Published on 17/12/2025

95% of business leaders view climate transition as source of growth and opportunity

A recent HSBC survey found that 95% of business leaders view the climate transition as a source of growth and opportunity. Natalie Blyth, Global Head of Sustainable Finance & Transition at HSBC, notes that sustainability strategy has become a key part of business strategy. The survey collected responses from over 1,650 senior business decision makers.

The survey revealed a shift in corporate views on sustainability from risk mitigation to growth and value creation. 99% of business leaders agree that climate transition will be important for competitive advantage. They also see climate inaction as a source of financial and strategic risk, with 39% citing operational disruption as a key consequence.

According to Natalie Blyth, the survey shows a "critical pivot" in how companies view sustainability. 96% of investors report that climate and environmental issues will be important to their investment strategy. The survey also found increased interest in sustainable finance and climate technologies, with 90% of business leaders integrating climate tech into their strategies.

Source: ESG Today

Australia passes landmark law overhauling nature protection

Both houses of the country’s parliament passed the legislation, Environment Minister Murray Watt said in Canberra. It amends the Environment Protection and Biodiversity Conservation Act 1999, a framework widely viewed by industry and environmental advocates as outdated and in need of reform. Past efforts to update the laws, the most recent earlier this year, had foundered. The new laws strengthen protections for the environment while also streamlining approval processes for major developments in areas like mining. “In addition, these reforms will deliver much quicker processes to ensure we can deliver the housing, renewables and critical minerals that our country desperately needs,” Watt said. Earlier in December, he said the bill could inject up to A$7 billion ($4.5 billion) into the economy.

Australia, the world’s driest inhabited continent, is constantly grappling with trade-offs between its powerhouse mining and energy industries that underpin the nation’s prosperity, and its unique and often fragile environment. The new laws will increase scrutiny of major projects related to the country’s three largest exports: iron ore, coal and liquefied natural gas. The government will now establish a nationwide Environmental Protection Authority and require large projects to disclose their emissions, Claire Smith, partner and head of Environment at law firm Clayton Utz, told Bloomberg. “We’ve been waiting on reforms for the environment for 15 years,” she said. “The earlier Act was overly complex, and frankly, it wasn’t actually protecting the environment. There’s much bigger penalties for impacting threatened species and other contraventions, which could see fines as high as A$825 million.”

The new EPA will operate concurrently with separate bodies by the same name in Australia’s eight states and territories. The law also creates national standards to guide departmental decision-making. While the Greens party pushed for resource projects to be assessed on their carbon-emission intensity, it was not successful. “The government has other legislation that regulates carbon impacts, but the new law requires emissions disclosure,” Smith said.

Sources: Energy Connects, Bloomberg

A decade of climate upskilling: How financial institutions responded to the Paris Agreement

The Paris Agreement in 2015 drove financial institutions to prioritize climate change, the understanding of its risks has improved significantly. The industry has made progress, with 80% of investor implementing climate risk management processes. This shift has led to increased hiring of climate experts and improved communication with scientists. Wendy Cromwell, head of sustainable investment at Wellington Management, highlights collaborations with MIT and Woodwell Climate Research Center to better understand climate risks.

Wendy Cromwell notes that climate change is now a regular feature of investment meetings, with traditional professionals asking questions about physical climate risks. Eva Halvarsson, CEO of AP2, says the past decade has seen huge progress in data availability and understanding of climate in the investment space. AP2 has aligned its portfolio with the EU's Paris-aligned Benchmark, leading to a divestment of over 250 firms. In 2020, AP2 became one of the first investors to align large chunks of its portfolio with the EU's Paris-aligned Benchmark.

Despite progress, challenges remain, including the ESG backlash and slow decarbonization. Hans-Christoph Hirt notes that some skills, like corporate governance and financial literacy, are still needed. Other experts note that climate targets have become a feature of investment activities, with net zero being a tool to operationalize responses to climate change. More work is needed, particularly in engaging with brown companies and addressing portfolio emissions versus real-economy decarbonization. Eva Halvarsson highlights the importance of forward-looking data and disclosures, enabling investors to make informed decisions. The industry must adapt to changing circumstances and continue to progress, with sustainable finance interest from other economies providing opportunities for growth.

