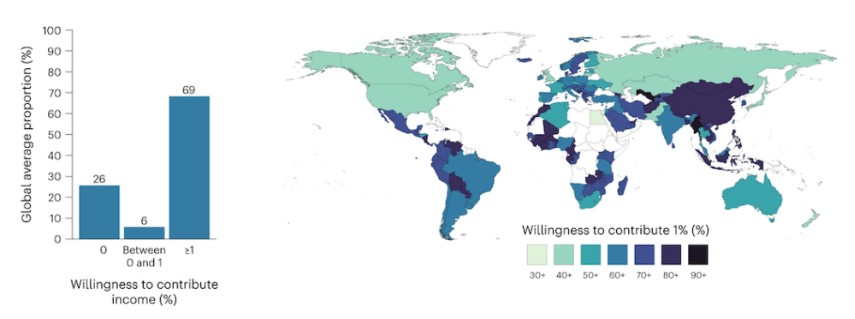

The research, recently published in Nature Climate Change, conducted an extensive survey with nearly 130,000 participants across 125 different countries. The findings indicate robust global support for climate action, with 86% of respondents endorsing pro-climate social norms. Furthermore, an overwhelming 89% expressed the desire for increased government efforts to tackle climate change. Moreover, 69% of participants showed a willingness to contribute 1% of their income towards addressing global warming.

[Graphe] Share of respondents willing to contribute none, up to 1% or at least 1% of their income to tackling climate change:

One striking discovery was a pervasive "perception gap" among respondents. Despite the high levels of personal commitment, individuals consistently underestimated the willingness of their peers to take action on climate change. According to the study, 114 out of 125 countries surveyed are willing to pay a personal cost to combat climate change, yet 96% of them believe that less than half of their fellow citizens would be willing to do so. Therefore, the researchers argue that correcting this perception gap is crucial, as individuals are "conditional cooperators" – contributing more to public goods when they believe others are doing the same.

The interview with the authors delves into their surprise at the widespread approval for climate action, especially given the prevalent global pessimism. They highlight that in 114 out of 125 countries, a majority of individuals expressed a commitment to combating global warming. The researchers emphasize the need to shift the narrative from focusing on climate change skeptics to effectively communicating the vast majority's willingness to act against climate change and their expectations from governments worldwide. The study aims to initiate a debate on this topic and raise awareness about the substantial global support for climate action.

Sources: Carbon Brief, Nature Climate Change