Source: Responsible Investor

Socialwashing: how companies are hijacking the just transition

According to a recent report, more companies are exploiting the concept of just transition, particularly in the fossil fuel sector. This concept, which describes the mechanisms for making the ecological and social transition more equitable, notably by sharing the transition efforts according to the economic capacity of the various players, was at the heart of the COP30 climate negotiations, for example. It is also omnipresent when discussing the energy transition or the economic transformations needed to move towards sustainability, to such an extent that the "just transition" is now an issue for companies, which are increasingly incorporating it into their communications. A recent report by the organisation InfluenceMap highlights the risk that just transition could become a new form of "socialwashing" for private actors, who abuse the term without clearly defining it. "The majority of interventions on this subject are either vague or contrary to the energy transition," and this communication risks "compromising both the energy transition and its just implementation".

The energy sector is the main source of this proliferation of references to the just transition, accounting for nearly 20% of mentions. Paradoxically, 11% of references to the just transition are even associated with communications aimed at justifying the continued or increased use of fossil fuels. In France, for example, the oil giant TotalEnergies communicates extensively about its supposed commitments to the just transition. In an attempt to steer the debate on the subject, the multinational has also funded a survey conducted by OpinionWay on the just transition, which concludes that it is necessary to "reduce taxes", "increase subsidies" and "facilitate access to aid" for energy companies.

This trend also affects many other polluting sectors, such as manufacturing and mining, with companies such as the British multinational Anglo American. In total, only 20% of mentions of the just transition address the subject in a relevant manner, referring to the urgency of the ecological transition and the phase-out of fossil fuels while emphasising the importance of taking into account the social impacts of the transition and the fair sharing of efforts.

Sources : Novethic, InfluenceMap

The city that turns human waste into clean fuel

In Mannheim, Germany, a pilot project called Mannheim 001 is converting sewage gases into green methanol, a cleaner alternative to heavy fuel oil. David Strittmatter, co-founder of Icodos, says "it's the first time the entire value chain - from sewage to finished methanol - has been demonstrated." The project produces 15,000 liters of methanol per year, enough to fuel smaller workboats.

International shipping is responsible for 3% of global greenhouse gas emissions, and regulators are pushing for cleaner alternatives. Methanol is emerging as a promising option, with companies like Maersk and CMA CGM already operating methanol-powered container vessels. Strittmatter says "shipping companies have very strong ambitions to reduce their footprint" and notes that wastewater contains up to three times more energy than the treatment process needs.

The vision extends beyond shipping, with methanol also being a feedstock for plastics, solvents, and other chemicals. Strittmatter says "we're turning a liability into a resource" and estimates that scaling sewage-to-methanol worldwide could cover the entire fuel demand of the global shipping sector. With funding from the European Commission and Mannheim's Climate Fund, Icodos is planning to upscale the project, with a new plant already secured near Paris.

Source: Reasons to be cheerful

BP scraps plans for large scale UK low carbon hydrogen project

- Company: BP PLC

- Sector: Energy

- Clover rating: 1/5

BP has said that it has withdrawn its plans to develop H2Teesside, a large-scale hydrogen production and carbon capture facility in Teesside in north-east England, citing deteriorating demand for hydrogen by industrial consumers, and alternative plans to build a new data centre at the site. BP initially announced its plans to build H2Teesside in 2021, with a production capacity targeted at 1 GW by 2030, making the proposed facility the largest hydrogen project in the UK. The new announcement follows the establishment of a new strategy by BP in February 2025, reallocating capital to increase oil and gas investment and reducing low carbon energy to less than 5% of the company’s capex allocation.

Blue hydrogen is produced by converting natural gas into hydrogen and CO2, which is then captured and permanently stored. When initially announcing the project, BP stated that it had begun a feasibility study into the project to explore technologies that could capture up to 98% of carbon emissions from the hydrogen production process. In a letter to the UK’s Department for Energy Security and Net Zero, BP said that plans to develop a data centre at the site, which have been approved by local authorities, “has resulted in a conflict over the same land as H2T,” adding that “the two proposals are incompatible on the same piece of land.”

Sources: ESG Today, Financial Times

Apple trying to stall India antitrust case by challenging penalty law, watchdog says

- Company: APPLE INC

- Sector: Technology

- Clover rating: 3/5

The iPhone maker last month challenged India's antitrust penalty law which allows the regulator to use global turnover when calculating the penalties, calling the legislation one that could lead to disproportionate fines for cases where the breach occurred only in India. Apple argued it risks facing a fine of up to $38 billion after it was found to have breached laws in a case where Tinder-owner Match and Indian startups succeeded in convincing the watchdog the tech firm's in-app fee hurts smaller players, and is anti-competitive.

A final decision on the case, including the fine, is still pending. In December, a lawyer for the Competition Commission of India (CCI) accused Apple of trying to "stall the proceedings" dating back to 2021. Apple’s counsel urged the court to prevent the regulator from taking coercive steps. Judges at the Delhi High Court asked the CCI to file a detailed response to Apple's arguments. Apple denies wrongdoing, saying it is a smaller player than Google's dominant Android platform.

The dispute centres on a 2024 amendment that lets CCI use global turnover, not just India revenue, to calculate penalties. In a private submission to the CCI, reported by Reuters in October, Match argued a fine based on global turnover could "act as a significant deterrent against recidivism".

AT&T commits to drop DEI programs and goals

- Company: AT&T

- Sector: Technology

- Clover rating: 2/5

Telecommunications and media giant AT&T has committed to ending its diversity, equity and inclusion (DEI) policies, and to refrain from DEI-based hiring quotas, training and supplier requirements, in a letter to U.S. Federal Communications Commission Chairman Brendan Carr. The letter by AT&T forms the latest in a series of moves by U.S. companies and investors to pull back on their DEI programs and policies, which began following a Supreme Court ruling in 2023 that struck down Harvard’s use of race-based affirmative action criteria in college admissions, and led to increased scrutiny over the legality of key aspects of corporate DEI policies. The Trump administration has actively pushed back against DEI as well, with the President issuing an executive order on his first day in office terminating all federal government DEI programs.

AT&T’s 2023 annual report included a section on “Diversity, Equity and Inclusion,” stating that the company “believe(s) that championing diversity and fostering inclusion does more than just make us a better company, it contributes to a world where people are empowered to be their very best,” and highlights “an emphasis on attracting and hiring talented people who represent a mix of backgrounds, identities and experiences.” In the letter, AT&T makes a series of commitments, including stating that it “does not and will not have any roles focused on DEI,” that its “hiring, training and career development opportunities are not and will not be based on or limited by race, gender, or other protected characteristics,” that it will not use race, sex or sexual orientation-based hiring quotas, and that it has removed DEI-related training. The company also confirmed that its procurement practices are not based on demographic goals, and that it does not require suppliers to meet demographic-based goals.

How cyclones and monsoon rains converged to devastate parts of Asia

Tropical cyclones and monsoon rains have devastated parts of Asia, killing over 1,100 people during 2025 rainy season and leaving many homeless[EJ1] . According to Dr Andri Ramdhani, Indonesia's location near the equator makes it less prone to tropical cyclones, but Cyclone Senyar formed just north of the equator in the strait of Malacca. Indonesia has been particularly hard hit, with at least 604 people killed and 464 missing.

The cyclones have combined with heavy monsoon rains to fuel intense wind and rain, affecting areas of Indonesia, Malaysia, Thailand, and Vietnam. In Sri Lanka, the death toll has risen to 366, with 367 missing, and over 1.3 million people affected. President Anura Kumara Dissanayake has declared a state of emergency, vowing to build back with international support. Thailand's ministry of public health has reported at least 170 deaths, with authorities working to deliver aid and clear damage.

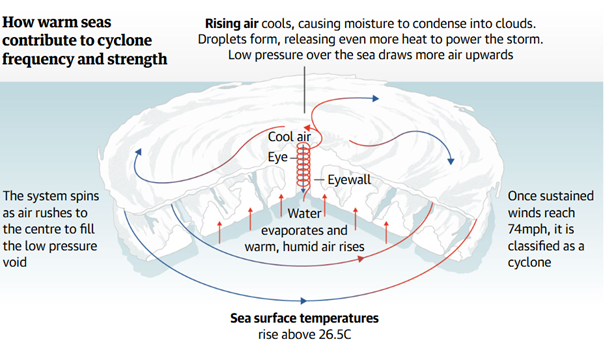

The extreme weather has caused widespread destruction, with nearly 300,000 people displaced in Indonesia and 148,000 in Sri Lanka. Dr Andri Ramdhani notes that the formation of Cyclone Senyar was a "rare" event, but one that has become more frequent in the past five years. Human-caused climate breakdown has increased the occurrence of intense and destructive tropical cyclones, with warming oceans providing more energy for stronger storms. President Dissanayake said, "We are facing the largest and most challenging natural disaster in our history... We will build a better nation than what existed before."

Source: The Guardian